It took 10 years for Bitcoin to receive its first spot-traded, exchange-traded fund (ETF). Up until January 2024, this type of Bitcoin investing was dominated by futures-traded ETFs which don’t hold actual BTC.

By holding the actual asset, spot-traded ETFs offer not only direct exposure to Bitcoin without the hassles of BTC custody, but minimal price deviation such as contango in futures contracts.

Most importantly, by opening the doors to both retail and institutional investors, Bitcoin ETFs drove the price of Bitcoin up, as custodial exchanges, typically Coinbase, bought BTC in their name. But does that mean it is a good idea to invest in crypto ETFs as well?

Let’s first examine what exactly does it mean to have such exposure in the case of Bitcoin?

Exposure to Custodial Bitcoin as ETF Shares

As increased liquidity crashed against the wall of Bitcoin’s scarcity of 21 million BTC, investors gained outsized returns. Case in point, since the launch of VanEck’s Bitcoin ETF (HODL) from January 2024 by the end of January 2025, the fund had a life return of 117.70%.

Unlike most Bitcoin ETFs, VanEck delegated custodial responsibilities to Gemini instead of Coinbase. Image credit: VanEck

Last week, VanEck Bitcoin ETF executed a four-for-one forward stock split, elevating the number of the fund’s shares from 12.8 million to 51.2 million. As with companies represented by shares, the total value of the fund’s assets remained unchanged, now holding 14,430 BTC worth around $1.42 billion.

And just like Nvidia did a stock split to lower the barrier to entry for investors, so did VanEck. The fund’s Net Asset Value (NAV) is the total value of ETF’s assets divided by the number of shares. Following the 4x increase, HODL is presently priced at $27.88 per share.

If the NAV price is in a consistent premium range, when its market price is higher than NAV price, this suggests bullish market conditions because investors are paying more for ETF shares than the value of underlying holdings.

Vice-versa, if the NAV price is in a consistent discount range, when its market price is lower than NAV price, investors are buying ETF shares for less than the underlying value, suggesting bearishness. Of course, this would represent an investing opportunity

In the case of VanEck’s HODL, its 12-month low (discount) was $14.44 on February 23, 2024, while its 12-month high (premium) was $30.16 on January 21, 2025.

Lastly, for the convenience of delegated custody, investors pay a small fee to cover the costs of managing the fund. However, to attract the initial capital inflows, many Bitcoin ETFs waived such fees. VanEck will start charging 0.20% Sponsor Fee after January 10th, 2026, or sooner if the funds’ assets exceed $2.5 billion.

Are Crypto ETFs Worth It?

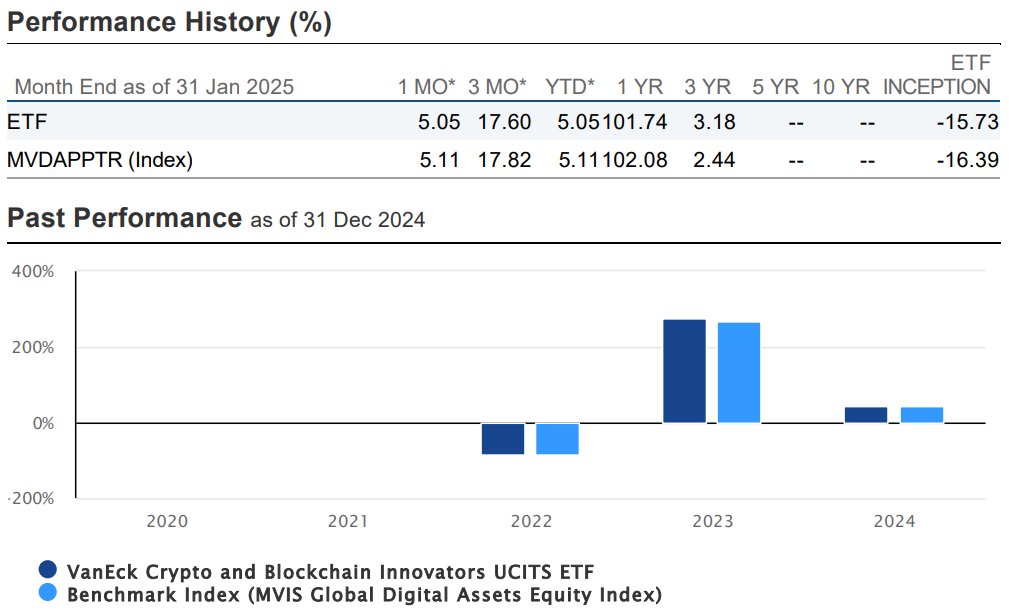

Crypto ETFs should not be confused with bundled-up, blockchain-related companies. For example, the VanEck Crypto ETF (DAPP) is called as such but instead of holding cryptocurrencies other than Bitcoin, it holds exposure to companies.

These range from Coinbase and Microstrategy to Riot Platforms and Bitdeer, with each carrying a different weight in the portfolio. So far, DAPP’s performance appears highly cyclical, yielding greatly lower returns vs HODL, at negative 15.73 life returns.

Image credit: VanEck

However, retail investors may notice that in both cases, one year exposure to such ETFs yielded above 100% returns. For comparison, the average stock market return yielded around 11.3% annually over the last 10 years, per S&P Dow Jones Indices.

When it comes to ETFs holding physical altcoins, under the umbrella of exchange-traded products (ETPs), they typically cover the largest market cap cryptos, such as Ether (ETH), Ripple (XRP) or Solana (SOL).

The problem is that with tens of thousands of tokens unleashed, the altcoin market suffers from fragmentation and capital dilution. On top of that, it remains unclear which general-purpose smart contract platform – Solana, Ethereum, or a future newcomer – will gain the upper hand.

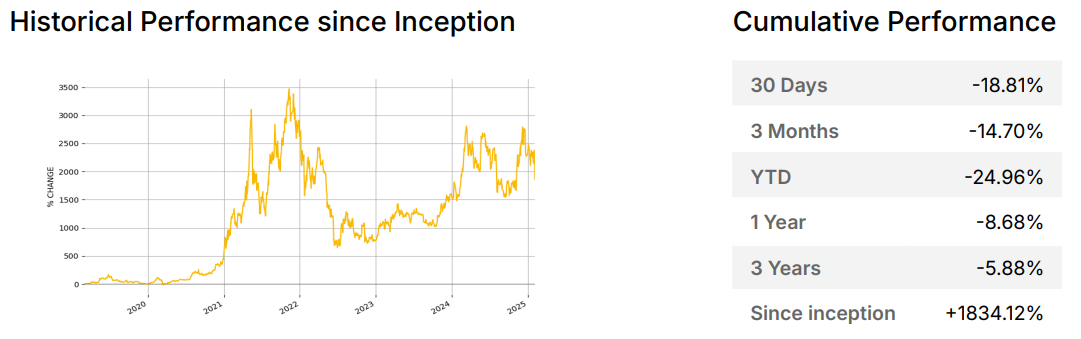

Case in point, even the ETP that reinvests staking yields, 21Shares Ethereum Staking ETP (AETH), underperforms vs Bitcoin ETFs.

Holding the second largest cryptocurrency, ETH, AETH fund has a 1.49% fee, having launched in March 2019. Image credit: 21shares

Without the staking benefit, iShares Ethereum Trust (ETHA) yielded negative 20.58% returns over one year. Given early launch, AETH’s inception performance is outstanding, but investors should expect continued underperforming divergence of cryptos from Bitcoin.

After all, as a proof-of-work-backed sound money, Bitcoin lacks competition. At present, it seems that Solana blockchain, owing to its fast execution and low fees, is a better choice than legacy smart contract platforms. It is also the main hub for launching countless memecoins.

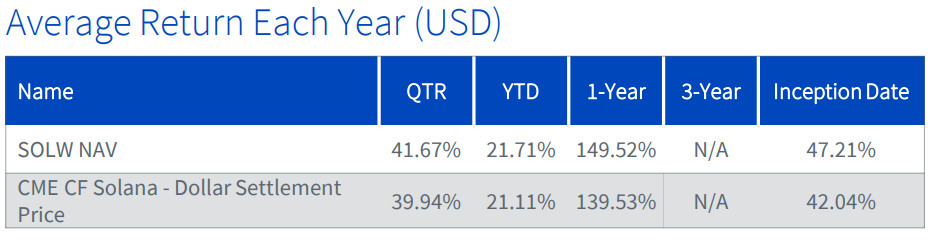

Launched in March 2022 with 0.50% fee, even WisdomTree Physical Solana (SOLW) has poorer life performance than Bitcoin ETFs.

In short, retail investors should expect the capital dilution of the altcoin market to carry over into exchange-traded products. If new crypto ETFs launch, the selected altcoins may gain a momentary price boost, but they are unlikely to beat the long-term performance of Bitcoin ETFs.

In the end, there is only a finite amount of capital, and the crypto market does itself a disservice by launching so many coins. This especially applies to memecoins, which continually erode the reputational standing of the entire crypto market.

Needless to say, such erosion of trust tends to benefit Bitcoin.

If you invest in cryptocurrencies, are you more focused on speculative, potentially higher gains in altcoins or steady gains in Bitcoin? Let us know in the comments below.