[ad_1]

Introduction

In 2008, Bitcoin heralded a revolutionary change in the world of finance with the advent of blockchain technology. Decentralization, anonymity, and transparency helped Bitcoin and the subsequent blockchains develop traction among investors. Being a data structure, a blockchain relied on the connections of blocks that contained essential information about transactions. Every block had information about the previous block in the form of a cryptographic hash. For years, the technology had no competitor, but the introduction of directed acyclic graph changed the situation.

What is The Directed Acyclic Graph (DAG)?

The Directed Acyclic Graph (DAG) is a data structure like blockchains, but instead of operating on a single sequential chain, it is a network of many linked transactions. It appeared for the first time in 2016 when IOTA, a crypto project, applied the concept for its transactions. The project referred to its transaction structure as a tangle instead of a blockchain ledger. The term came originated the fact that it is like a web consisting of nodes that contain transactions.

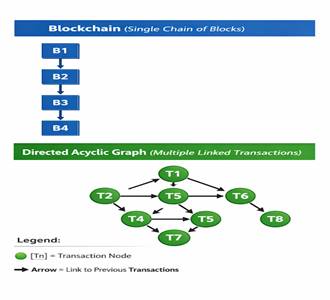

If we try to represent a blockchain diagrammatically, it has many blocks arranged in a line, with every block connected only to the previous one. On the other hand, the representation of a DAG structure show dots, many of which are connected to more than one dots in such a way that the loop only moves forwards, never coming back to where it originated. Every dot (or sphere) is a vertex and every line an edge. From the following image, you can understand the nomenclature of the model. The edges are directed because they point to one direction, and they are acyclic because they never come back to the vertex from which they originated.

How the Structure Works

At every step towards understanding DAG, one does need information about the blockchain technology as well because that’s what DAG claims to improve or replace. A blockchain works on the basis of blocks that carry data of one or more transactions. It groups many transactions together in order to be space efficient. Every block is added and verified by miners or validators.

Contrarily, every transaction in DAG structure stands on its own without being grouped into blocks. Neither does this structure need any miners or validators, nor is it sequential like blockchain structure. Before a transaction is added, the user’s device does a very small amount of work to prove it is genuine. This small effort helps prevent spam and also helps confirm earlier transactions, keeping the network secure and orderly.

Every new transaction in DAG structure must connect to an earlier unconfirmed transaction, or if all previous transactions are already confirmed, the new transaction merely needs to reference the last one. This structure refers to a previous unconfirmed transaction as a “tip”. When you propose a transaction to the network, it connects to a few previous tips which are automatically confirmed consequent upon your reference. Yours will be confirmed only one someone else builds on it.

Advantages of DAG Structure

No Delay

In blockchains, your transaction has to wait until a block is created. If too many transactions are sent at once, they form a queue, and wait for a long time or pay a higher fee. But you can get your transaction processed at once in DAG networks provided that you confirm the previous unconfirmed transactions. Your wallet automatically checks the transaction that it is going to confirm by tracing it to the very first transaction on the network. Therefore, it is highly unlikely that you accidentally confirm an invalid transaction.

NO scalability Issues

Think of a blockchain as an expressway, which can be crowded at times, so it needs a few extra lanes added. These extra lanes are the scalability solutions. Since there is no such issue as a waiting time for blocks, DAG can process many more transactions on its own, without needing any scalability solutions.

No Miners, No Validators, No Fees

DAG structure does not work on any consensus mechanism, so there are no miners or validators. That’s why transactions are processed free of cost. However, there are a few special nodes that charge a very tiny fee, to secure the network.

Disadvantages of DAG

Centralization poses a serious risk in DAG’s way to progress. Certain special nodes and coordinator nodes run by corporations tend to have an upper hand. This carries a potential danger of scams and attacks in future. Moreover, DAG is 8 years younger than the blockchain technology is it is not as time tested yet.

Bottom Line

Both blockchain and Directed Acyclic Graph technology aim to enable decentralized and secure transactions, but they approach the problem in very different ways. While blockchain remains the more mature and widely adopted solution, DAG introduces notable improvements in speed, scalability, and transaction costs. However, concerns around centralization and its relatively short track record still limit broader adoption. As innovation accelerates in 2026, DAG is likely to complement rather than fully replace blockchain, with each technology serving use cases where its strengths are most effective.

Frequently Asked Questions

What is the main difference between DAG and blockchain technology?

Blockchain records transactions in sequential blocks, while DAG processes individual transactions in a web-like structure, allowing faster and more scalable validation.

Is DAG more scalable than blockchain?

Yes, DAG can handle higher transaction volumes without relying on block creation, reducing congestion and scalability issues.

Does DAG require miners or validators?

No, DAG networks do not rely on traditional miners or validators. Each new transaction helps validate previous ones, keeping the network operational.

Can DAG replace blockchain in the future?

DAG is unlikely to fully replace blockchain but may complement it by powering applications that require high speed, low fees, and scalability.

[ad_2]