[ad_1]

2023 was rough for cryptocurrency prices and the overall state of the market. But it also saw the birth of many narratives and catalysts for many cryptocurrency projects and ecosystems, with some of them seeing explosive, overnight surges in total value locked (TVL) and others growing more organically.

One thing is true: capital, research, and development (besides the hard work) are being poured into new technologies and features that could bring a wave of improvements to decentralized finance (DeFi). This article will explore these technologies and some of the best-performing protocols and cryptocurrency narratives.

zkEVM

The zkEVM ecosystem has recently become a popular topic in the crypto community, especially in the Ethereum ecosystem. Combining zero-knowledge proofs (ZKP) and EVM could benefit Ethereum regarding scalability, throughput, composability, and data replication.

But it wasn’t until 2022 that zkEVMs were being actively developed, and they still are today more than ever, with more builders and protocols joining the narrative.

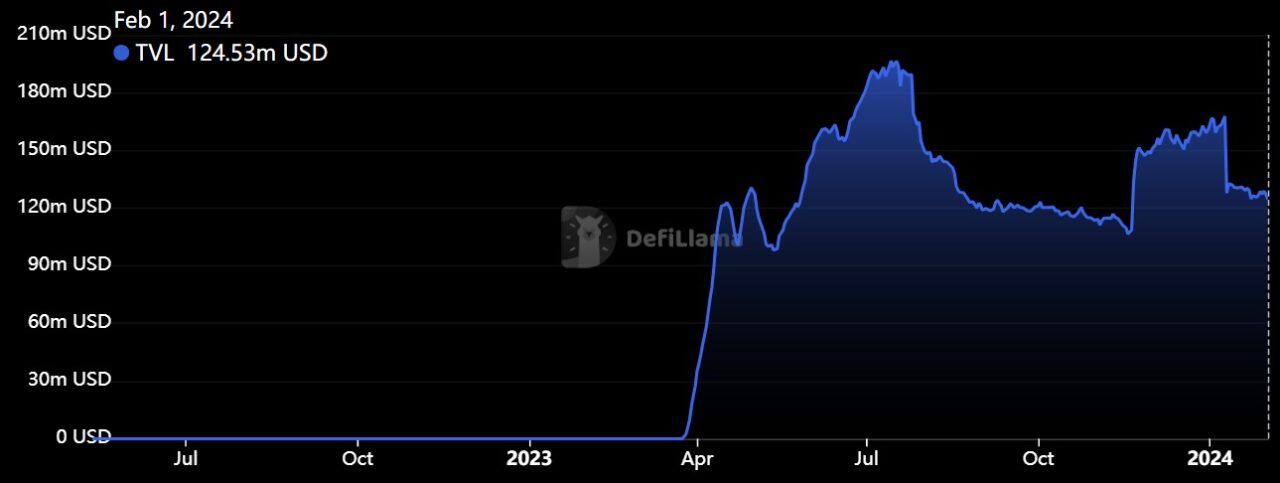

The TVL surge of zkSync Era, currently the fastest-growing zkEVM. Source: DeFiLlama

What is zkEVM?

As we stated, zkEVM refers to protocols that leverage zero-knowledge proofs while being EVM-compatible. Using ZKPs (in the form of zero-knowledge rollups), these protocols can execute smart contracts with more privacy, as they don’t reveal the data and terms within those contracts. Those are the main benefits of zkEVM projects: privacy, security, scalability, and composability.

The EVM compatibility will depend on the project; specific protocols can highly replicate the EVM to allow for interoperability but might not be able to generate ZK proofs faster. Meanwhile, other projects could have lower EVM compatibility but faster proof generation.

That also means, as Vitalik Buterin explained, that there’s a trade-off between EVM compatibility and performance.

Some of the most popular zkEVM rollups taking off this year:

- zkSync Era: $120M TVL, high performance, lower compatibility.

- Linea: $60M TVL, moderated compatibility and performance

- Polygon zkEVM: $19M TVL, moderated compatibility and performance

Real World Assets – RWAs

Real World Assets (RWA), as the name suggests, refers to tangible and intangible assets that can be tokenized using blockchain technology. In other words, RWAs protocols bring the off-chain assets on-chain, unlocking an untapped potential of new revenues and resources for DeFi.

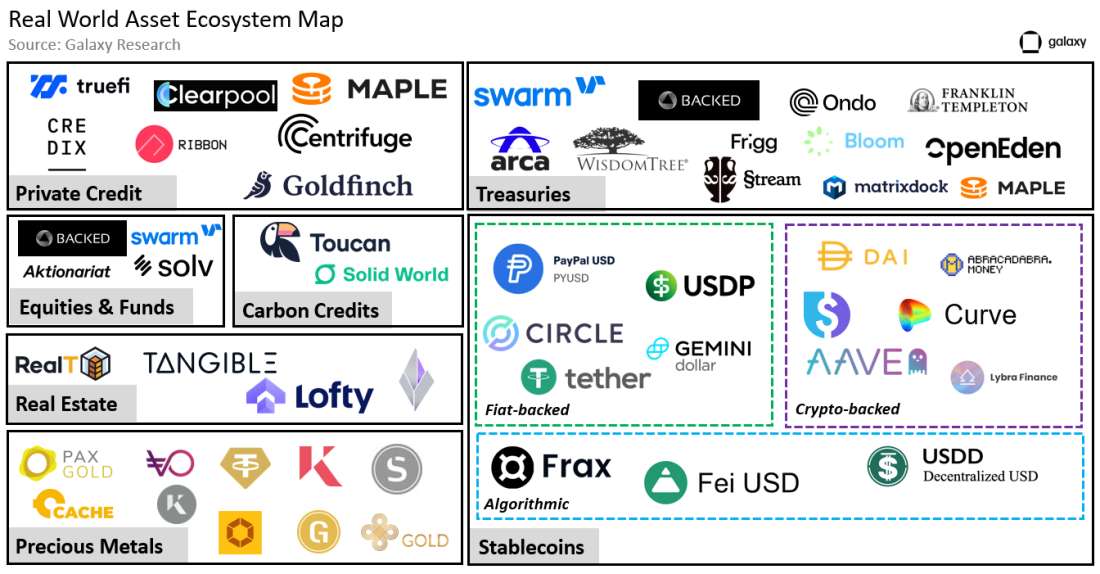

There are many types of RWAs protocols, from on-chain credit providers to debt markets, lending, commodities, and real estate.

Source: Galaxy Digital

RWAs have outpaced the medium DeFi APY in 2023, which is currently sitting at roughly 3%. Further, RWAs constitute around 6.3% of DeFi’s total TVL, as per DefiLlama. RWA protocols and service providers have surged organically, unlike most narratives that have seen explosive ups and downs.

RWAs have many pros and cons. Let’s start with the benefits:

- RWAs can become a new source of liquidity for the DeFi ecosystem, unlocking untapped yield for the space.

- Massive institutional adoption

- Lower barrier of entry for several markets, especially for real estate

- Faster operability and trading of items without middlemen

The cons/challenges of RWAs

Regulation will heavily influence the success of RWAs. For RWAs to access large markets, such as credit, real estate, or lending, they need large sums of liquidity, and the most obvious way to channel it is through big institutions.

This puts a few questions on the table:

- By requiring the help of TradFi institutions, does it stop being DeFi?

- Do RWAs work better for institutions and private companies?

- Custodial trade-off: Do users own the token but not the asset itself? If so, can regulators take control of such help, or can financial institutions or agencies deny redemptions in the case of lending and on-chain credit, for example?

SocialFi: Tokenizing Influence

SocialFi is one of the hottest trends in crypto, taking off with protocols such as friend.tech and Stars Arena, currently market leaders.

In SocialFi (or SoFi), influence matters as content creators monetize their social media following and engagement. Revenue is generated through cryptocurrencies, and the digital identity is an NFT. This could be considered a new version of Web3 that clusters social media, crypto, NFTs and content creation.

SocialFi has a lot of benefits for users, including a higher degree of privacy, new monetization methods, creators’ ability to better engage with users, and the mitigation of censorship and data control by centralized parties.

However, SocialFi boomed quickly soon after friend.tech became Base’s flagship product. Shortly after, forks and new apps sprung up on different ecosystems, most notably AVAX’s Stars Arena, which was hacked for $3M. The hack reminded crypto users that new, experimental technologies can be dangerous, and exponential growth in such a small time frame can attract a lot of malicious actors.

Top SocialFi protocols:

- friend.tech: $40 TVL, market leader with over 72k active daily wallets

- StarsArena: $3M (recently recovered), with over 25k active daily wallet

Liquid Staking Derivatives (LSD)

Liquid Staking Derivatives (LSD) were probably the most hyped narrative of 2023, especially in Q1. LSD are tokenized versions of locked tokens in deposit contracts or while being staked. This allows users to use their tokenized ETH (or other tokens) without having to unstake the actual funds.

At the time of writing, the total value locked in liquid staking is approximately $33.8 billion, and Lido is currently the market leader with $21 billion in TVL, dominating the market.

LSD currently accounts for approximately 20% of DeFi’s total value locked. The success of this ecosystem can be traced back to the Shanghai update, when Ethereum transitioned to a Proof-of-Stake consensus algorithm, which saw a considerable amount of ETH become locked until the Shapella upgrade, which created a liquidity crunch for ETH-based projects and put stakers at a potential loss due to market conditions.

- The solution? Create a tokenized version of those staked assets, like Coinbase’s Wrapped Staked ETH, and then leverage those for various DeFi activities.

The main benefits of LSD could be narrowed down to how these protocols turn staked assets into more flexible and dynamic yield instruments. Basically, users receive a tokenized version of their assets, like a receipt, allowing for extra yield opportunities in DeFi.

Telegram Trading Bots

Telegram crypto trading bots became popular in 2023 as they offer an automated system for trading in decentralized exchanges, allowing users to trade and execute operations more efficiently and faster.

Users don’t need a computer to connect to their wallets to trade tokens in a decentralized exchange (DEX); instead, they can simply copy and paste the token’s address in the bot’s chat to buy/sell it. This makes the trading process considerably faster than doing so in a DEX’s original website. It doesn’t end there, however, as trading bots offer features such as stop loss, take profit orders, MEV and anti-rug security measures, liquidity sniping and more.

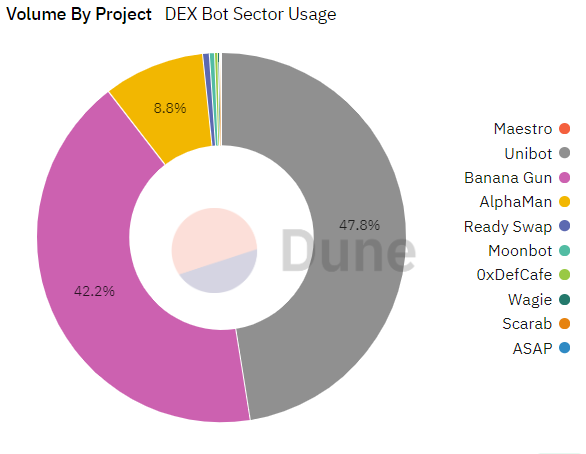

Banana Gun, Maestro and Unibot are currently the most popular trading bots. Unibot by itself can process transactions 6 times faster than Uniswap’s very own website.

This ecosystem of trading bots has around 124,000 total unique users who have traded over $740 million. It’s worth noting here that no trading bot can guarantee trading success, and that users’ investments are at risk.

Final Thoughts

The narratives mentioned here revolve around the most talked about topics, trends and protocols this year, but there are a few other narratives that are being formed and gaining traction at their own pace as well.

- Chinese tokens: this year, Hong Kong allowed retail investors to invest in digital assets, which has brought a surge in price for Chinese-related coins such as NEO, BitDAO’s BIT, VeChain’s VET, and more.

- Decentralized stablecoins: These stablecoins are controlled by a decentralized organization instead of a single central body like Tether or Circle, therefore a centralized party can’t tamper with the supply of the coin or pretend they have assets to back the coin that they really don’t.

[ad_2]