[ad_1]

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Decentralized finance likes to tell a very simple story about itself. Billions of people are unbanked. Traditional finance is slow, exclusionary, expensive, and biased toward incumbents. Blockchains are open, permissionless, global, and neutral. Therefore, DeFi will bank the unbanked.

Summary

- DeFi didn’t replace traditional finance — it wrapped it. Its money, identity, pricing, access, and liquidity all still come from banks, regulators, and centralized infrastructure, so it can’t reach the people that system excludes.

- The unbanked don’t lack products; they lack rails. DeFi assumes stable internet, identity, custody, legal recourse, and on-ramps — exactly what unbanked populations don’t have — making most “financial inclusion” narratives structurally false.

- Until crypto builds new infrastructure instead of prettier interfaces, it’s just optimizing for capital, not people. Faster finance ≠ fairer finance — and without new rails, everything else is theater.

It is a compelling narrative. It is also increasingly disconnected from reality. After five years of explosive experimentation, DeFi has built an extraordinary parallel financial system — but almost all of it still depends on the very infrastructure it claims to be replacing. We did not build new rails. We built new products on top of old ones. And that distinction is not cosmetic. It is the core reason why DeFi has failed to change or revolutionize financial services meaningfully.

You might also like: Silence and invisibility are how crypto wins people’s hearts | Opinion

Status quo?

Look closely at today’s DeFi ecosystem. Stablecoins such as Tether (USDT) and USDC (USDC) — the lifeblood of onchain activity — are overwhelmingly backed by bank deposits, Treasury bills, or custodial cash equivalents held in the traditional system. Fiat on-ramps and off-ramps are controlled by regulated intermediaries who decide who gets access and who does not. Oracles pull price data from centralized exchanges. Even user access is mediated through app stores, browsers, cloud providers, and payment networks that sit firmly inside the existing financial and legal order.

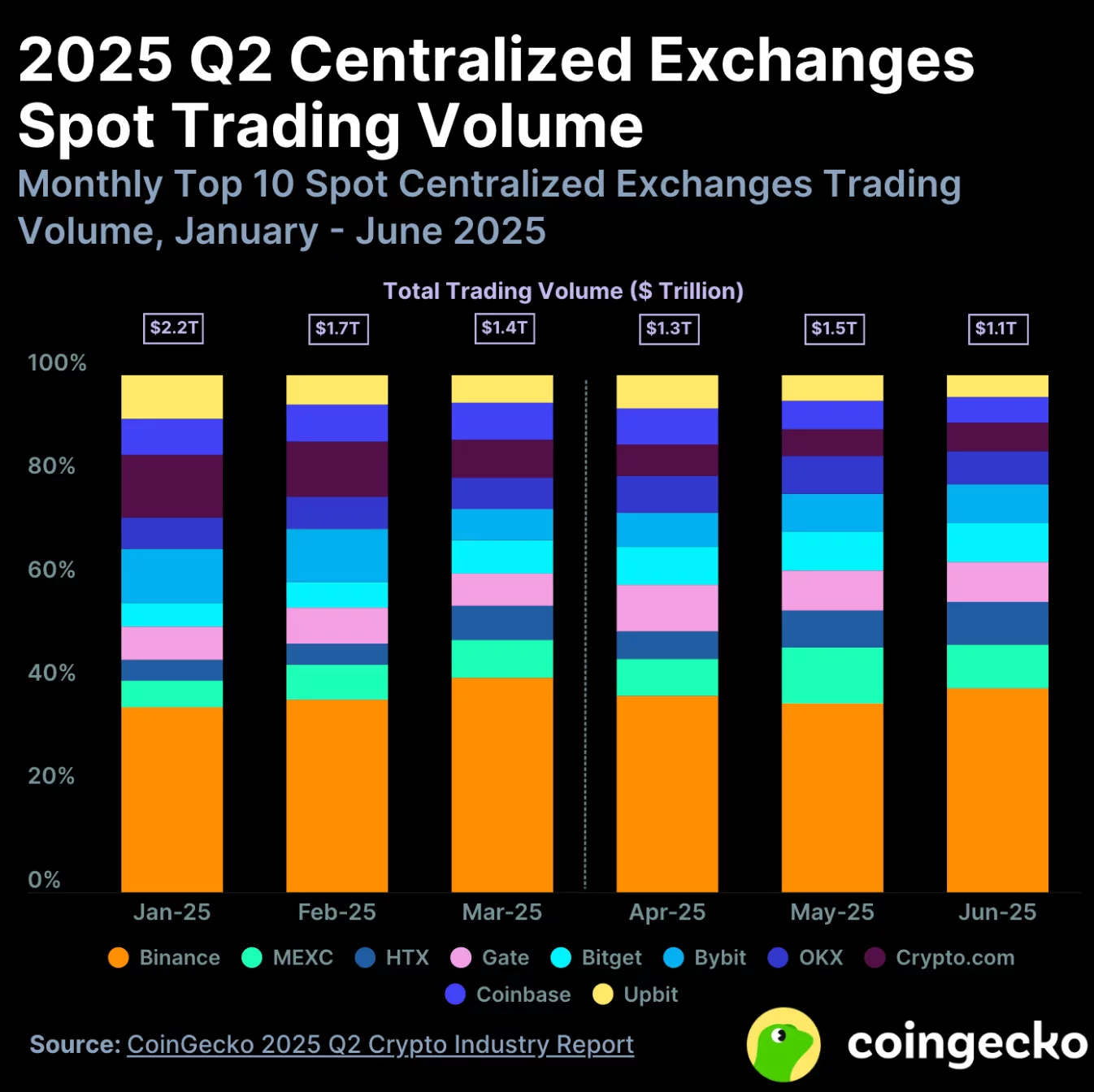

Source: Coingecko

This is not a critique of any single project. It is a structural observation. DeFi did not displace traditional finance. It wrapped it. That wrapping has delivered efficiency gains, composability, and new market structures for people who already had access to capital, identity, banking, and legal protection. But it has not delivered a new financial system for those without them. For the unbanked, DeFi remains distant, abstract, and mostly inaccessible — not because the technology is bad, but because the rails are wrong.

The infrastructure issue

The unbanked problem is not primarily a product problem. It is an infrastructure problem. An unbanked person is not someone who lacks a yield optimizer or a decentralized exchange. They are someone who lacks reliable identity, reliable connectivity, reliable custody, reliable payments, reliable dispute resolution, and reliable recourse. They live in economies where money is unstable, institutions are weak, documentation is inconsistent, and access is intermittent.

DeFi, by contrast, assumes a world of stable internet, stable electricity, stable devices, stable identity, and stable legal fallback. It assumes you can acquire stablecoins through regulated gateways. It assumes you can safeguard private keys. It assumes you can resolve mistakes. It assumes you can afford volatility. It assumes you can tolerate loss. These assumptions are invisible to insiders. They are fatal to outsiders.

So what happened? The industry followed the path of least resistance. Instead of rebuilding financial infrastructure from the ground up, it optimized for speed, capital efficiency, and narrative velocity. It focused on products that could scale fastest in environments where capital already existed. It has integrated with banks instead of replacing them. It mirrored markets instead of redesigning them. This was not irrational. It was pragmatic. It was how the industry survived. But pragmatism slowly turned into dependency.

Today, DeFi does not merely interface with traditional finance — it is deeply coupled to it. Its liquidity, stability, legitimacy, and growth all rely on the health, cooperation, and tolerance of the very system it set out to transcend. When regulators tighten, liquidity contracts. When banks wobble, stablecoins wobble. When institutions hesitate, adoption slows.

Admitting dependency

This is not decentralization. It is financial parasitism with better UX. And it creates a strategic ceiling that the industry rarely acknowledges. As long as DeFi depends on traditional finance for its core primitives — money, identity, pricing, liquidity, and access — it cannot serve populations that traditional finance excludes. It can only repackage finance for those already inside the system.

That is why, after years of progress, DeFi adoption still maps closely onto wealth, not need. It flows toward traders, funds, technologists, and institutions — not toward small merchants in Lagos, families in rural India, or workers in unstable economies. The uncomfortable truth is that DeFi has optimized for capital, not for people.

Modernizing financial rails is not glamorous. It is slow, politically messy, and operationally hard. It means building new payment infrastructure that does not require bank accounts. New identity systems that do not depend on state issuance. New custody models that do not assume individual technical sophistication. New credit systems that do not rely on formal financial histories. New legal and social layers that can absorb error, fraud, and failure.

This work is not flashy. It does not produce token charts that go up and to the right. It does not generate viral narratives or overnight liquidity. It looks more like infrastructure than innovation. But without it, everything else is theater.

Finance does not change the world because it is programmable. It changes the world because it determines who can save, who can borrow, who can invest, who can transact, and who can plan for the future. Those outcomes are not produced by protocols alone. They are produced by systems that integrate technology with institutions, law, culture, and human behavior.

DeFi has mastered the technology. It has not yet engaged seriously with the rest. That is why the next phase of crypto will not be about higher throughput, better composability, or more sophisticated derivatives. It will be about whether the industry is willing to step out of its comfort zone — away from financial centers, away from institutional capital, away from regulatory arbitrage — and into the hard, unglamorous work of building rails where rails do not exist.

Not wrappers. Not mirrors. Not extensions. Rails. Until then, the industry should be honest with itself. DeFi has not failed. But it has not yet tried to solve the problem it was created for. It built a faster financial system. It did not build a fairer one. That remains the real work ahead.

Read more: The double-edged future: Bringing fintech onchain | Opinion

[ad_2]