[ad_1]

The crypto lending market is showing signs of life again. Centralized finance (CeFi) and decentralized finance (DeFi) platforms are experiencing a resurgence, with the latter leading.

This rise follows a devastating collapse that saw major players like Celsius, Genesis, and BlockFi crumble. This left investors reeling and battered trust in the sector.

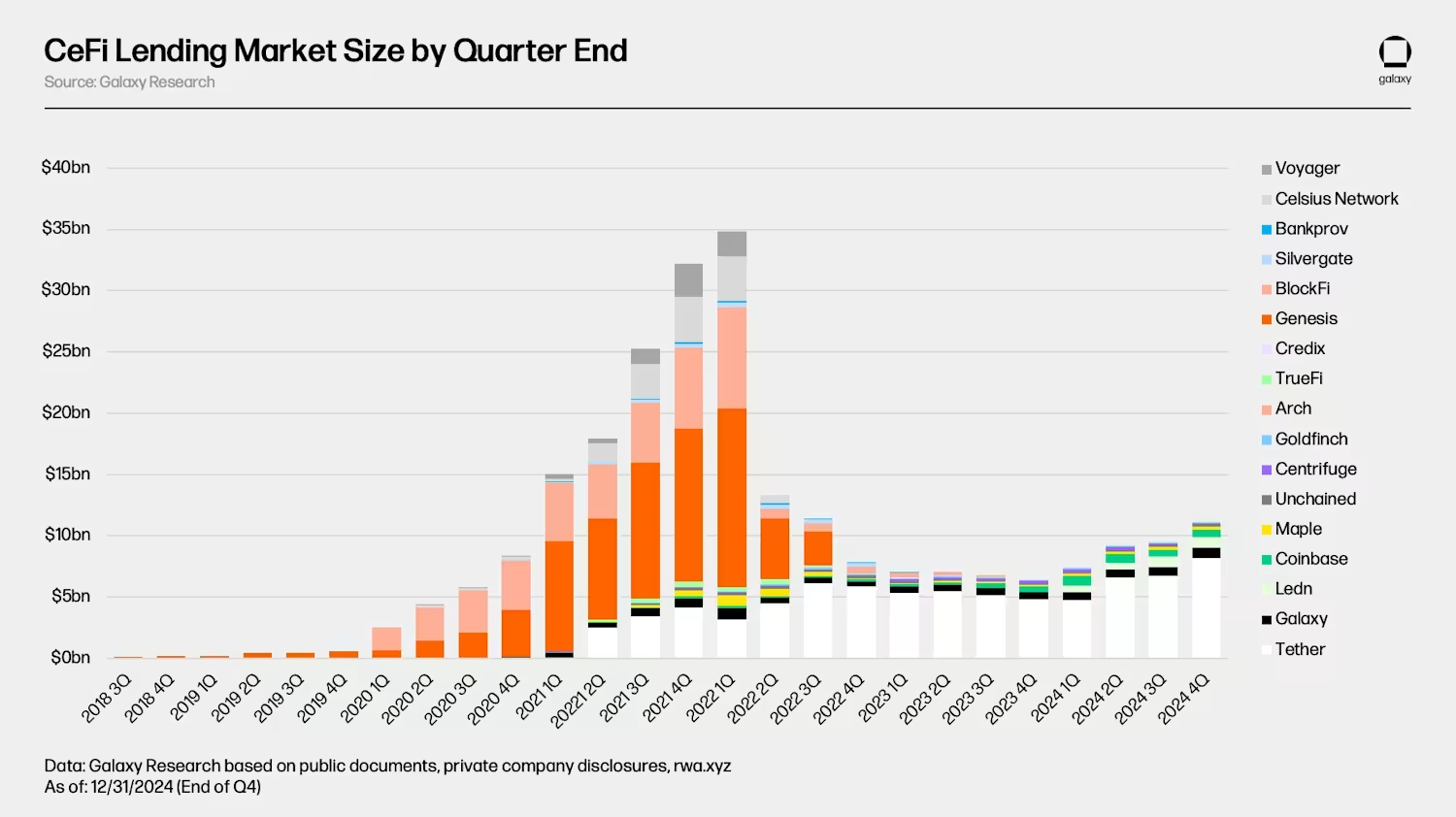

According to a recent report by Galaxy Digital, the total size of outstanding CeFi borrows as of Q4 2024 was $11.2 billion. This represented a 73% rise from the bear market lows when it reached $6.4 billion.

CeFi Lending Market Performance. Source: Galaxy Digital

Despite this positive growth, the CeFi lending market remains significantly below its previous highs.

“This is largely due to the lack of recovery in CeFi lending after the 2022 bear market and the decimation of the largest lenders and borrowers in the market,” the report read.

The total market size is down by 68% from its peak of $34.8 billion. The collapse of major lending platforms is the primary factor behind this sharp decline, which led to a major loss of confidence and a corresponding drop in loan volumes.

Notably, the recovery in CeFi lending is also marked by a consolidation of market share. The top three lenders—Tether, Galaxy, and Ledn—control 89% of the market as of Q4 2024. Previously, in 2022, the then-top three lenders, including Genesis, BlockFi, and Celsius, held 75% of the market share.

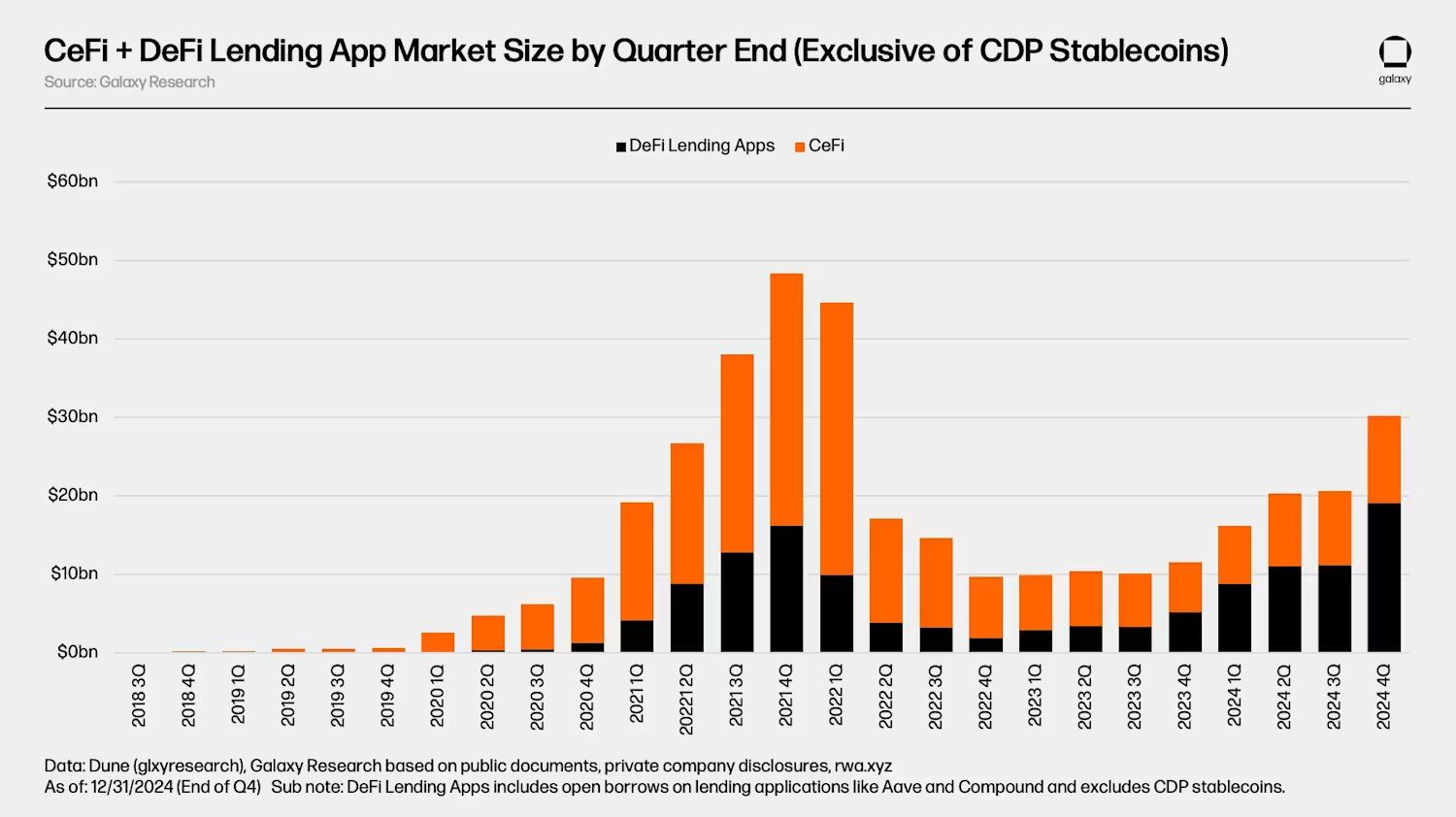

Together, these players are driving CeFi’s recovery, though they face growing competition from DeFi protocols. Galaxy Digital emphasized that DeFi lending has experienced a much stronger recovery. In the bull run of 2020 to 2021, DeFi lending apps made up just 34% of the market. Yet, by Q4 2024, it accounted for 63%.

“Most CeFi firms do not offer yield products to US clients since 2022. DeFi platforms often don’t comply with these regulations nor require KYC, which could be a factor,” Ledn’s co-founder Mauricio Di Bartolomeo posted.

The growth is also demonstrated by the fact that DeFi borrowing has reached a new peak, 18% higher than the previous bull market peak. DeFi lending apps like Aave (AAVE) and Compound (COMP) survived the bear market without collapse, benefiting from their decentralized nature and strong risk management. In fact, DeFi lending surged to 959% from Q4 2022 to Q4 2024.

“Aave and Compound, has seen strong growth from the bear market bottom of $1.8 billion in open borrows. There were $19.1 billion in open borrows across 20 lending applications and 12 blockchains at the conclusion of Q4 2024,” Galaxy noted.

The rise has contributed significantly to the overall improvement in the crypto lending market. Excluding CDP stablecoins, the crypto lending market saw a 214% recovery from Q4 2022 to Q4 2024.

“The total market has expanded to $30.2 billion, mostly driven by DeFi lending app expansion,” the report noted.

CeFi and DeFi Lending Recovery. Source: Galaxy Digital

As CeFi lending continues to stabilize under the control of a few large players, DeFi platforms have emerged as the true leaders in the recovery. Their decentralized and permissionless nature provides a strong foundation for growth in a market still recovering from previous turbulence. Despite challenges, it has seen substantial growth, highlighting the resilience of the crypto lending space in the face of adversity.

[ad_2]