[ad_1]

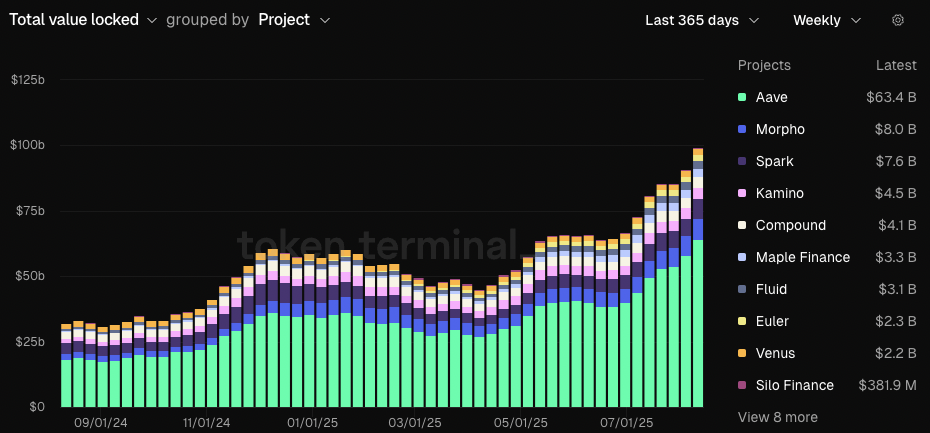

With the ETH price flying and regulators opening up to decentralized finance (DeFi), onchain lending and borrowing markets are making concurrent all-time highs, hitting the $100 billion threshold today.

The onchain lending market reached the $100 billion milestone this week, according to TokenTerminal, with Aave commanding a lion’s share of the market, with $63.4 billion, or 63.4%, of the total TVL.

Morpho and Spark are neck and neck for second largest with $8 billion and $7.6 billion, respectively.

DeFi Lending Total TVL – TokenTerminal

The lending space has exploded over the last two months, growing 49% from $66.8 billion since the beginning of July. The move coincides with ETH’s parabolic move. ETH is up 90% from $2,470 to $4,700 in the same timeframe, and indicates that a significant portion of DeFi lending TVL is denominated in ETH.

As a result, Ethereum DeFi tokens have performed well over the last two months, with AAVE up 25%, LDO up 114%, and SPK up 155% since July 1.

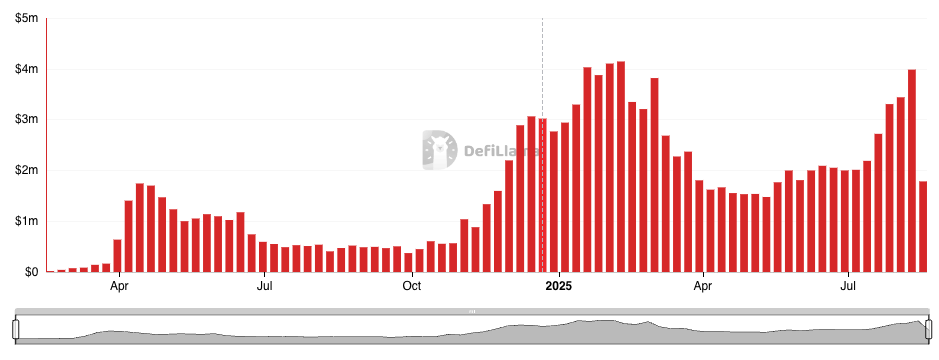

Morpho has seen a large increase in bothVL, and total fees generated. The protocol recorded its fourth-highest fee-generating week ever between Aug. 4 and 10, with $3.98 million, a 135% increase from its local low of $1.48 million at the beginning of May.

The lending and borrowing protocol has been one of the fastest-growing DeFi platforms over the last year, and its recent fee surge could be partially attributed to the success of its integration on the HyperEVM.

Onchain lending market and collateralized debt position (CDP) protocol, Felix, uses Morpho HyperEVM vaults on the backend of its Felix Vanilla markets. The Morpho-powered market announced that it crossed $550 million in deposits on Aug 11.

Users can leverage Felix Vanilla, and therefore Morpho to loop their Kinetiq staked HYPE positions and borrow stablecoins. Felix also has an ongoing points program, which may be incentivizing its use.

Morpho Fees – DeFiLlama

[ad_2]