[ad_1]

Decentralized activities account for the biggest share of block space on L2 chains. Almost all rollup platforms grew in 2024, getting the biggest boost from DEX trading and lending. Other activities take up less than 5% of block space on some chains.

DeFi and L2 chains proved to be a good fit in 2024, as DEX trading and lending became the main drivers of activity on these networks. The crypto landscape in 2024 also included stablecoins serving as the main source of liquidity on L2.

Mantle reserves more than 57% of block space for DeFi activities. Base has the second-largest share of DeFi activity, mostly related to meme token creation and the launch of small-scale liquidity pairs. More than 43% of Base’s on-chain space is taken by those types of L2 transfers.

DeFi also underscores the need for value transfers from Ethereum, which led to the $1B in net inflows to major L2 ecosystems.

After the last few weeks of market recovery, the value of DeFi for all chains surpassed $103B once again. Ethereum still has the largest share at nearly $60B. L2 chains are competing with Solana, TRON and BSC for a share of activity. However, Ethereum’s dominance is the major driver of liquidity and traffic into the current selection of L2s.

The other driver of L2 success is the apps themselves, mostly Uniswap and Aave, which have shown their capabilities of drawing in traders and value.

Most L2 chains remain fragmented

Among L2 chains, Polygon remains the most widely used for cross-chain activities. Polygon was a first-runner and keeps close ties with Ethereum, through more liquid bridges.

Polygon also carries bridges with connections to multiple other chains, making up to $63M in liquidity locked. Bridging is not a high-traffic activity, as most of the bridged or wrapped assets remain on the new chain. Bridging back to the original chain is also often complicated or limited.

Arbitrum remains the busiest L2 chain in terms of bridging. Even though Arbitrum leads in this category, on-chain data shows that only around 819 wallets bridge assets per week. Each day, under 150 bridging wallets are active, moving under 400 ETH.

Optimism, Zora, and Scroll are also among chains with around 10% in bridging activity. However, L2s are not fulfilling the vision of Vitalik Buterin in being cross-compatible not only with Ethereum, but among each other.

Questions remain about correct usage of L2 chains

In 2024, L2s were all about rapid growth, high transaction volumes, and value inflows. In some use cases, L2s successfully scaled Ethereum and moved traffic to a cheaper, faster layer.

L2 chains also turned to business models to draw the attention of VC backers or produce a viable token for short-term market success.

One of the biggest problems for L2 chains is the rapid slowdown in volumes soon after launching. The airdrop incentive model often causes developers to flock to early-stage L2 even during the testnet period.

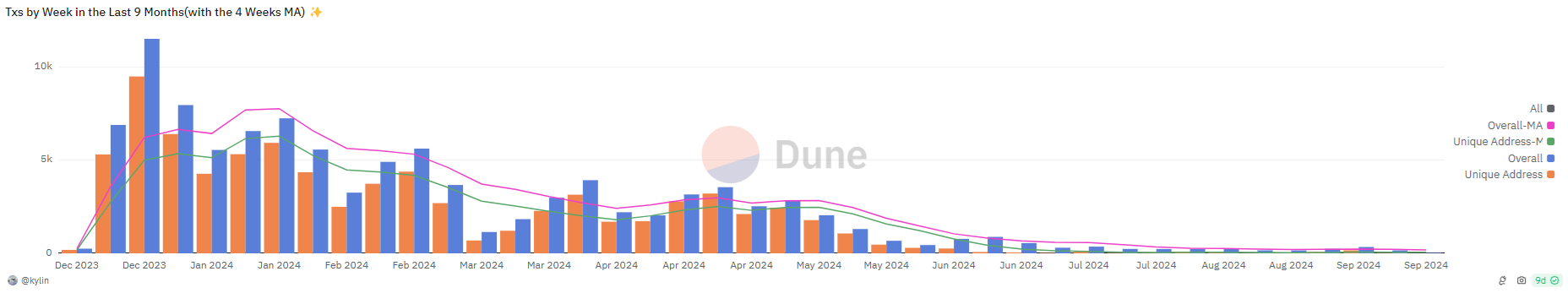

ZKSync transactions slowed down after the airdrop incentives ran out. | Source: Dune Analytics

Soon after the main net launch, these users are already flocking to new chains, boosting transaction counts at their new destination. All of the activity is directed to one goal – to receive a larger airdrop share. After a few months, the traffic on new L2 chains slows down to nothing.

L2 chains may have to thank fat-fee apps and liquidity hubs for their survival and for marinating activity levels, which combine to offer passive returns or trading. Even with early incentives, this meant the first generation of large-scale L2 platforms managed to survive and grow their liquidity and user base.

L2 as a narrative showed signs of too much hype, but existing chains are hosting real activity, with a potentially bullish effect for Ethereum.

L2 chains also offer their own specific focus and culture, often defining the most common types of apps. Chains like Linea host outsized SocialFi activity, turning that into a staple. The chain is also the leading host for NFT activity. Arbitrum is often chosen for gaming, while Base is the go-to chain for high-speed DEX activity and a meme coin launchpad.

L2s remain highly active but have not yet reached the limits of Ethereum’s blocks. Most chains managed to strike a balance and achieve net gains even after paying all the L1 fees for using Ethereum. Taiko remains the only major L2 that is operating at a loss due to its high-frequency interactions with Ethereum blocks.

Cryptopolitan reporting by Hristina Vasileva.

[ad_2]