[ad_1]

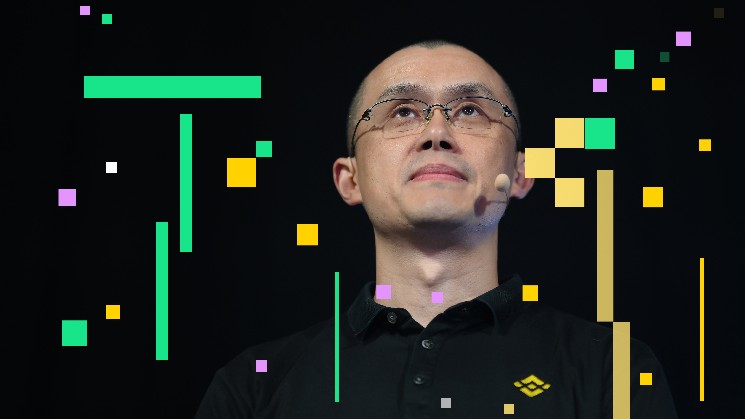

YZi Labs, the family office founded by Binance co-founder Changpeng “CZ” Zhao and Yi He, which was rebranded from Binance Labs, has expanded its position in Ethena Labs, the protocol behind USDe, which has become the third-largest U.S. dollar-denominated crypto asset with more than $13 billion in circulation.

The investment comes as Ethena enters a new stage of growth, which includes extending its footprint on BNB Chain. This includes rolling out products designed to bridge crypto and traditional finance, such as USDtb, a fiat-backed stablecoin in development, and Converge, an institutional settlement layer being built with Securitize and partners connected to BlackRock.

USDe, marketed as a “synthetic dollar,” uses bitcoin BTC, ether (ETH) and Solana’s SOL (SOL)as backing assets, pairing them with an equal value of short perpetual futures positions on exchanges to maintain a $1 peg.

Launched less than two years ago, the synthetic dollar crossed the $10 billion supply milestone faster than any other dollar-pegged crypto asset.

“Since our investment team first met Guy [Young] in late 2023, Ethena has become the category definer for yield-bearing synthetic dollars,” said Dana Hou, investment partner at YZi Labs.

For users, the developments mean more options for holding and using digital dollars across centralized exchanges and decentralized finance protocols. For institutions, products like Converge aim to create a familiar settlement layer for tokenized assets, potentially broadening adoption of on-chain financial infrastructure.

Read more: Ethena’s USDe Outpaces BlackRock’s Bitcoin, Ether ETFs With $3.1B Inflow Surge

[ad_2]