[ad_1]

As of mid-February 2025, 12 U.S. spot bitcoin exchange-traded funds (ETFs) hold $114.41 billion in bitcoin, representing 5.94% of the leading crypto asset’s market cap. While retail investors have access to these funds, the following editorial examines the financial titans accumulating sizable bitcoin ETF shares.

12 ETFs Now Control Nearly 6% of Bitcoin’s Market Cap

When people claim that Blackrock, Fidelity, and Ark Invest own vast quantities of bitcoin (BTC), it is more accurate to note that the investors in their exchange-traded funds (ETFs) own the BTC, while these firms act solely as custodians.

Since Jan. 11, 2024, this group of 12 spot bitcoin ETFs has accumulated over 1 million BTC, with Blackrock’s IBIT taking the lead by holding a substantial portion of the $114.41 billion in BTC under management. At the time of writing, IBIT holds $57.46 billion of that total.

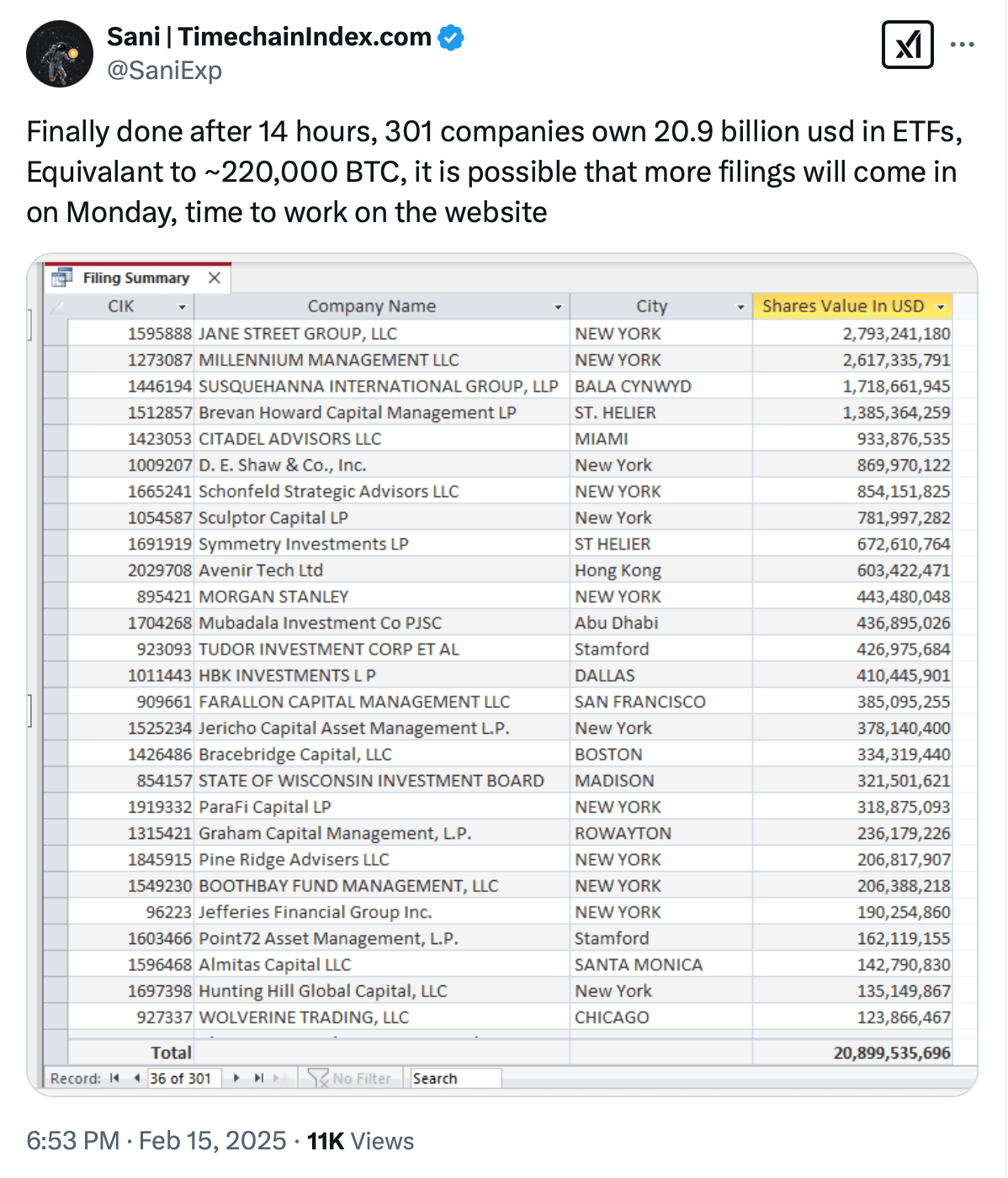

Onchain analyst Sani discovered $20.9 billion out of more than 300 institutions.

But who stands as one of the largest holders of IBIT? The answer is Goldman Sachs Group Inc., as the financial giant commands a significant portion of Blackrock’s IBIT. Alongside Goldman are Millennium Management, Susquehanna International Group, and the State of Wisconsin Investment Board (SWIB).

Speaking of Susquehanna, the firm is deeply involved in numerous BTC ETFs. Susquehanna, the global quantitative trading and investment firm known for its market making, proprietary trading, and institutional brokerage services, holds shares in Coinshares’ Valkyrie BRRR, Fidelity’s FBTC, Grayscale’s GBTC, Franklin Templeton’s EZBC, Vaneck’s HODL, Invesco Galaxy’s BTCO, Wisdomtree’s BTCW and Hashdex’s DEFI too.

The quantitative trading firm Jane Street Group is also actively engaged in eight of the 12 funds. Bracebridge Capital LLC ranks among ARKB’s foremost holders, while Millennium Management LLC remains one of BITB’s dominant shareholders. Horizon Kinetics Asset Management LLC controls a significant stake in Grayscale’s Bitcoin Mini Trust.

Additional key holders of the BTC mini-fund include Parafi Capital, IMC-Chicago, Multicoin Capital Management, Hightower Advisors, and Eagleclaw Capital Management. IMC-Chicago is also involved in GBTC and IBIT. Hightower Advisors has dabbled in GBTC, FBTC, IBIT, ARKB, EZBC, and BITB. Beyond IBIT, Goldman also takes part in FBTC alongside Millennium Management dipping into several bitcoin ETFs.

The expanding institutional ETF participation signals Bitcoin’s evolution as an asset class. Alongside this, firms such as Susquehanna and Jane Street employ diversified ETF stakes to hedge or arbitrage, blending quantitative techniques with crypto exposure. This activity will continue to harden bitcoin’s scarcity. As far as activity is concerned, well, that’s another story.

[ad_2]