[ad_1]

The price of Curve DAO (CRV) plummeted by up to 35% within a few hours. This sharp decline came after news broke that Michael Egorov, the founder of Curve, might face liquidation.

Egorov, a key figure in the decentralized finance (DeFi) sector, is currently navigating a precarious trading situation.

Curve Founder’s Potential Liquidation Causes Panic

According to Arkham, an on-chain analysis platform, Egorov is close to seeing $140 million worth of CRV liquidated. He has borrowed around $95.7 million in stablecoins, primarily crvUSD, against $141 million in CRV distributed across five accounts on various lending protocols.

“Based on current rates, Egorov is paying $60 million annually in order to keep his positions open on Llamalend,” Arkham said.

Read more: What Is Curve (CRV)?

Egorov borrowed $50 million through the DeFi platform – Llamalend at an annual percentage yield (APY) of roughly 120%. This high rate is largely due to the near absence of crvUSD available to borrow against CRV on Llamalend. Notably, three of Egorov’s accounts comprise more than 90% of the crvUSD borrowed on this protocol.

Additionally, data from Spot On Chain reveals that Egorov presently has 139 million CRV tokens worth $37 million as collateral, with debts amounting to $27 million across three platforms. According to the latest updates, Egorov’s $20.2 million position on DeFi platform UwULend has been liquidated.

The falling price of CRV has also impacted other major players in the market. For example, a crypto whale, 0xF07, was compelled to transfer 29.62 million CRV, valued at approximately $7.68 million, to Binance due to a liquidation on Fraxlend.

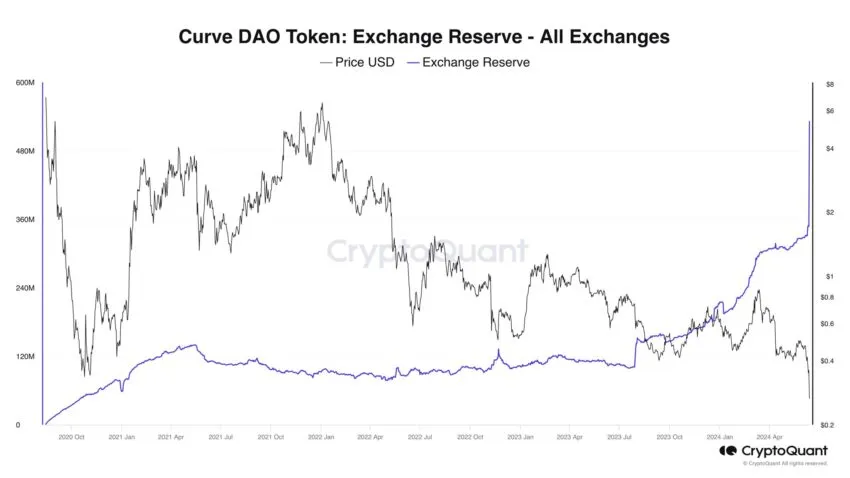

That being said, Ki Young Ju, founder of another on-chain analysis platform – CryptoQuant, observed a significant increase in the CRV balance on exchanges, reaching an all-time high. It surged by 57% in just four hours.

Curve DAO Token Exchange Reserves. Source: CryptoQuant

After initially dropping from $0.35 to $0.21, the price of CRV has since shown resilience, recovering to about $0.26, marking an 18% rebound. This scenario highlights the volatile and unpredictable nature of the crypto markets.

[ad_2]