[ad_1]

The floor price of CryptoPunks, perhaps the most iconic Ethereum-based NFT collection, has climbed above $208,000 — its highest level since April 2022 in U.S. dollar terms— amid a broader resurgence in digital collectibles as ETH rallies.

CryptoPunks Floor Price in ETH

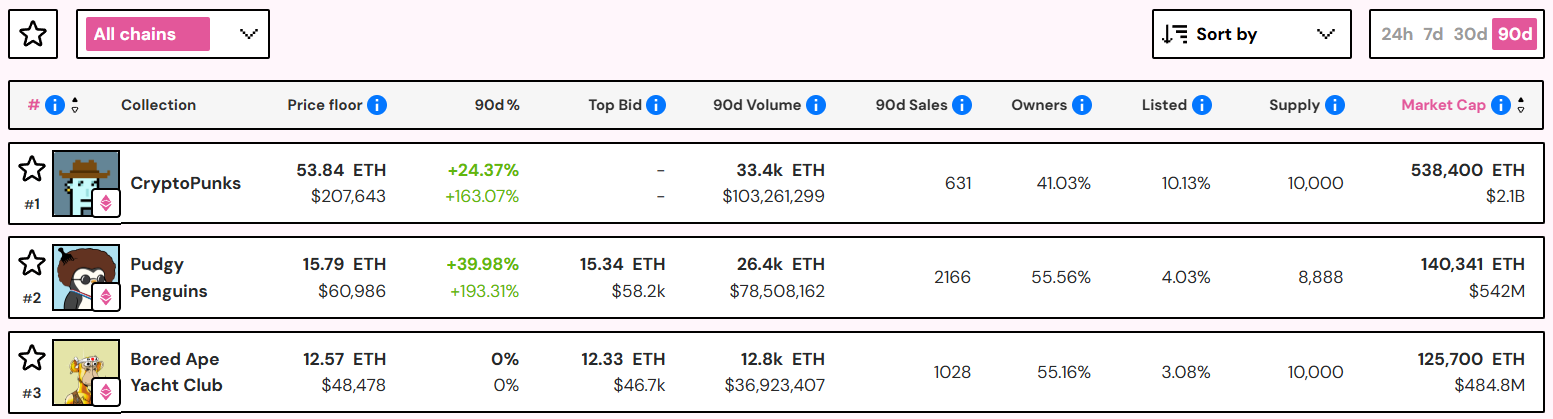

Data from NFTPriceFloor, a website tracking NFT prices, also shows that several top collections have recorded explosive growth over the past 90 days.

Top NFT collections by floor price in ETH

While CryptoPunks led the pack with a 163% increase in U.S. dollar terms, securing the top spot by floor price per NFT, Pudgy Penguins followed closely with a nearly 200% surge, climbing to second place in the rankings.

But in terms of Ether (ETH), the picture looks a bit different. CryptoPunks are currently priced around 53.84 ETH — a level last seen in February 2024 — showing that most of the recent gains can be attributed to the rising price of ETH, which has more than doubled since early May.

Wealth Effect Triggered by ETH Rally

Launched in 2017 by Larva Labs, CryptoPunks comprises 10,000 algorithmically generated pixel-art characters and is widely credited with defining the profile picture NFT genre. In March 2022, the collection was acquired by Yuga Labs, the company behind the Bored Ape Yacht Club.

In an interview with The Defiant, NFTPriceFloor co-founder Nicolás Lallement pushed back on the idea that the recent price movement is merely driven by ETH volatility. “I wouldn’t call this just post-ETH rally noise,” Lallement said, describing the relationship between ETH and NFTs as “almost mechanical,” and noting that rising ETH prices tend to trigger a wealth effect.

“When ETH rallies, we tend to see a wealth effect kick in: top collectors, many of whom are sitting on ETH-based grails like Punks or Art Blocks, feel more confident to re-enter the market. So while the ETH pump is definitely a catalyst, I’d argue it’s enabling something deeper,” Lallement explained.

He also pointed out that activity is expanding beyond CryptoPunks and Moonbirds, the latter having been bought out in June from Yuga Labs by Spencer Ventures and Orange Cap Games.

Broader NFT Comeback

As volume picks up in other early collections like MoonCats, CrypToadz, Cool Cats and Hashmasks, Lallement suggests that the dynamic “might be the early stages of a broader comeback, not just opportunistic dumping.”

Big players may also be fueling momentum. Ribbit Capital’s Micky Malka recently founded the Node Foundation after acquiring the CryptoPunks IP, with plans to create a generative art museum in Silicon Valley. GameSquare, which holds its treasury in ETH, has pledged millions of dollars to acquire top-tier NFTs, including a rare Ape Punk formerly owned by Compound founder Robert Leshner.

“The narrowing gap between Fidenza and CryptoPunks floor prices is… a clear signal,” Lallement added, noting that Fidenzas — a generative art collection on Art Blocks — now trade at 42 ETH, just around 10 ETH below Punks. In his view, that signals that a growing number of market participants “genuinely believe” an NFT bull market “might be on the horizon or already underway.”

[ad_2]