[ad_1]

The cryptocurrency market saw a slight increase in trading activity this week, with global market capitalization rising by 3% over the seven-day period.

This growing optimism has led whales to accumulate assets such as Telegram-linked Toncoin (TON), the leading altcoin Ethereum (ETH), and AI-driven Artificial Superintelligence Alliance (FET).

Toncoin (TON)

This week, crypto whales have paid attention to Toncoin (TON) as its price continues to grow. This rally comes a week after Telegram CEO Pavel Durov broke his silence regarding his arrest in France.

At press time, the altcoin trades at $5.55, having seen a 16% price hike over the past seven days, putting many of its holders in profit.

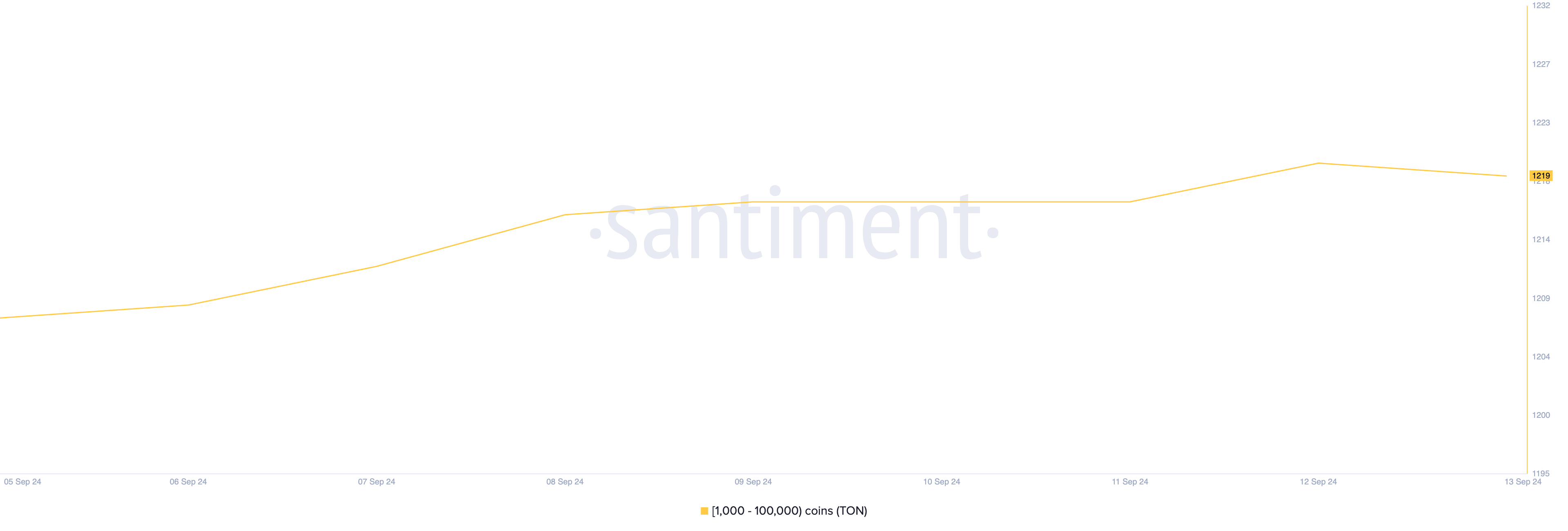

Toncoin Supply Distribution. Source: Santiment

This has led to an uptick in the number of whales trading the altcoin. Santiment’s data shows that the count of whale addresses holding between 1,000 and 100,000 TON currently stands at 1219, its highest in 30 days.

Ethereum (ETH)

Ethereum’s large holders’ netflow has spiked by 109% this week. Large holders are whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and those they sell over a specific period.

This accumulation has taken place despite Ethereum facing resistance at the $2,386 price level, indicating that whales remain unfazed by the price challenges.

Ethereum Large Holders Netflow. Source: IntoTheBlock

Whales likely expect a price rally as market sentiment shifts from negative to positive. If ETH manages to break above the $2,386 resistance level, it could continue its uptrend and reach $2,783.

Artificial Superintelligence Alliance (FET)

The value of AI-based asset Artificial Superintelligence Alliance (FET) has witnessed a 25% growth this week. It received even more attention from market participants following reports that OpenAI wants to raise a new $6.5 billion equity financing.

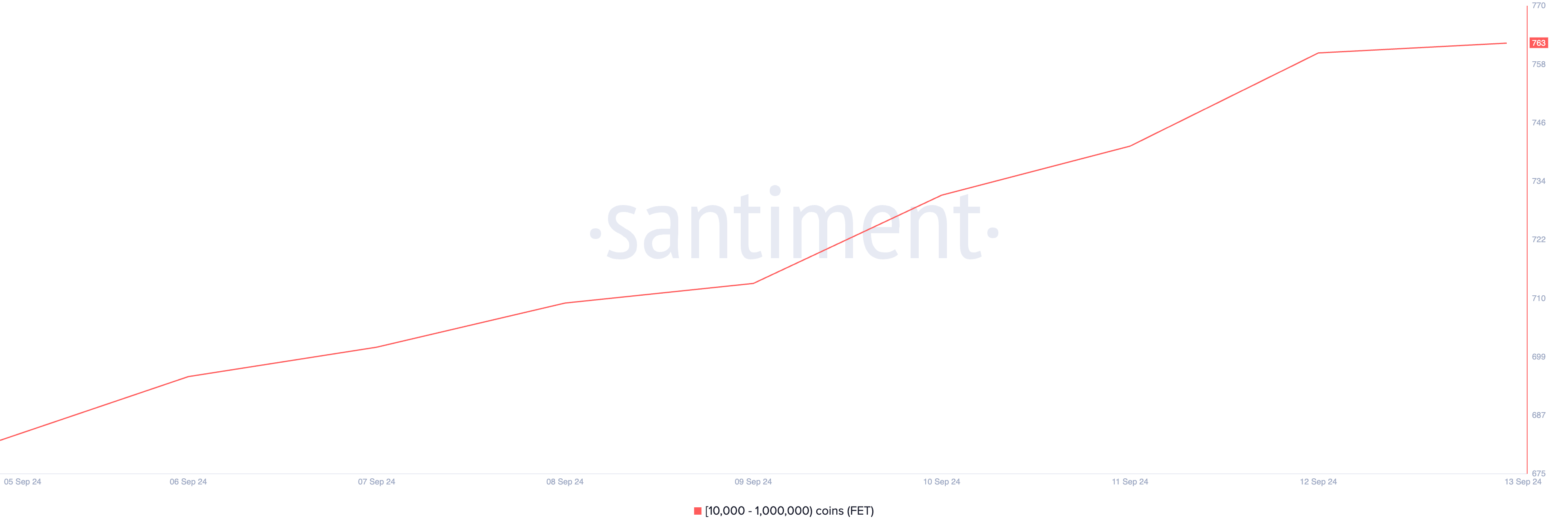

FET Supply Distribution. Source: Santiment

Santiment data reveals an 11% increase in the count of crypto whale addresses holding between 10,000 and 1,000,000 FET. As of press time, this group now includes 763 addresses, marking an all-time high.

[ad_2]