September is showing an uneasy mood across digital asset treasuries (DATs).

What began as a year of aggressive accumulation by corporate players has now run into the harsh reality of collapsing market net asset values (mNAVs), investor caution, and punishing stock declines.

DATs Holding Top Crypto Assets Are Losing Purchasing Power as September Mutes the Rally

According to Kaiko’s latest report, digital asset treasury companies have been central to crypto’s 2025 rally.

Firms like Strategy (MSTR), BitMine, and SharpLink have been steadily accumulating Bitcoin, Ethereum, and Solana, helping to support spot prices and attracting new inflows.

Strategy has been the most visible example. In less than nine months, it has added 190,000 BTC, bringing total holdings to over 638,000, almost on pace with its record 2024 purchases.

Top Public BTC Treasury Companies. Source: Bitcoin Treasuries.

BitMine and SharpLink have mirrored this strategy with Ethereum (ETH), while new entrants are diversifying into XRP, SOL, and even smaller coins like HYPE and ENA.

This activity has fueled enthusiasm around listed crypto treasury firms, particularly in Asia-Pacific, where the model has taken off.

mNAV Collapse Signals Investor Caution

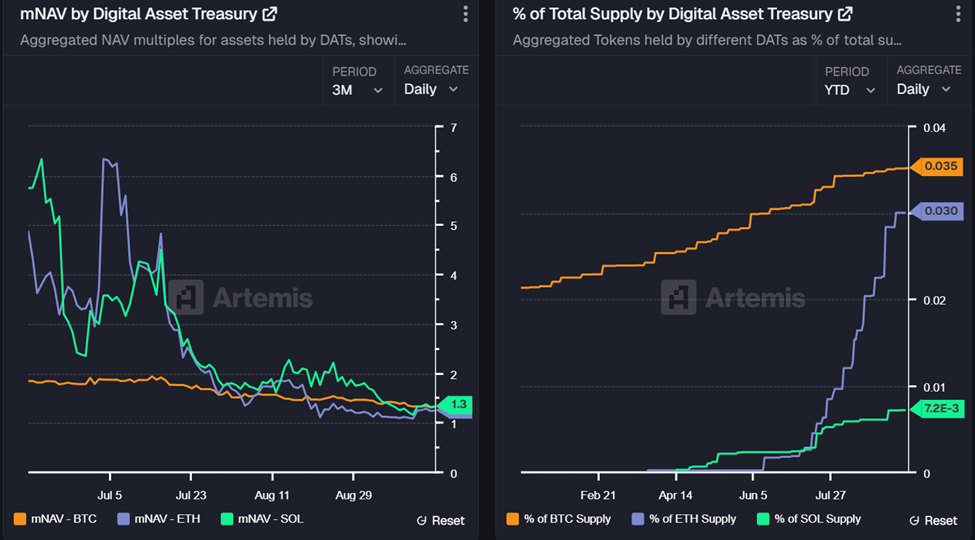

However, risks are piling up beneath the surface. Artemis Analytics data shows that the mNAV of companies holding BTC, ETH, and SOL has dropped sharply for three consecutive months, hitting a fresh low in September.

mNAV by Digital Asset Treasury. Source: Artemis

The numbers suggest that, despite accumulation, DATs are bleeding purchasing power as underlying assets fail to offset equity declines.

The pressure has been visible in stock performance. BeInCrypto previously reported that Next Technology Holding’s shares (NXTT) fell nearly 5% after the firm filed to raise $500 million for additional Bitcoin purchases.

The firm already holds 5,833 BTC, valued at $673 million, but the announcement triggered skepticism rather than confidence.

The sharpest losses came from KindlyMD’s NAKA stock, which plunged 55% after PIPE shares entered the market, adding to a 90% monthly drop.

CEO David Bailey told shareholders that volatility was expected and framed the turbulence as an opportunity to align with long-term backers. However, the severity of the crash reflects the structural risks critics have long warned about.

“From the beginning, I warned that Bitcoin treasury companies were Ponzi schemes built on a pyramid. Today, NAKA dropped by 55%, now down 96% since May,” gold advocate Peter Schiff remarked.

Similarly, MicroStrategy’s NAV compression has limited new BTC buys. Its net asset value (NAV) multiple fell from 1.75x in June to 1.24x in September, curbing new purchases.

Innovation or Recklessness?

Amid the turbulence, some in crypto circles are floating unconventional fixes. DeFi analyst Ignas argued that tokenizing DAT stocks could create arbitrage opportunities, bring liquidity on-chain, and re-engage crypto-native investors.

“DATs are running out of buying power as mNAVs collapse. They should tokenize their stock so even crypto degens could buy,” he said.

While tokenization could widen access, it would also add another layer of speculation to already volatile instruments.

ETH-based treasuries, Ignas added, have yet to explore debt financing, leaving more potential stress ahead.

Seriously, as DAT volatility collapsed, they are much less fun.

plus, ETH DATs have still not opened the pandora box of debt. So they have more potential pic.twitter.com/qmjQ0ueF8O

— Ignas | DeFi (@DefiIgnas) September 16, 2025

Nevertheless, the September downturn highlights a paradox. DATs support crypto spot markets through heavy accumulation.

Yet, their equities are collapsing as investors question sustainability. The model appears caught between its promise as a new corporate treasury strategy and the brutal reality of public market scrutiny.

The post From Accumulation to Anxiety: Crypto Treasury Firms Confront Harsh Market Realities appeared first on BeInCrypto.