[ad_1]

Political and regulatory tensions surrounding cryptocurrency are rising in Washington as Senator Jon Ossoff voiced support for impeaching President Donald Trump over a private event tied to the promotion of his meme coin, while SEC Commissioner Hester Peirce urged for more transparent crypto regulations to end the uncertainty plaguing US financial firms.

SEC Commissioner Hester Peirce: US Crypto Regulation Feels Like Playing ‘The Floor is Lava’ in the Dark

At the SEC’s “Know Your Custodian” roundtable on April 25, SEC Commissioner and head of the agency’s crypto task force, Hester Peirce, delivered a vivid analogy to describe the current regulatory landscape facing US financial firms engaging with cryptocurrency: it’s like playing a game of “the floor is lava” — but without any light.

Peirce explained that navigating crypto regulations today means firms must hop from one uncertain legal position to another, all while avoiding direct contact with crypto assets themselves — which she likened to “burning legal lava.”

“It is time that we find a way to end this game. We need to turn on the lights and build some walkways over the lava pit,” Peirce urged, calling for a clearer regulatory framework that would allow financial institutions to engage more openly with the rapidly evolving digital asset sector.

Navigating in the Dark

Peirce detailed how SEC-registered entities — such as investment advisers, broker-dealers, and custodians — are often left uncertain about how to handle crypto assets. Firms are unsure whether a given token constitutes a security, which custodians meet federal qualifications, and whether participation in activities like staking or exercising governance rights could inadvertently trigger regulatory breaches.

This regulatory fog, according to Peirce, is choking innovation and hampering the development of a robust, transparent crypto market in the United States. Firms are increasingly forced to operate with extreme caution, avoiding direct custody of crypto assets altogether, which in turn restricts the liquidity and maturity of US-based crypto markets.

Peirce was not alone in voicing concern. SEC Commissioner Mark Uyeda echoed her sentiment, stressing that as more registrants seek to work with crypto assets, it’s critical they have access to qualified custodians that meet all legal and regulatory requirements.

Uyeda proposed that the SEC should consider permitting advisers to use state-chartered limited-purpose trust companies, which are already authorized to hold crypto assets, as qualified custodians. He argued that broadening access to compliant custodial options could offer some much-needed clarity and operational support to firms navigating the sector.

The inability of brokers and Alternative Trading Systems (ATS) to custody crypto assets under the current rules, Uyeda warned, could stifle the development of a healthy secondary market for digital assets in the United States.

A New Direction Under Chair Paul Atkins

The roundtable also marked an important moment for the newly sworn-in SEC Chair, Paul Atkins, who laid out a notably different vision from that of his predecessor, Gary Gensler.

Atkins, who was appointed by President Donald Trump, stated that he expects blockchain technology to deliver “huge benefits” through increased efficiency, greater risk mitigation, enhanced transparency, and reduced costs across the financial system.

Importantly, Atkins pledged to focus the SEC’s energy on crafting “clear regulatory rules of the road” for digital assets — a commitment that many in the crypto community have long been hoping for. Without directly criticizing Gensler, Atkins made it clear that the previous regulatory approach had contributed to significant confusion and uncertainty in the market.

“I look forward to engaging with market participants and working with colleagues in President Trump’s administration and Congress to establish a rational, fit-for-purpose framework for crypto assets,” Atkins said.

Peirce’s metaphor resonated widely because it captures what many market participants have long complained about: the absence of coherent and accessible guidelines. Crypto firms, investment funds, custodians, and trading platforms are often left guessing about how to operate within the law, while enforcement actions against the industry mount.

Calls for regulatory reform have grown louder as the United States risks falling behind other jurisdictions — such as the European Union, with its MiCA framework, or countries like Singapore and the UAE — that have adopted clearer and more supportive digital asset regulations.

If Atkins, Peirce, and Uyeda succeed in pushing through more practical reforms, it could mark a major turning point for crypto in America. The prospect of regulatory clarity would likely unlock new levels of institutional adoption, investment, and innovation within the sector.

For now, however, Peirce’s warning remains clear: unless US regulators build structured “walkways” across the legal lava pits, the nation’s financial firms will continue to stumble in the dark, risking not only their own survival but also America’s future leadership in blockchain and digital finance.

Senator Jon Ossoff Calls for Impeachment Proceedings Against President Trump Over Private Meme Coin Dinner

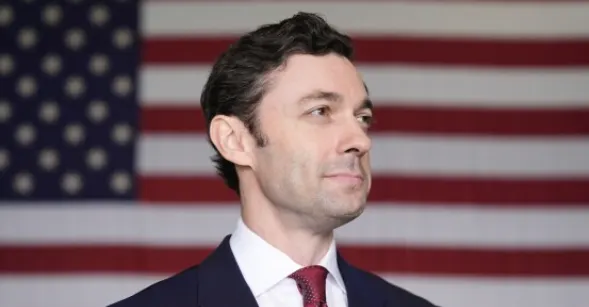

In other crypto news, US Senator Jon Ossoff has thrown his support behind launching impeachment proceedings against President Donald Trump, citing a growing controversy over Trump’s association with the Official Trump meme coin and a private dinner event tied to its holders. Speaking during an April 25 town hall in Georgia, where he is running for reelection, Ossoff said Trump’s actions clearly meet the standard for an impeachable offense.

“I mean, I saw just 48 hours ago, he is granting audiences to people who buy his meme coin,” Ossoff said, according to a report by NBC News. “When the sitting president of the United States is selling access for what are effectively payments directly to him, there is no question that that rises to the level of an impeachable offense.”

While expressing strong support for impeachment proceedings, Ossoff acknowledged the political reality that such action is unlikely to succeed unless the Democratic Party regains control of Congress during the 2026 midterm elections. Republicans currently hold majorities in both the House of Representatives and the Senate.

The Dinner That Sparked a Political Firestorm

The controversy centers around the Official Trump (TRUMP) meme coin, a cryptocurrency project directly tied to Trump’s personal brand. On April 23, the TRUMP meme coin website announced plans for an exclusive dinner with President Trump at his Washington, D.C. golf club, inviting the top 220 holders of the TRUMP token to attend.

TRUMP holders can register to dine with the US President (Source: gettrumpmemes.com)

A leaderboard tracking the largest TRUMP wallets was published alongside the announcement, with a registration link for eligible holders. The site noted that participants would need to pass a background check, could not be from a Know Your Customer (KYC) watchlist country, and would not be allowed to bring guests.

Following the announcement, the price of the TRUMP token surged by over 50%, according to CoinMarketCap data — further intensifying concerns that the president was personally profiting from the event.

Social media speculation quickly emerged suggesting that a TRUMP holder would need to own at least $300,000 worth of the token to secure an invitation. However, the TRUMP team denied those claims on April 25, clarifying that the threshold was based on a curated leaderboard rather than raw blockchain data, which includes locked tokens, exchange wallets, and non-participating addresses.

Still, the controversy over selling direct access to the sitting president for crypto holdings has not subsided.

Legal experts have sounded alarms about the potential conflicts of interest created by Trump’s cryptocurrency activities, including not just the TRUMP meme coin but also his involvement in World Liberty Financial, a decentralized finance (DeFi) protocol affiliated with his brand.

“Within just a couple of days of him taking office, he’s signed a number of executive orders that are significantly going to affect the way that our crypto and digital assets industry works,” said Charlyn Ho, a partner at the law firm Rikka, in a February interview. “So if he has a personal pecuniary benefit arising from his own policies, that’s a conflict of interest.”

Ho and other legal scholars warn that Trump’s direct financial involvement in cryptocurrency projects that could be influenced by federal policy presents unprecedented ethical challenges for the presidency.

The concerns are amplified by the fact that Trump’s executive orders in the early days of his new term have already had notable impacts on the crypto sector, including proposed changes to digital asset taxation, decentralized finance regulations, and stablecoin oversight.

A Brewing Battle Ahead of the 2026 Midterms

Senator Ossoff’s town hall comments suggest that Democrats may increasingly focus on Trump’s crypto-related activities as a potential campaign issue ahead of the 2026 midterms. With control of Congress hanging in the balance, Democrats hope to position Trump’s personal financial dealings as a symbol of broader ethical and governance failures.

Despite these criticisms, Trump’s political base remains fiercely loyal, and his embrace of emerging technologies like cryptocurrency has been praised by some conservative and libertarian voters seeking alternatives to traditional financial institutions.

Still, Ossoff’s comments signal that the president’s blending of official duties with personal crypto ventures is unlikely to fade quietly. As legal experts, ethics watchdogs, and political opponents continue to scrutinize the administration’s entanglements with the crypto industry, the stage appears set for a fierce political and legal battle that could shape the remainder of Trump’s presidency — and the future of digital asset regulation in the United States.

[ad_2]