[ad_1]

Crypto lending is one of the hottest growth sectors in DeFi, doubling its activity since the 2021 bull market. However, there is limited interest in lending DAO tokens.

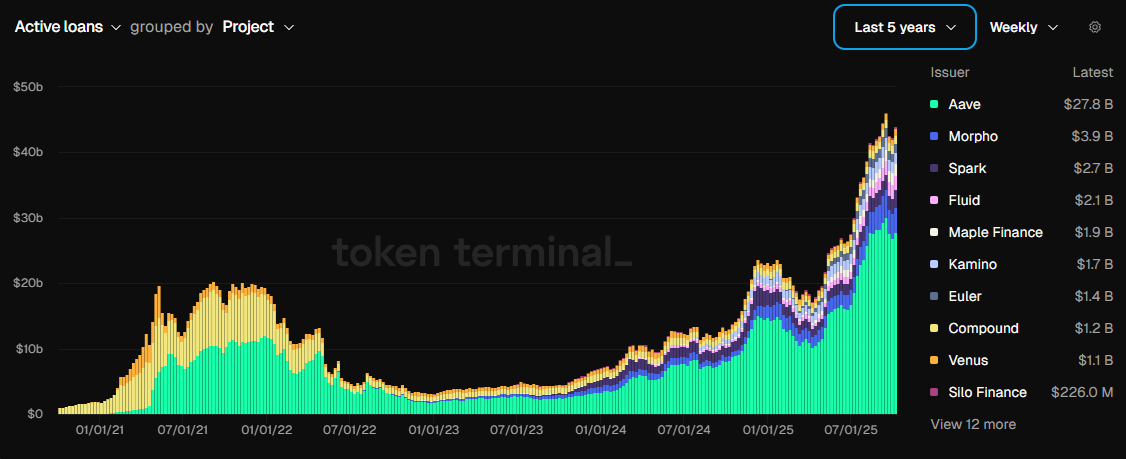

Crypto lending has evolved since 2021, doubling in value since the peak of the previous bull market. In total, lending protocols hold over $46B in active loans, up from around $20B at the peak of the market in 2021.

Crypto lending is more diverse in 2025, but there is limited interest in lending project tokens. | Source: Token Terminal

Aave still has a major share in lending during the current cycle. The main difference is that Curve Finance has mostly divested its loans and has become one of the minor projects. Currently, Aave and Morpho have taken the lead.

The crypto lending landscape is more diverse, with smaller projects managing to carve out a niche. Lending was also accelerated by the growth of stablecoins, where some protocols minted their own assets. For lending projects, improved measures against liquidations and the bullish direction of the crypto market meant the sector achieved a robust recovery after the years-long bear market.

Demand for lending means a steady inflow of fees. Major protocols produce $40M in weekly fees, with $5.28M in revenues. Crypto lending projects are still highly dependent on the Ethereum ecosystem, with ETH widely used for collateral. The total value locked in lending protocols is over $92B, while Ethereum locks in $56B in its top lending apps.

Crypto lending tokens are lagging

Despite the success of crypto lending as an indispensable aspect of DeFi, the tokens of lending protocols are not a hot narrative.

Aave remains the top protocol, but the AAVE native token only expanded to $291. The asset is still 50% down from its all-time peak in 2021.

Lending tokens are now valued at a $9.88B market capitalization, lagging behind other narratives. The collection of lending tokens is still in the green after the latest market recovery. However, the trend in lending is similar to other crypto sectors.

While there are more products and better security, the tokens are not as attractive as during earlier market cycles. Projects also rarely advertise their token, instead focusing on their security and low liquidation risk.

RWA supports the DeFi lending trend

The approach to crypto lending shifted in 2025, aiming for less risky collateral. The biggest problem for lending in 2021 was the presence of Terra (LUNA), which created a vast amount of unbacked stablecoins.

In 2025, tokenized bonds means protocols can back their stablecoins not only with volatile crypto assets, but through low-risk debt.

Currently, RWA tokens are not directly accepted as collateral. However, stablecoins serve as tokenized US T-bill debt and introduce a low-risk asset for lending. Additionally, for some projects, holding tokenized debt also adds a source of predictable passive income.

Direct RWA lending is still rare, with limited vaults using RWA tokens as collateral. Additionally, projects like Clearpool are also growing their influence, offering P2P lending and tokenized private credit.

[ad_2]