[ad_1]

Gemini started operating in France, allowing users to deposit, trade and store digital assets.

The move comes weeks before EU’s MiCA regulations allow registered companies to expand across the trading bloc.

Gemini crypto exchange opened up to users in France just weeks before the European Union’s Markets in Crypto Assets (MiCA) regulations kick in, paving the way for an expansion across the 27-nation trading bloc.

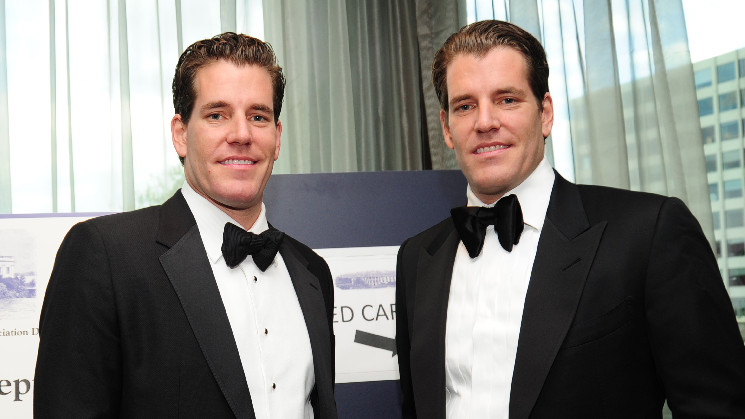

Users, including institutions, in the EU’s second-largest economy are now able to open a Gemini account to deposit, trade and store digital assets, the New York-based company founded by Cameron and Tyler Winklevoss said Tuesday. They will be able to add funds using debit cards and bank transfers.

The move paves the way for growth in other EU countries after MiCA takes full effect at the end of the year. (Rules relating to stablecoin issues came into force in June.) Next year, companies with MiCA approval in one country will be allowed to operate across the bloc. While they’re waiting for approval, companies registered in an EU member country will be able to operate in the country of registration for a specified period of time. For France-registered firms, that’s 18 months.

“Gemini’s research into the French market shows its growing interest in digital assets, and a robust regulatory framework presents a unique opportunity to introduce our platform to the trading community and extend our presence in the European market over the coming months,” Gillian Lynch, Gemini’s CEO of U.K. and Europe, said in a statement.

The company’s affiliate, Gemini Intergalactic Europe, secured digital asset service provider registration in France in December. It is also registered with the central bank of Ireland.

Read more: France Opens for MiCA Applications, First Among Biggest EU Economies

[ad_2]