[ad_1]

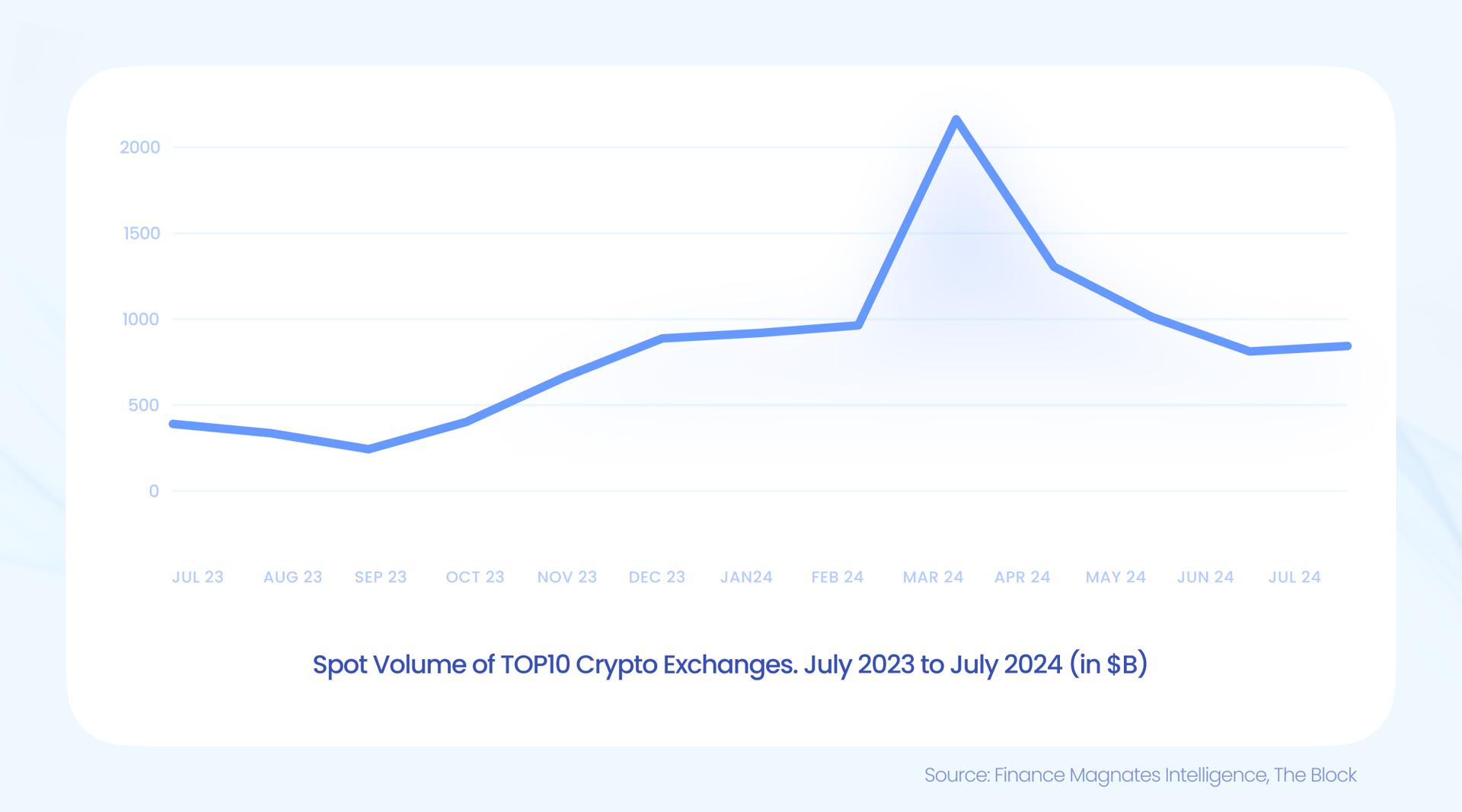

Despite Bitcoin’s (BTC) mixed performance during the vacation period, activity on major cryptocurrency exchanges remains substantial. The total volume of the largest centralized platforms has maintained multi-month highs, growing by over 100% compared to last year. However, it’s impossible to ignore the 60% decrease compared to the record-breaking March.

According to the latest analysis conducted by Finance Magnates Intelligence, the total spot volume for the 10 largest centralized exchanges in July was $844.9 billion, representing a 13% increase from the $812.5 billion reported a month earlier.

Although this result is about 60% lower than the record-breaking $2 trillion from March when Bitcoin tested all-time highs, investor activity still remains at multi-month highs.

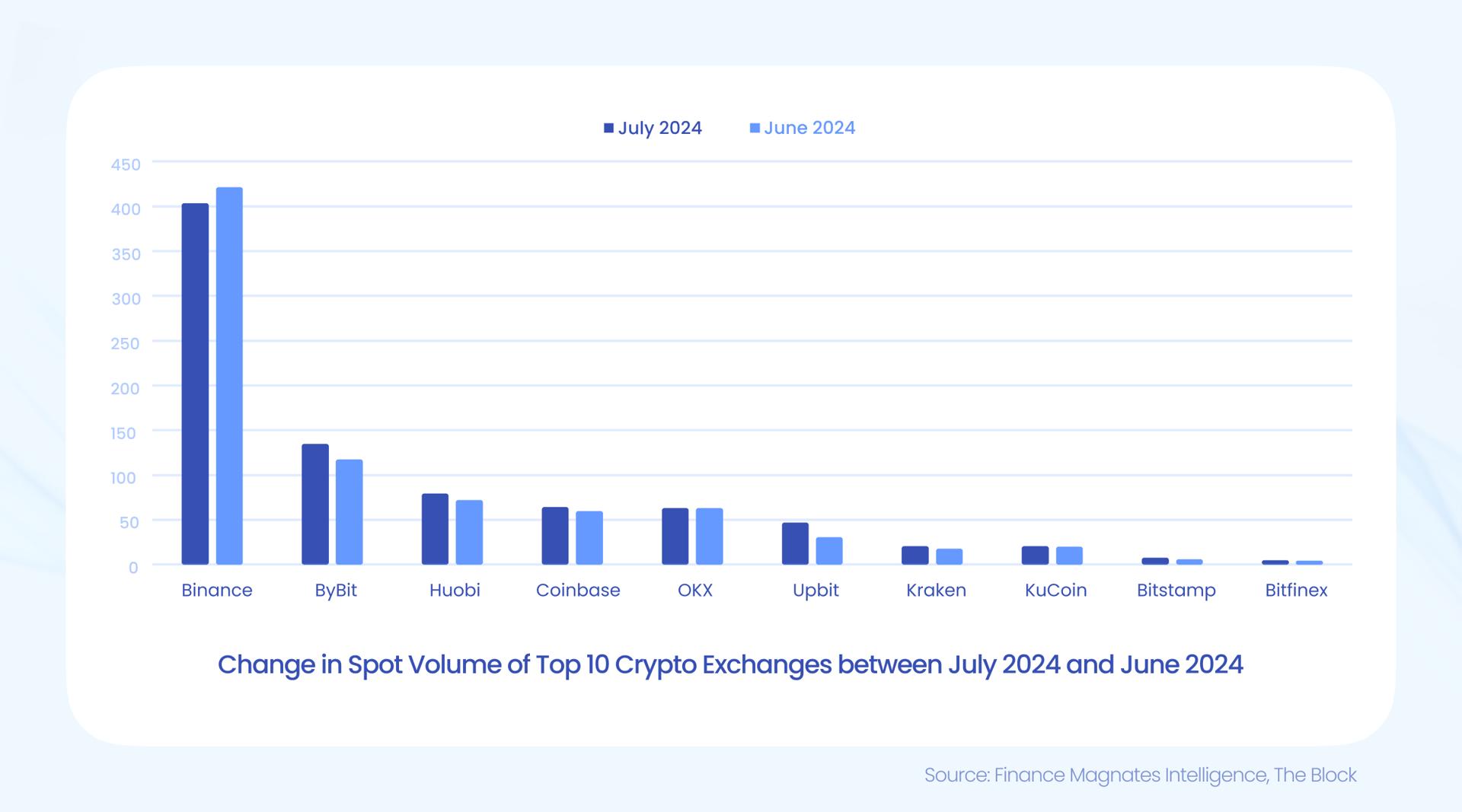

Only Binance and OKX recorded modest month-over-month declines. The remaining exchanges observed a rebound from local June lows.

“In July, the combined spot and derivatives trading volume on centralized exchanges rose 19.0% to $4.94tn, recording the first increase in four months,” the newest report from CCData commented. “The surge in volume follows multiple bullish catalysts, including the launch of the spot Ethereum ETFs in the US and the pro-crypto sentiment voiced by US political figures at the Bitcoin conference held in Nashville, Texas.”

No Changes at the Top

There’s little change among the leaders. Binance still reigns supreme on the podium with a result of $403.7 billion, Bybit is second with $134.6 billion, and Huobi is third, achieving $79.4 billion. At the end of July, Bybit announced the addition of the popular FX trading platform MetaTrader 5 to its offerings.

Only Coinbase and OKX swapped positions. Coinbase is currently in fourth place thanks to a 7% increase in monthly volumes to nearly $64 billion, while OKX is now just under $63 billion.

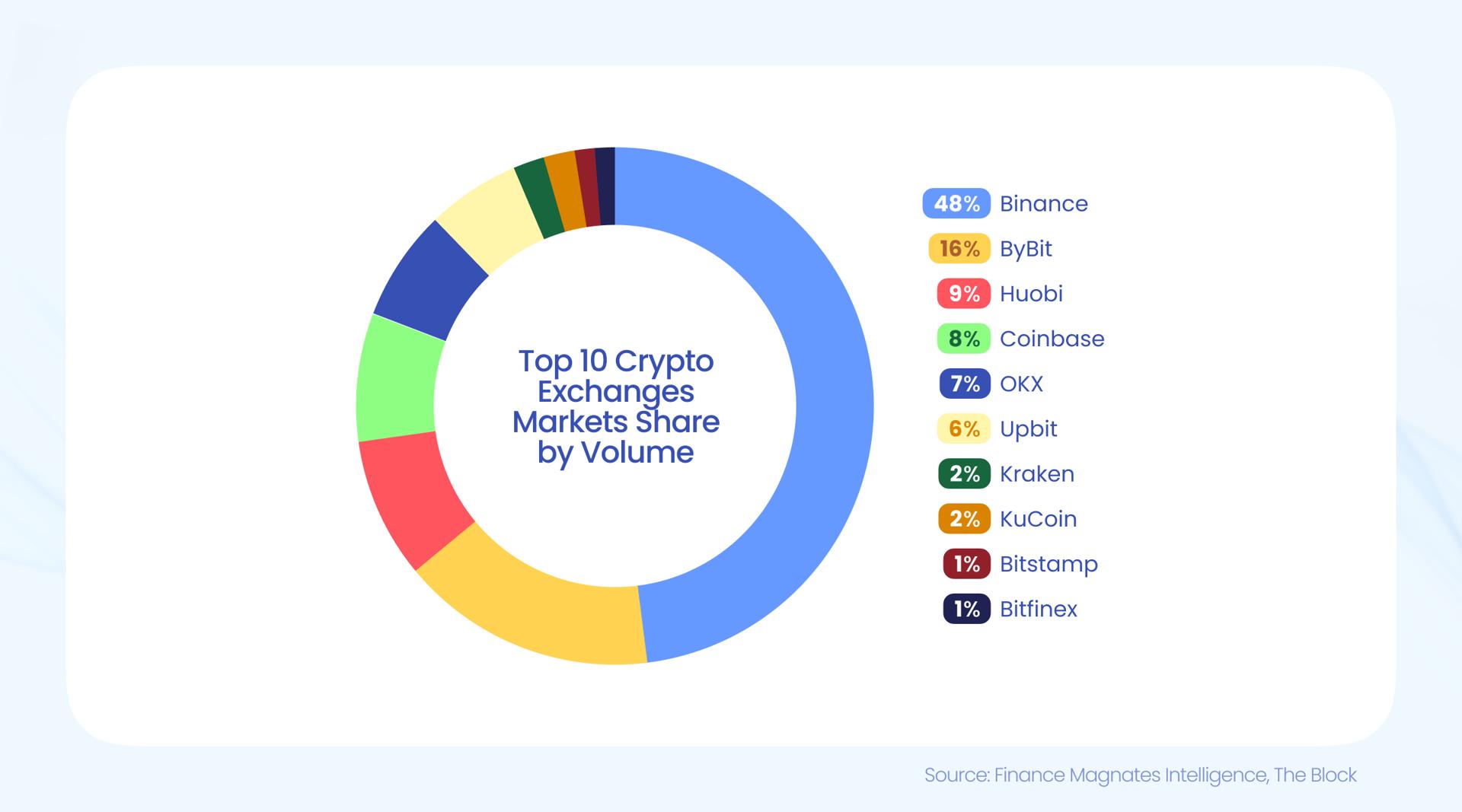

As a result, the market share distribution remains unchanged. Binance remains the leader, accounting for almost half of the activity among the top 10 centralized exchanges in terms of spot volumes.

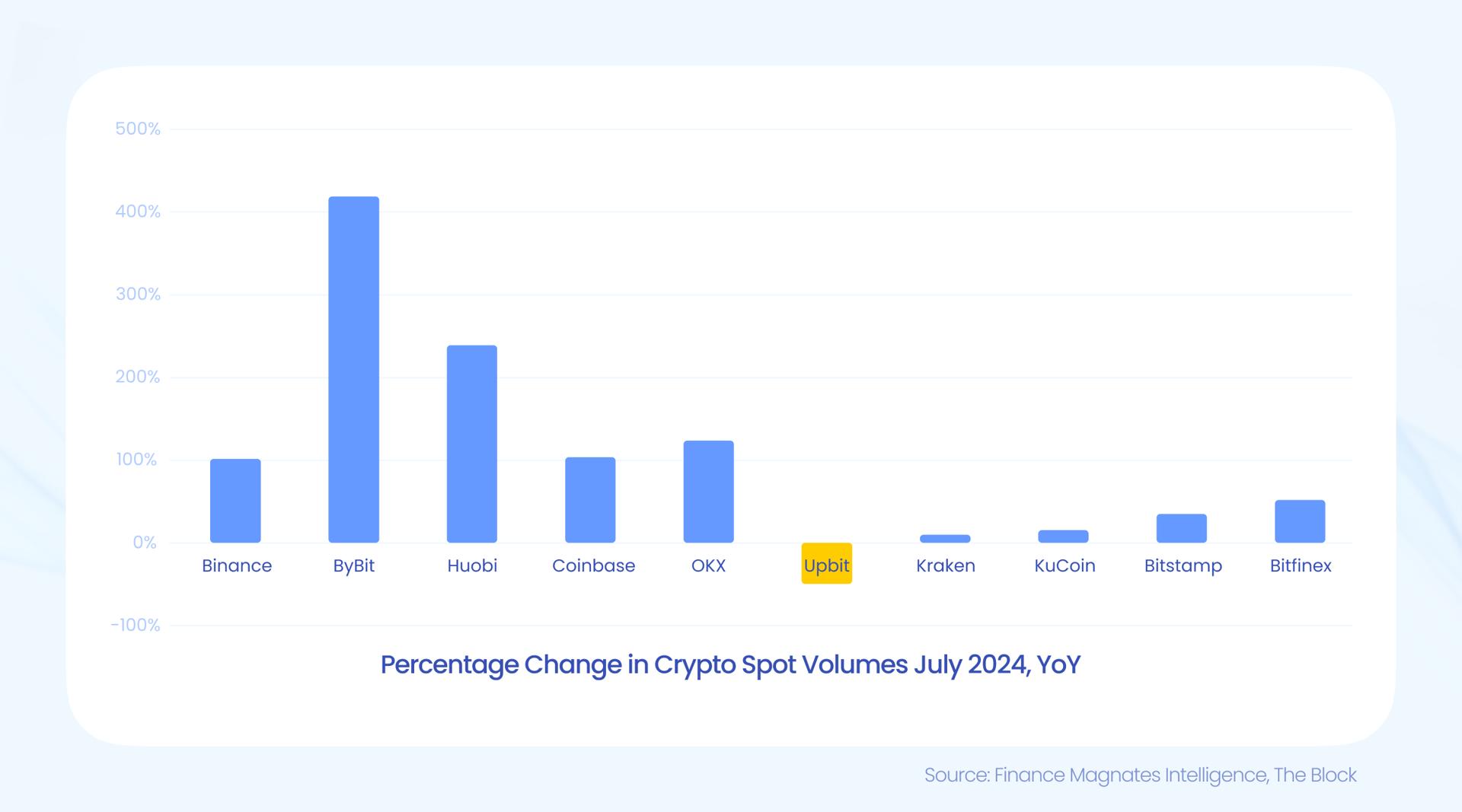

Huge Volume Differences Compared to 2023

Although month-to-month differences are small, when compared to July 2023, we see a huge leap. The average change is 105%, with some record-breakers increasing their volumes several times over.

The leader here is ByBit, which a year ago reported a volume of just under $23 billion. Currently, it’s 400% larger at $135 billion. Huobi also recorded a jump of 239% from $21.3 billion. Only Upbit experienced a decline, with its volume shrinking from almost $61 billion to $46.7 billion reported last month.

What will August look like? This month began with huge drops in Bitcoin, testing the $50,000 level (six-month lows) and wiping $320 billion in value from the market. However, this ensured record volatility and investor activity.

[ad_2]