[ad_1]

Bitcoin is trading at $105,332 today with a market capitalization of $2.09 trillion and a 24-hour trade volume of $42.12 billion. The price range over the past 24 hours has fluctuated between $105,042 and $107,528, indicating relatively narrow intraday movements as momentum weakens across multiple timeframes.

Bitcoin

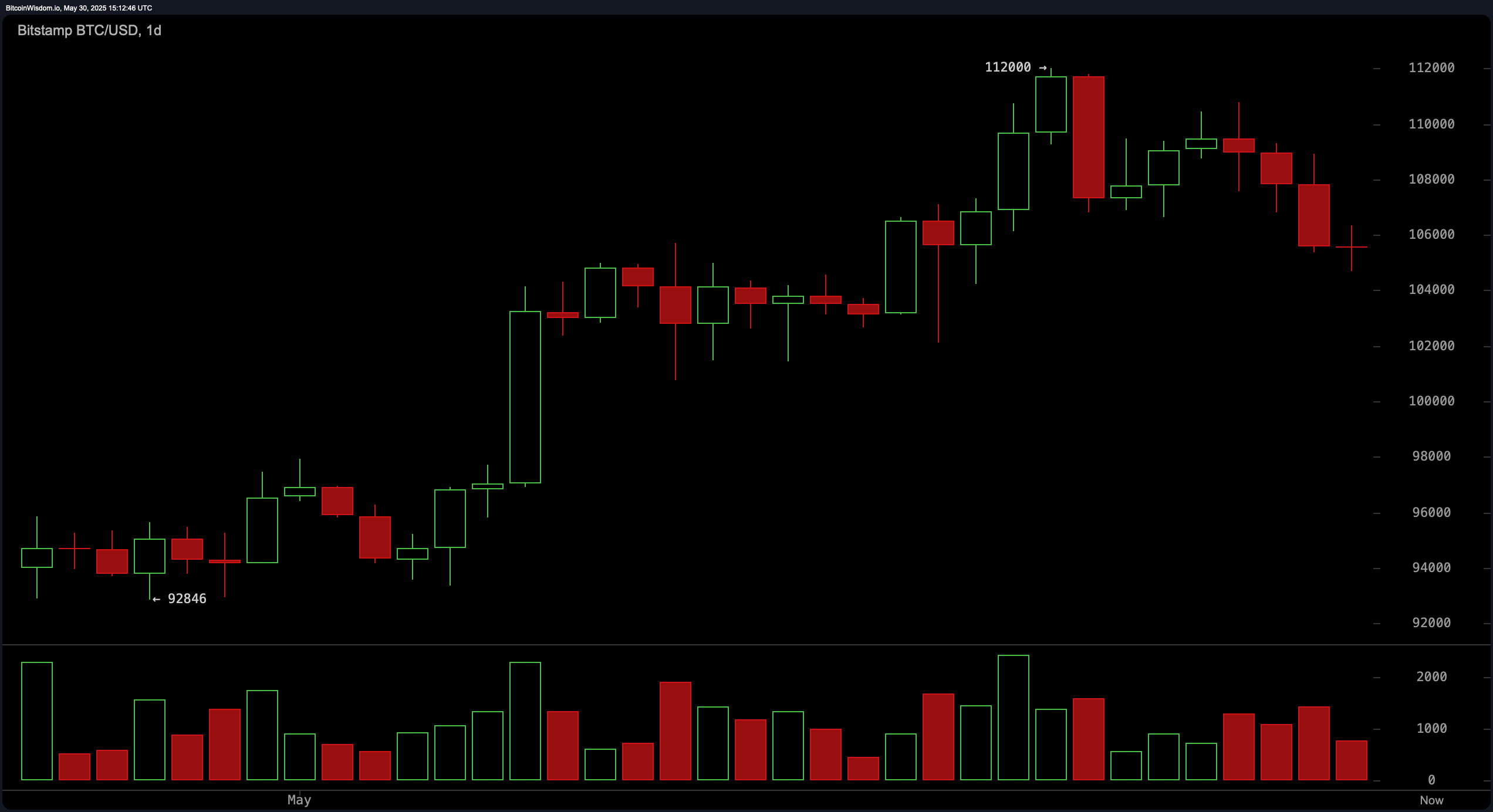

Bitcoin’s daily chart indicates a weakening uptrend with a sharp reversal after touching highs near $112,000, followed by significant volume on the sell-off—characteristic of distribution. The recent candlestick patterns reflect a bearish engulfing formation, often signaling a broader downtrend. Price is hovering around $106,000, within a key support range of $104,000 to $105,000, while resistance is clustered between $110,000 and $112,000. Indicators like the relative strength index (RSI) at 54 and the average directional index (ADX) at 27 signal a lack of strong trend momentum. A cautious approach is advised, with a bullish entry considered only if bitcoin convincingly breaks above $107,000 with rising volume.

BTC/USD 1-day chart via Bitstamp on May 30, 2025.

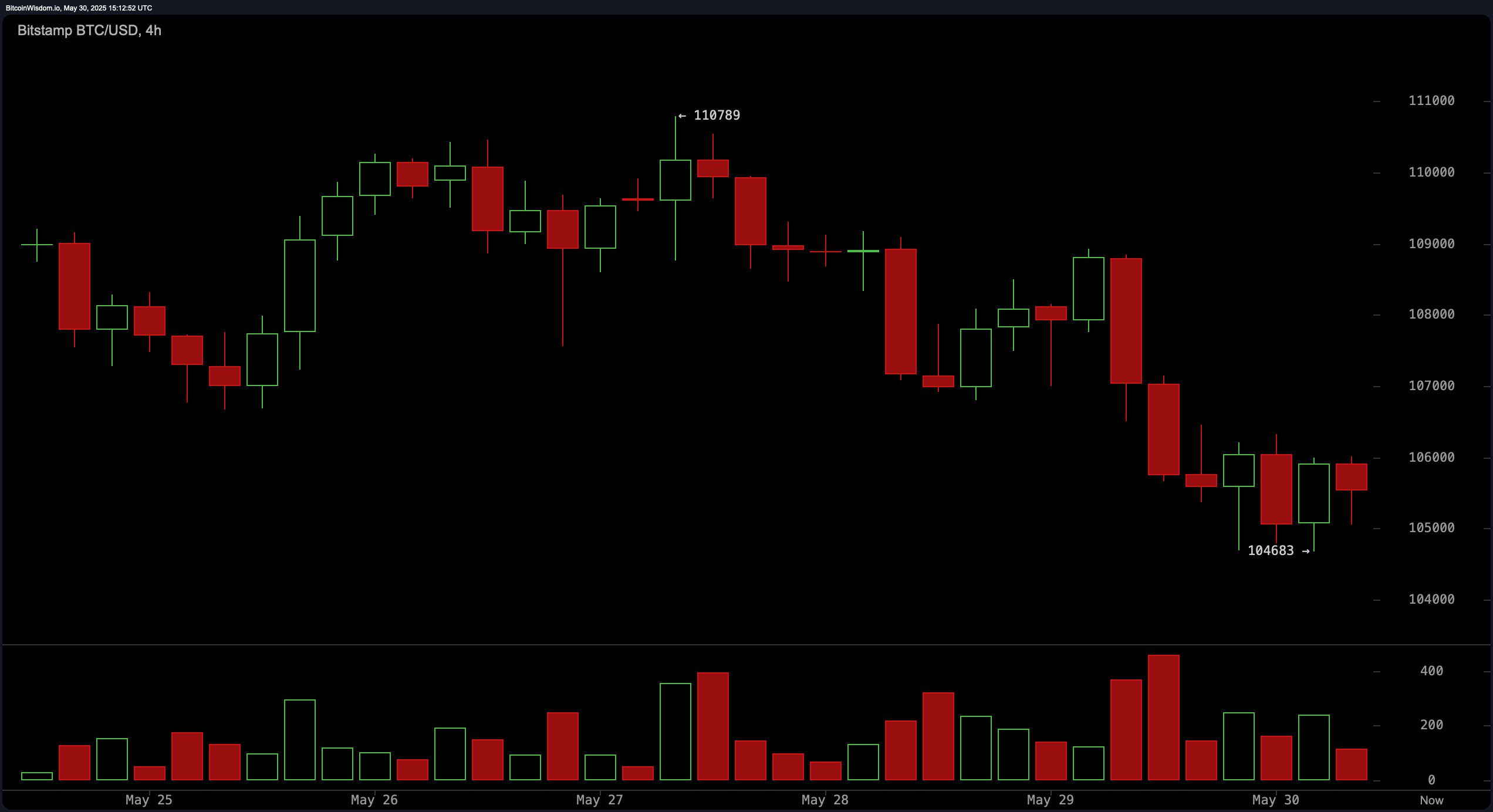

On the 4-hour chart, bitcoin displays a classic double-top structure, with heavy rejection near $110,789 and subsequent drops indicating pronounced bearish momentum. The price has consistently formed lower highs and was recently rejected near $106,500, a critical level. Short-term resistance sits just under $108,000, and failure to reclaim $106,500 could signal further downside. The bearish structure is reinforced by increased red volume spikes during sell-offs, a typical precursor to continued weakness. Traders might consider short positions near resistance or wait for a confirmed breakout to the upside.

BTC/USD 4-hour chart via Bitstamp on May 30, 2025.

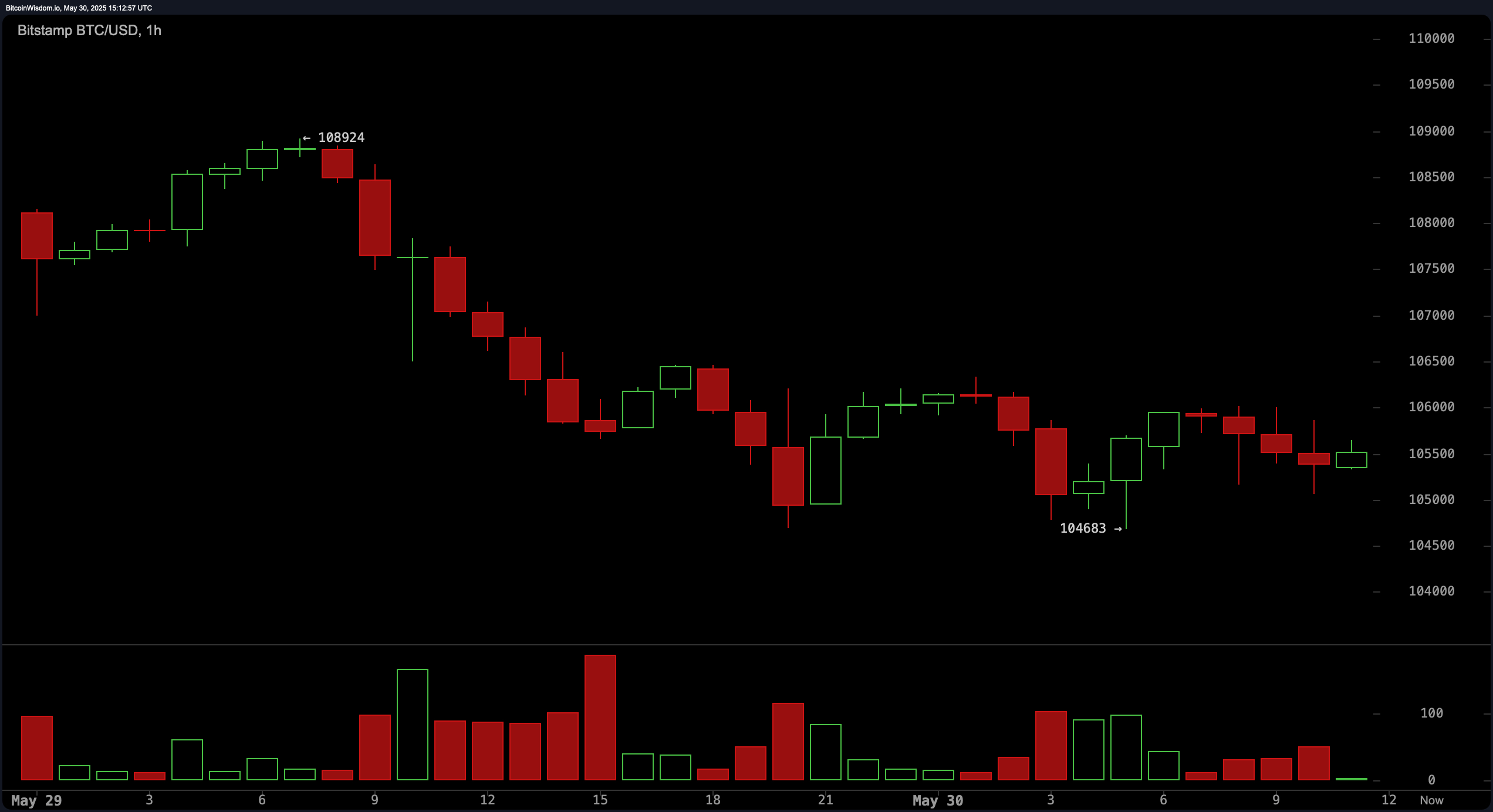

The BTC/USD 1-hour chart reveals short-term consolidation and a potential base forming around $104,683. While red volume still dominates, its declining nature hints at seller exhaustion. Price is moving sideways between $104,500 and $106,000, suggesting a standoff between buyers and sellers. This range-bound action is typical of market indecision, with intraday resistance at $105,800 to $106,200. Scalping opportunities may arise on breakouts above $106,000, although stop-loss levels should be tightly managed due to prevailing volatility.

BTC/USD 1-hour chart via Bitstamp on May 30, 2025.

Oscillators currently reinforce the market’s indecisive tone. The relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and awesome oscillator all register neutral readings. However, the momentum indicator shows a bearish signal at −1,424, and the moving average convergence divergence (MACD) level of 2,647 also supports a bearish bias. These signals collectively imply limited bullish conviction, warranting careful monitoring for any shifts in volume or directional cues.

The moving averages reinforce a near-term bearish outlook, with shorter-term exponential moving averages (EMAs) and simple moving averages (SMAs) such as the EMA (10) at 107,075 and the SMA (10) at 108,289 suggesting bearish conditions. In contrast, longer-term averages such as the EMA (200) at 90,541 and the SMA (200) at 94,669 indicate bullish conditions, underscoring broader bullish support. This mixed setup suggests a potential for short-term pullbacks within a longer-term uptrend, making precise entries and exits critical for successful positioning in the current market landscape.

Bull Verdict:

Bitcoin retains a bullish undertone on the macro scale, supported by rising long-term moving averages and a resilient market structure above $104,000. If the price reclaims $107,000 with strong volume and invalidates the short-term bearish formations, a return toward $110,000–$112,000 becomes plausible. Momentum from longer-term buyers remains intact, indicating a potential continuation of the broader uptrend after consolidation.

Bear Verdict:

Despite holding above key support, bitcoin exhibits multiple signs of short-term weakness across timeframes. Lower highs, fading momentum, and sell signals from the momentum indicator and moving average convergence divergence (MACD) suggest an increased risk of a further drop. Failure to break above $106,500 with conviction could lead to a retest of support near $104,000—or potentially lower—before any sustainable recovery.

[ad_2]