Amid a 35% market cap decline since early 2023, how could Circle’s IPO recalibrate its market position and affect the broader crypto ecosystem?

In a move towards regaining the lost market share, Circle Internet Financial, the company behind USD Coin (USDC) — the world’s second-largest stablecoin by market cap — has decided to become a publicly traded company.

On Jan. 11, 2024, Circle announced its confidential filing for an Initial Public Offering (IPO) in the U.S. The IPO’s timing and specifics, such as the number of shares to be offered and their price range, remain under wraps, pending review by the U.S. SEC.

Initially, in 2021, the company revealed plans to go public through a merger with Concord Acquisition Corp, valuing Circle at $4.5 billion. This valuation later swelled to $9 billion in 2022, though the deal eventually fell through.

What exactly is happening, and how might it impact the wider ecosystem?

What could this IPO mean for Circle?

Circle’s journey towards its IPO unfolds against a backdrop of fluctuating fortunes in the stablecoin market, particularly for its flagship stablecoin, USDC.

Throughout 2023, USDC experienced a notable decline in market cap, dropping approximately 35% from around $43 billion in Mar. 2023 to $28 billion as of Feb. 11.

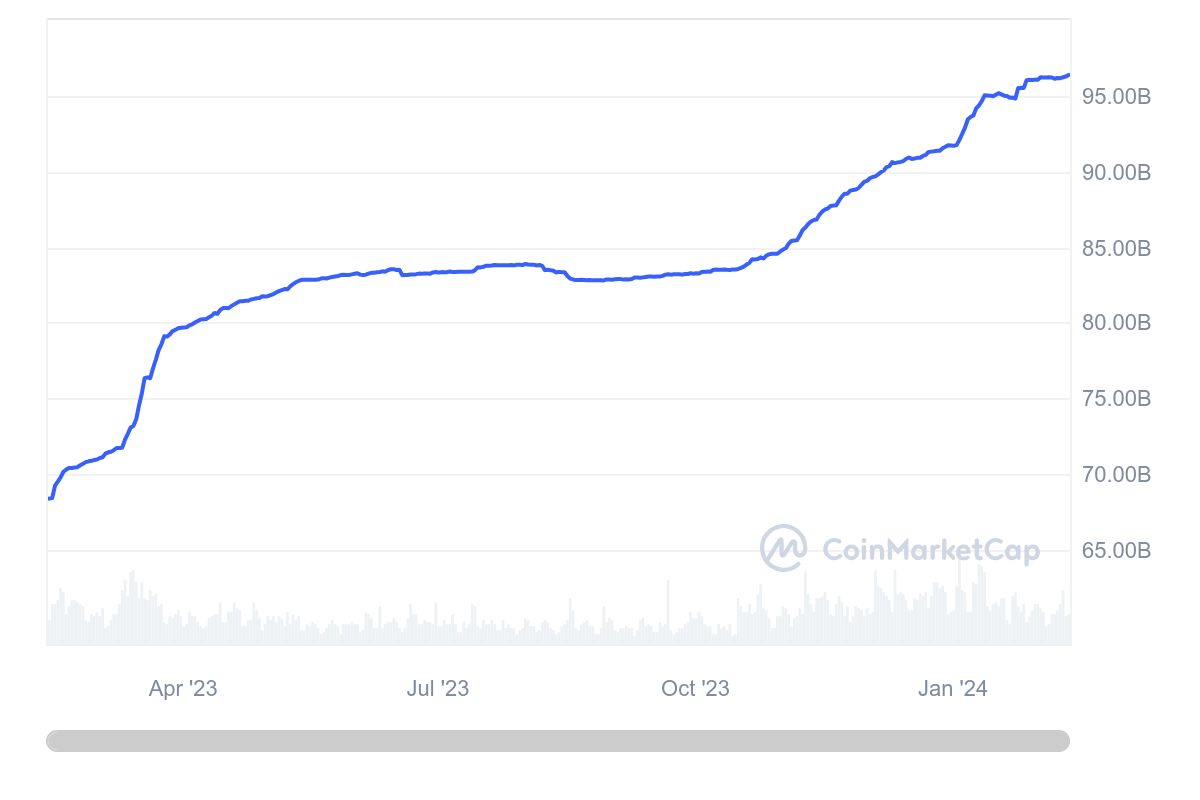

This contraction starkly contrasts with its main competitor, Tether USD (USDT), which has maintained a robust market cap of over $96 billion and has grown over 20% since early 2023, solidifying its position as the dominant player in the stablecoin space.

Traditionally, IPOs serve as a capital infusion mechanism, enabling companies to enhance their infrastructure and expand their marketing efforts.

For Circle, going public could mean an influx of resources that could be dedicated to promoting USDC and bolstering its competitiveness against USDT.

This strategic move could address the market share loss by reinforcing trust among current and prospective users and expanding the utility of USDC across a broader array of financial services.

Since its introduction in 2018, USDC has facilitated the settlement of over $12 trillion in blockchain transactions. Of this total, $197 billion worth of transactions occurred in 2023 alone.

Moreover, the growth in USDC wallet users, up by 59% in 2023, alongside the processing of 595 million transactions between Jan. to Nov., indicates a strong user base and operational scale that could be further expanded with the proceeds from an IPO.

While the dip in market cap highlights competitive pressures, the expansion in wallet users and transaction volumes points to underlying strengths. Hence, Circle’s IPO could recalibrate its market position and foster a more competitive stance against USDT.

Circle’s IPO to bring trust in stablecoins

The recent SEC approval of 11 spot Bitcoin (BTC) ETFs in Jan. 2024, including those from financial industry giants such as Grayscale and BlackRock, represents a notable shift in the perception and acceptance of crypto assets within the traditional financial system.

This historic decision not only legitimizes Bitcoin as an asset class but also opens the door for broader institutional and retail investment.

Projections suggest that the ETFs could attract between $50 billion and $100 billion in the initial year alone. Out of this amount, ETF providers have already accumulated over $28 billion in assets under management (AUM) in less than a month, indicating the potential for further capital infusion.

However, the journey to this point was not without its challenges. Historically, cryptocurrencies like Bitcoin have been marred by concerns over their use in illicit activities, including money laundering and financing terrorism.

The SEC, under Chair Gary Gensler, had long been skeptical of Bitcoin ETFs, citing the potential for market manipulation and investor protection issues.

Yet, the recent approval indicates a readiness to embrace the potential of cryptocurrencies under a regulated framework, signaling a shift toward change.

Similarly, stablecoins have faced their own set of challenges. Over the years, Tether has been scrutinized several times for its reserves and transparency, raising concerns over its stability and reliability.

Additionally, the collapse of Terra UST highlighted the vulnerabilities within the algorithmic stablecoin market, casting a shadow over the stability and security of these digital assets.

You might also like: What happened to Terra Luna: one year after collapse

All these dispersed events have contributed to a general stigma around stablecoins, questioning their viability as stable and trustworthy mediums of exchange.

Circle’s potential IPO could mark a crucial moment for the stablecoin industry. Just as Bitcoin ETFs are expected to bring a new level of institutional and retail investment to the cryptocurrency, Circle’s IPO could similarly elevate USDC and the stablecoin market, fostering their deeper integration with traditional finance.

The road ahead

In 2021, Coinbase made waves with its IPO, marking a milestone for crypto-centric businesses entering public markets and serving as a gauge for investor interest in crypto-related stocks.

Meanwhile, the crypto market experienced a strong rebound in 2023, accompanied by a resurgence in the prices of crypto-related stocks. This uptrend was fueled by a bullish performance in major assets like Bitcoin, which surged by over 150% last year.

Considering the precedent set by Coinbase and the market’s recovery in 2023, coupled with the launch of spot BTC ETFs, Circle’s potential IPO holds the promise of further integrating crypto assets into the mainstream financial system.

However, it’s important to note that the SEC is known for its rigorous regulatory processes, so until Circle receives the green light, any discussion remains speculative.

Read more: Crypto’s skeptics have a tougher case to argue in 2024 | Opinion