[ad_1]

- Circle stock remains in a deep bear market this month.

- The stock has crashed amid valuation and interest rate cut concerns.

- Tether is raising capital at a $500 billion valuation.

Circle stock price remains under pressure this month as investors assess the impact of the Federal Reserve’s interest rate cuts that will impact its revenue. It has plunged by 56% from its highest point this year. So, what next for CRCL as Tether’s valuation surges to $500 billion?

Tether valuation to hit $500 billion

The Circle stock price will be in the spotlight on Wednesday as investors assess its valuation. This will happen after a Bloomberg report noted that Tether’s valuation could hit a whopping $500 billion in an upcoming capital raise.

Tether will receive this valuation as it is raising about $20 billion in exchange for a 3% stake. A $500 billion valuation would be make it one of the biggest private companies globally. It would also be much higher than the $172 billion it has in assets today.

As such, the $500 billion valuation would be 2.7x of its assets. In contrast, Circle has a market cap of $30 billion, giving it a multiple of 0.4x to its USDC assets.

Tether and Circle have different business models

At face value, Tether and Circle are similar companies that offer the same product, with the only difference being the name of their coins. However, a closer look behind the scenes shows that the two are much different.

One difference is that Tether’s USDT is different from USDC in several ways. First, USDT is not audited by a Big Four accounting company like KPMG and PWC.

Instead, Tether focuses on quarterly attestations of its reserves through small accounting firms. In a recent statement, Paulo Ardonino noted that getting a Big Four audit firm was a big priority for the firm.

The other major difference is that Tether takes all of its profits. In contrast, Circle has an expensive deal with Coinbase, where the latter keep 100% of the interest income from USDC held on its platform.

The two companies then split 50:50 the reserve revenue of USDC assets held out of Coinbase. This deal is reviewed every three years, with the next one coming in 2026.

Additionally, whereas Circle’s USDC is backed by fiat and short-term treasuries, Tether’s USDT is backed by numerous asset, including US treasuries, money market funds, corporate bonds, gold, and Bitcoin.

The diversity of Tether’s holdings makes it a more profitable company than Circle. However, it also means that the company’s USDT is not compliant with the GENIUS Act, which explains why it is launching a new US-based stablecoin.

What is clear between the two companies is that the Federal Reserve interest rate cuts will impact their business. Circle, which relies solely on short-term US bonds, will be affected more as bond yields fall.

Indeed, some of Tether’s holdings will benefit in a low-rate environment. Bitcoin and gold prices could continue soaring, boosting its reserves.

Circle stock price technical analysis

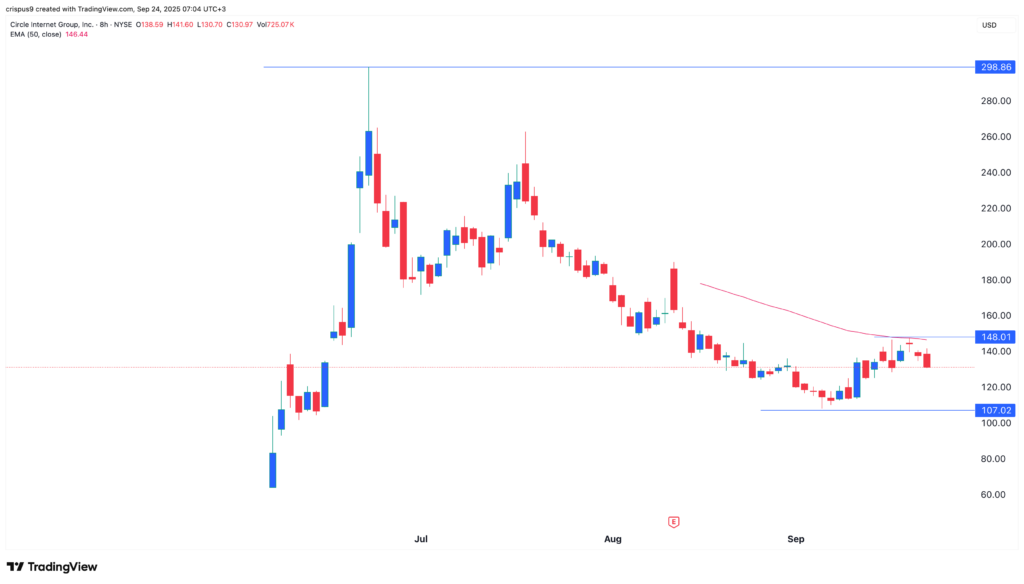

CRCL stock chart | Source: TradingView

The eight-hour chart shows that the CRCL stock price has crashed in the past few months, moving from a high of $298 to the current $130. This crash happened as investors remain concerned about its valuation and interest rate cuts.

It has remained below the 50-period moving average and the recent attempt to recover has found a major resistance at $148. Therefore, the most likely scenario is where the Circle share price continues falling as sellers target the year-to-date low of $107.

[ad_2]