[ad_1]

Stablecoin issuer Circle declares that it has no current plans to issue its own stablecoin pegged to the Hong Kong dollar. However, it is open to collaborating with other firms.

Summary

- Circle has no plans to launch a Hong Kong dollar-backed stablecoin, instead focusing on expanding the adoption of its U.S. dollar and euro-pegged stablecoins, USDC and EURC, across Asia.

- At the moment, Circle is the world’s second-largest stablecoin issuer, with USDC holding a market cap of $75.28 billion and EURC leading among euro-backed stablecoins.

According to an interview with the Hong Kong Economic Times, the stablecoin firm’s Vice President for the Asia-Pacific region, Chen Qinqi, stated that the company has no plans to issue their own stablecoin backed by the Hong Kong dollar. Instead, it is currently focusing its efforts on expanding the utilization of its U.S dollar-stablecoin USDC and its euro-backed stablecoin EURC.

Hong Kong has seen a major increase in companies expressing interest in obtaining a license to issue HKD-pegged stablecoins, especially since the region released its Stablecoin Ordinance bill, which came into effect on Aug. 1.

The Stablecoin Ordinance provides a legal framework for stablecoin operations in the administrative region and includes requirements that firms need to adhere to if they wish to obtain a stablecoin issuer license from the Hong Kong Monetary Authority.

You might also like: Hong Kong to introduce stablecoin auditing guidelines in 1-3 years

At the moment, Chen Qinqi clarified that institutional investors in Hong Kong can use USDC in Hong Kong under the existing framework without additional regulation related to the Stablecoin Ordinance. Moreover, the company does currently hold a license from Singapore.

Institutional investors can obtain USDC (USDC) either directly from Circle or through their established partners, while retail investors must access it through partners.

Although Circle is not directly regulated in Japan, USDC became the first stablecoin that Japanese regulators have allowed licensed institutions to offer to the public. Both retail and professional investors in Japan can obtain USDC through partners.

Earlier in November, Circle CEO Jeremy Allaire hinted at a possible expansion into Hong Kong, as the company looks to hire more employees and open up a branch in the region. Allaire has also stated that the firm is considering applying for a license under the new framework in Hong Kong.

Chen stated that the company has yet to move forward with plans to open an office in Hong Kong and the team is still in the process of evaluating potential office locations. He refused to comment on any specific steps taken to obtain a license under the bill.

Circle’s stablecoin empire

According to data from DeFi Llama, Circle’s USD-backed token, USDC is currently the second largest stablecoin by market cap. Falling behind only to Tether’s USDT (USDT), USDC has a market cap of $75.28 billion. However, it does have a faster daily growth rate than Tether, with a rise in market value by 0.41% compared to USDT’s 0.06%.

On the other hand, Circle is still the largest stablecoin issuer by market cap amongst the euro-backed stablecoins. The firm’s EURC (EURC) has a market cap of $266.5 million, contributing to more than 45% of the total $570 million market cap generated by euro-backed stablecoins.

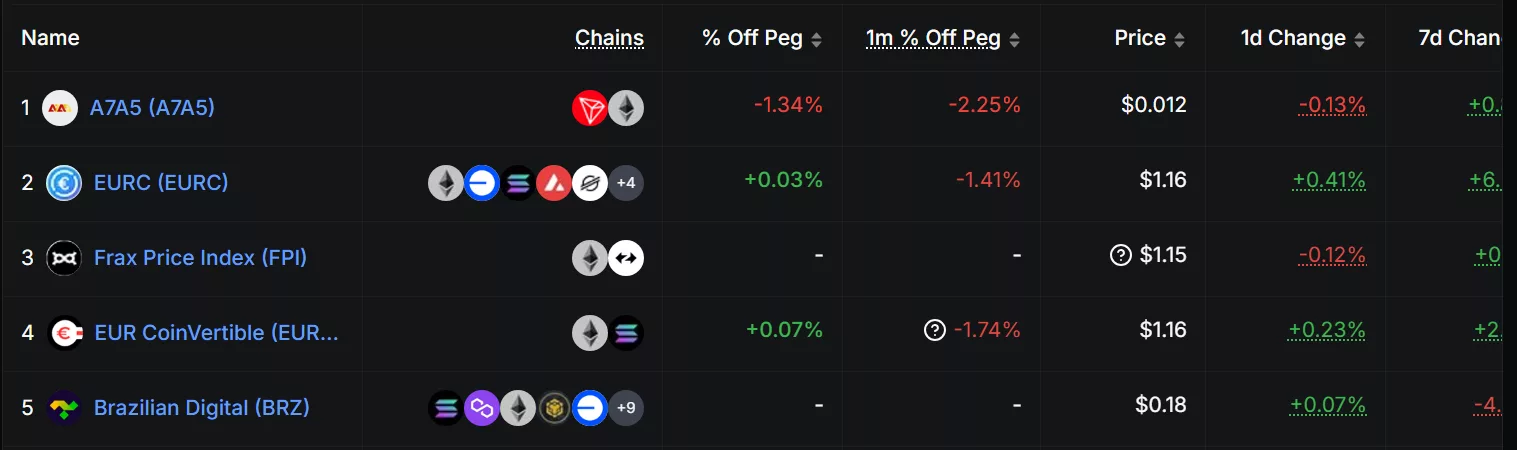

Circle is one of the top five non-USD pegged stablecoins by market cap | Source: DeFi Llama

With regards to non-USD backed stablecoins, EURC is still behind the ruble-backed A7A5. The ruble-backed stablecoin dominates the non-USD backed stablecoin market by more than 40%. Meanwhile, EURC still requires an additional $213 million if it wishes to surpass A7A5 as the largest non-USD pegged stablecoin issuer.

The stablecoin industry has been growing at an unprecedented pace, as it recently surpassed $300 billion in total market cap. JPMorgan’s latest report predicted that the stablecoin market is due for a massive increase, reaching $2 trillion within the next two years.

You might also like: Ruble-backed A7A5 becomes largest non-USD stablecoin

[ad_2]