Real-world asset (RWA) protocols Splyce and Chintai have launched a new product on Solana designed to give retail users access to institutional-grade tokenized securities — a move that could broaden the appeal of RWA tokenization on one of the world’s largest blockchains.

The product is powered by strategy tokens, or S-Tokens, which provide retail users with exposure to yields generated by Chintai. While users never directly hold Chintai’s tokenized securities, S-Tokens act as a “mirror” through a loan structure backed by the underlying assets.

S-Tokens are designed to broaden access to RWA yields beyond institutional investors. Today, most institutional RWA products operate as “walled gardens” with strict capital requirements and compliance hurdles, limiting retail participation, the companies told Cointelegraph.

The S-Token model aims to bridge this gap, offering retail users access to institutional-grade yields while allowing issuers to remain compliant.

With Splyce, users can engage with these assets directly through their existing Web3 wallets, maintaining the permissionless experience that typically defines DeFi.

“There are no jurisdictional restrictions on where S‑Tokens can be offered — they’re as permissionless as USDC or USDT,” Ross Blyth, Splyce’s chief marketing officer, told Cointelegraph. “That said, deposits are still subject to standard KYC/AML monitoring to ensure compliance with Anti-Money Laundering requirements.”

The first iteration of S-Tokens will involve the Kin Fund, a tokenized real estate fund launched by Kin Capital on the Chintai network.

Deloitte identified loans and securitization and private real estate as two of the potential largest tokenization opportunities of the next decade. Source: Deloitte

“Distribution and liquidity have always been the biggest hurdles for RWAs,” Chintai managing director Josh Gordon told Cointelegraph. “Soon, institutional-grade assets will be tradable across Solana decentralized exchanges with the same ease as tokens today.”

Related: VC Roundup: VCs fuel energy tokenization, AI datachains, programmable credit

A potential boost to Solana’s RWA momentum

Solana, known for its high throughput, low fees and strong developer ecosystem, has been gaining notable traction in the real-world asset space.

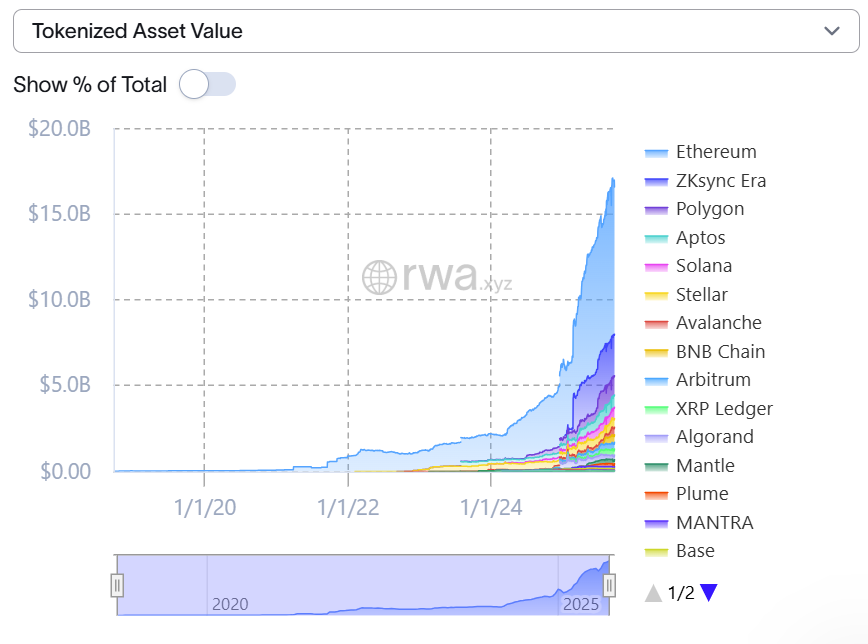

According to industry data, tokenized assets on Solana are now valued at more than $656 million. Only four other networks — Ethereum, ZKsync Era, Polygon and Aptos — currently support higher levels of tokenized assets.

Tokenized asset values across major networks. Source: RWA.xyz

Since the start of the year, the value of tokenized assets on Solana has grown by more than 260%. The network’s largest non-stablecoin tokenized products include the Ondo US Dollar Yield and the Ondo Short-Term US Government Bond Fund, which provide tokenized access to yield-bearing products such as short-term US Treasurys.

In addition, BlackRock launched its USD Institutional Digital Liquidity Fund (BUIDL) on Solana earlier this year. While BUIDL has quickly become the dominant tokenized US Treasury product across blockchains, its presence on Solana further underscores the network’s growing role in institutional RWA adoption.

Although the largest RWA products on Solana are still geared mainly toward qualified institutional buyers or accredited investors, limiting retail access, alternatives are emerging. Ondo Finance has also announced plans to extend retail access on Solana through its partnership with Alchemy Pay.

Meanwhile, Ondo’s YieldCoin (USDY) is available to retail users on Stellar, according to MEXC.

These developments come as Solana emerges as a platform for tokenized equities, with Forward Industries — a Nasdaq-listed company and Solana treasury holder — planning to tokenize its stock on the blockchain through a partnership with Superstate, a regulated issuance platform.

Related: $400T TradFi market is a huge runway for tokenized RWAs: Animoca