China Renaissance, once hailed as China’s “M&A King,” is reshaping its future around digital assets. The boutique investment bank approved a $200 million allocation to Web3 in 2025.

That includes $100 million invested in BNB Chain’s native token, BNB, through a strategic deal with YZi Labs, formerly Binance Labs.

From M&A Legacy to Digital Assets

The decision marks a turning point for the firm, which built its reputation brokering China’s landmark internet mergers. From the tie-up of ride-hailing giants Didi and Kuaidi to the merger of Meituan and Dianping, the firm thrived in an era of hyper-growth.

Yet as China’s internet boom faded, antitrust scrutiny mounted, and advisory fees dwindled. China Renaissance faced growing pressure to reinvent its business model. The firm now positions itself as a bridge between traditional finance and the decentralized world.

The Web3 pivot stems from leadership changes after founder Bao Fan’s disappearance in 2023. His wife, Xu Yanqing, assumed the chairmanship and rolled out the “China Renaissance 2.0” strategy. This plan places hard technology, digital finance, and Web3 at the growth center.

In June, the board approved a $100 million budget for crypto asset exposure, aligning with Hong Kong’s stablecoin legislation and updated digital asset policy. By August, China Renaissance doubled by signing a memorandum of understanding with YZi Labs to acquire $100 million in BNB.

Market observers quickly compared MicroStrategy, known for its corporate Bitcoin holdings. The media labeled China Renaissance as Hong Kong’s “BNB MicroStrategy.” Planned initiatives include working with Huaxing and Huaxia Fund (Hong Kong) to structure BNB-backed products and setting up a real-world asset (RWA) fund to expand BNB adoption in the city’s listed ecosystem.

At BNB Chain’s fifth anniversary event in August, Xu highlighted rising institutional interest:

“We no longer get asked why digital assets matter. Institutions now want to know how to allocate core assets like BNB correctly.”

She added that China Renaissance aims to be a “bridge between Web2 and Web3” by leveraging its investment banking, asset management, and wealth services expertise.

The strategic move was reinforced by YZi Labs, which issued an official statement on X after BNB’s listing on Hong Kong’s OSL exchange:

“BNB adoption continues to scale. With @Official_CRSHK leading the initiative, the listing of $BNB on @OSL_HK marks the first milestone since China Renaissance’s strategic partnership with YZi Labs. BNB is now entering the core of Hong Kong’s regulated financial markets — a signal of its growing role as both a utility token and an institutional-grade asset.”

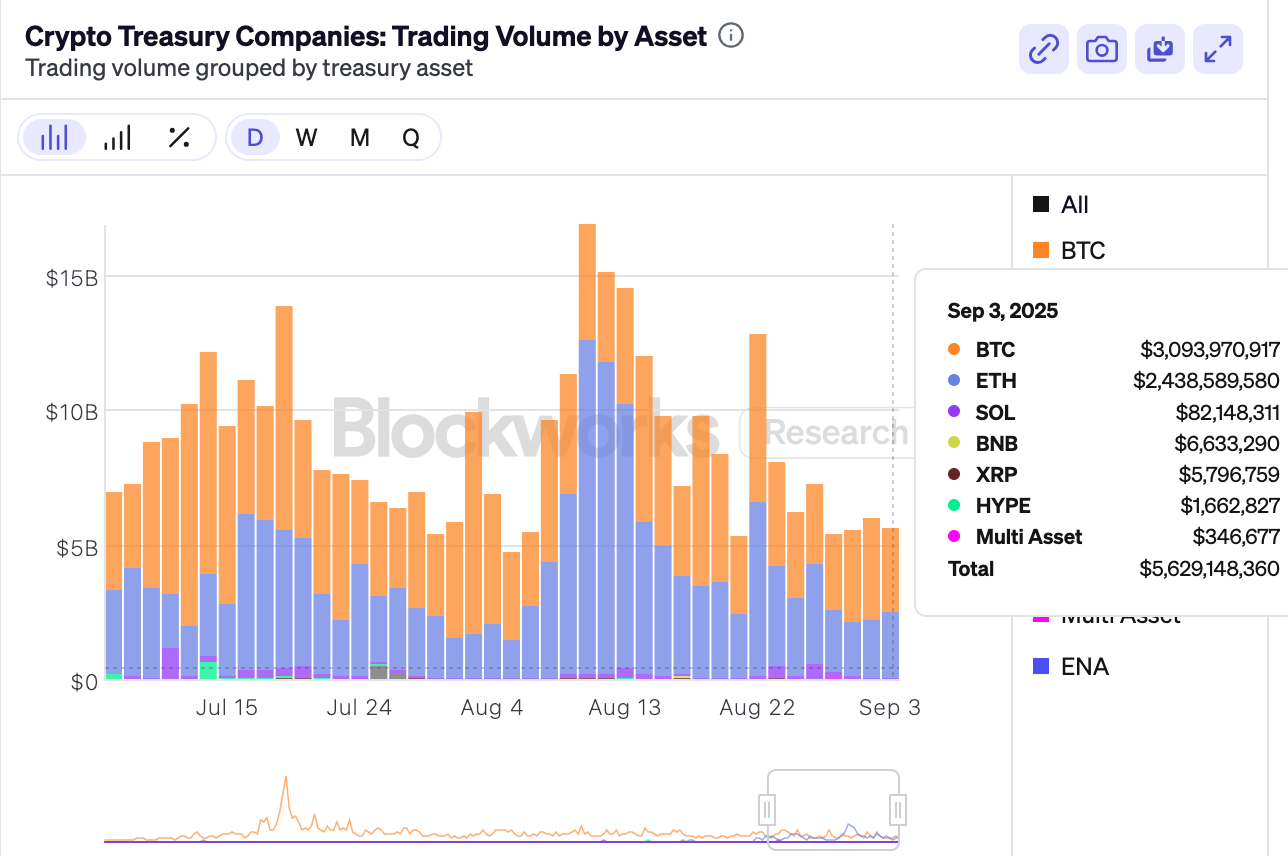

Crypto Treasury Companies: Trading Volume by Asset|Blockworks Research

Blockworks Research data on September 3 showed that BTC and ETH dominated treasury trading, with a combined value of over $5.5 billion. BNB’s $6.6 million share highlights its uphill climb.

Challenges Ahead in Hong Kong and Beyond

The bank’s timing reflects a broader shift as Hong Kong seeks to rebrand itself as a digital asset hub. Still, insiders caution that regulators remain skeptical of crypto treasury strategies. According to Caixin, Hong Kong authorities have shown “low recognition” of listed firms using balance sheets for token holdings. Market participants may need extensive lobbying.

The regulatory context adds another layer of complexity. BeInCrypto reported that Hong Kong has rolled out a licensing framework for stablecoin issuers and launched tokenization initiatives. Mainland China continues to enforce strict guardrails. Offshore yuan scarcity has limited CNH-pegged stablecoins, leaving the region’s USD- and HKD-linked tokens dominant. This divergence highlights why China Renaissance’s Hong Kong-based strategy matters: it offers exposure to digital assets in a jurisdiction moving toward cautious legalization, in contrast to Beijing’s restrictions.

Meanwhile, global capital markets are tightening rules for Chinese issuers. Reuters reported Nasdaq plans to enforce higher float requirements and faster delistings for thinly traded Chinese stocks. That raises another hurdle for firms like China Renaissance that straddle digital and traditional finance.

The pivot also carries operational risks. Unlike its traditional advisory role, Web3 investment means navigating volatile cycles, fast-changing narratives, and reputational threats. A protocol hack or project failure could erase valuations within 48 hours. Institutional investors like Singapore’s Temasek have already suffered reputational damage from exposure to collapsed platforms like FTX.

The firm’s story now resembles a high-stakes experiment. China Renaissance built its reputation for two decades by matching Chinese internet pioneers with capital. In 2025, a similar role is expected to exist in decentralized finance. Whether it becomes Web3’s go-to bank or fades into obsolescence depends on how well it adapts to a world where disintermediation is the rule, not the exception.

The post China’s Former M&A King Bets Its Future on Crypto appeared first on BeInCrypto.