Polymarket traders are pricing the prospect of China legalizing onshore Bitcoin purchases at roughly 5%.

At first glance, the number appears dismissive. Still, it raises the question of whether the Chinese government will explicitly permit citizens to convert renminbi into Bitcoin within mainland China by the end of 2026.

That distinction matters because the regulatory architecture Beijing recently completed points in the opposite direction.

The prediction market asks a binary question: Will the People’s Republic of China announce by Dec. 31, 2026, that Chinese citizens can legally buy Bitcoin with yuan within China?

The resolution hinges on the announcement itself, not on implementation. It excludes Hong Kong sandboxes, offshore products, and institutional workarounds. This is a test of onshore banking rails and legal purchase pathways, the exact infrastructure China spent the last year systematically dismantling.

The ban just got stronger

In February 2026, Chinese regulators issued a sweeping joint notice that effectively codified “Ban 2.0.” The document reaffirms that virtual-currency business activity constitutes illegal financial activity and that crypto holds no legal tender status.

However, it extends beyond the September 2021 framework it replaces, explicitly targeting marketing, traffic facilitation, payment clearing, and even the naming or registration of entities that support crypto activity.

The notice singles out stablecoins as a priority enforcement area, banning unauthorized offshore issuance of yuan-pegged stablecoins and framing them as vectors for anti-money laundering gaps, fraud, and unauthorized cross-border fund transfers.

It also introduces a civil deterrent: investing in virtual currencies or related products now violates “public order and good morals,” rendering such transactions legally invalid and imposing personal losses on investors.

This wasn’t a campaign memo. It abolished the 2021 notice, establishing itself as the new legal baseline. For anyone wagering on a reversal by year-end, the timeline looks punishing.

Hong Kong as a controlled experiment

Beijing’s approach to crypto becomes clearer when viewed through the lens of Hong Kong’s role as a regulatory laboratory.

In April 2024, Hong Kong launched Asia’s first spot Bitcoin and Ethereum ETFs, explicitly marketed as products for a jurisdiction where mainland trading remains banned.

The city’s stablecoin licensing framework took effect in August 2025, though as of early 2026, the Hong Kong Monetary Authority’s register showed zero licensed issuers.

The first batch is expected in March 2026, and regulators have signaled it will be “a very small number.”

Even offshore experimentation faces political constraints. The Financial Times reported that Chinese tech giants, including Ant Group and JD.com, suspended plans for a Hong Kong stablecoin after Beijing intervened.

The message: innovation can proceed in controlled environments, but only when it reinforces rather than circumvents central oversight.

This structure allows Beijing to permit the use of contained pilots, such as ETFs, tokenization frameworks, and licensed stablecoins, while maintaining an impermeable barrier to onshore renminbi-to-Bitcoin conversions.

Hong Kong functions as a pressure valve, not a preview of mainland policy.

The tokenization paradox

China’s February 2026 regulatory blitz also clarified where digital assets are permitted: in tightly supervised, permissioned tokenization lanes.

On Feb. 6, the China Securities Regulatory Commission tightened oversight for offshore tokenized asset-backed securities tied to onshore assets, requiring enhanced filings, disclosures, and cross-border coordination.

The same day, a notice from the People’s Bank of China paired the virtual currency crackdown with language stipulating that tokenized products backed by onshore assets would be subject to strict vetting.

Three days later, Reuters framed the move as establishing a legal pathway for offshore issuance of tokens backed by mainland assets, even as real-world asset issuance domestically remains banned.

The interpretation aligns with Beijing’s broader posture: digital finance is acceptable when it’s auditable, state-supervised, and routed through approved entities. Unregulated trading is not.

McKinsey forecasts a tokenized asset market capitalization of roughly $2 trillion by 2030, with a bullish case around $4 trillion, excluding “crypto like Bitcoin.”

Beijing can simultaneously be aggressively pro-tokenization and anti-Bitcoin trading, because tokenization aligns with the state’s surveillance and control infrastructure.

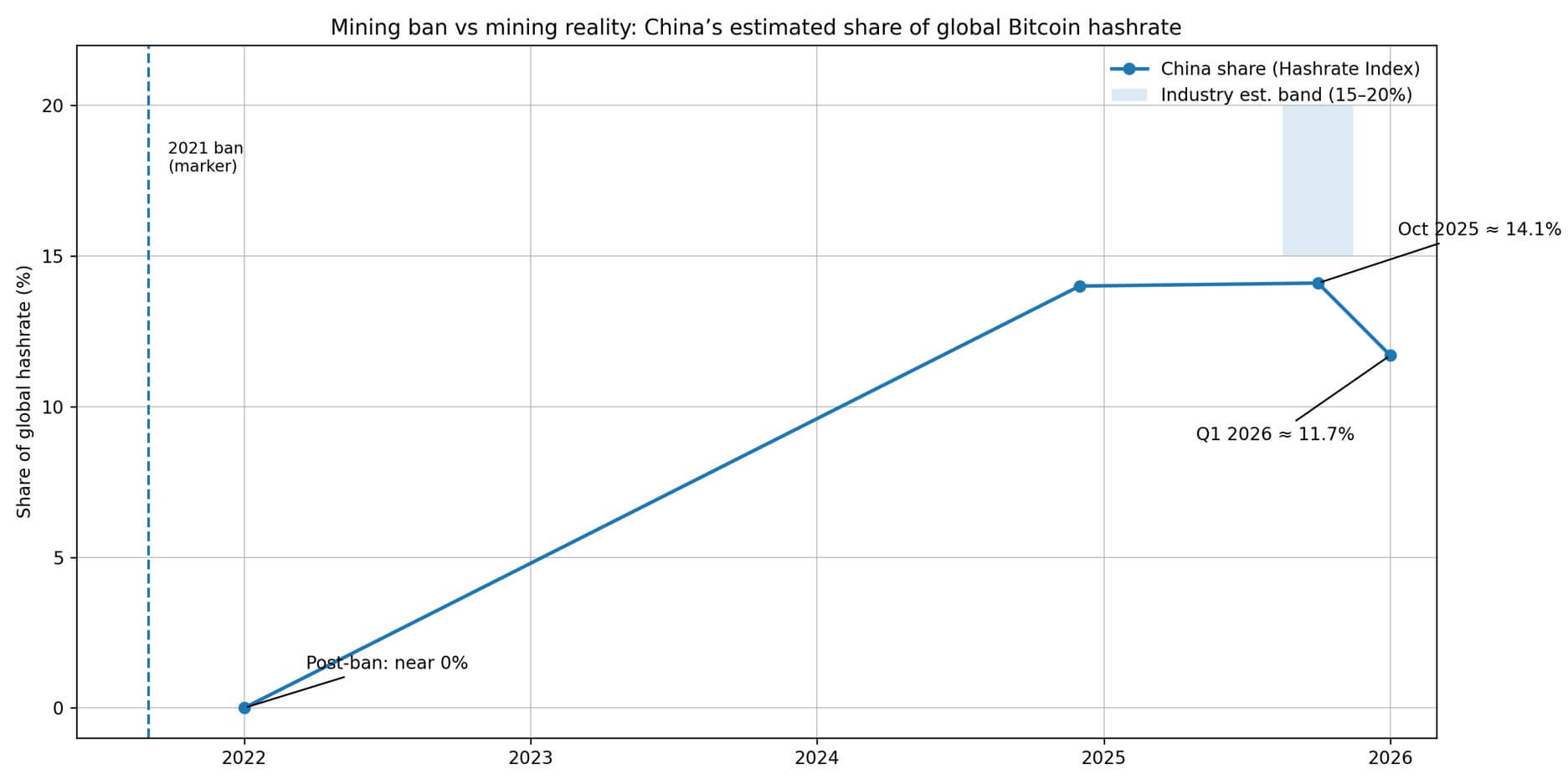

One data point complicates the tightening narrative: China’s Bitcoin mining share rebounded to roughly 14% by October 2025, according to the Hashrate Index, with some industry estimates placing it between 15% and 20% of global mining.

This resurgence occurred despite the mining ban and suggests enforcement gaps at the local level.

But this dynamic reflects compliance drift, not policy reversal. Local tolerance of underground mining doesn’t translate into legal clarity at the national level, and Beijing’s February 2026 notice makes no accommodation for mining activity.

What 5% odds actually price

Polymarket’s current pricing reflects a cluster of low-probability scenarios.

The most plausible path to a “Yes” resolution involves a narrow onshore pilot: a state-supervised platform in a free-trade zone that permits limited renminbi-to-Bitcoin purchases, subject to strict capital caps and know-your-customer controls.

Such a pilot would require explicit licensing pathways, access to banking services, and a shift away from “illegal financial activity.”

Nothing in the current regulatory environment signals movement toward that outcome. The February 2026 framework shifted the Overton window in the opposite direction, treating virtual-currency businesses not as a gray area to be tolerated but as illegal activities to be extinguished.

A secondary scenario, which is indirect Bitcoin exposure via tightly regulated products, might gain traction, such as mainland investors accessing Hong Kong crypto ETFs through approved channels.

However, this wouldn’t satisfy Polymarket’s resolution criteria, which hinge on a legal onshore renminbi-to-Bitcoin purchase.

Sovereignty lens and signals worth watching

Beijing’s hardline posture also aligns with broader anxieties about monetary sovereignty.

In 2025, the Bank for International Settlements noted that more than 99% of stablecoins are denominated in US dollars, raising concerns about stealth dollarization and capital-control evasion, which are precisely the vulnerabilities Chinese regulators cite when justifying crypto restrictions.

For a government that views capital controls as essential to macroeconomic stability, permitting unregulated renminbi-to-Bitcoin conversion would amount to opening a permanent leak in the dam.

The political cost of such a reversal, especially absent a crisis that forces Beijing’s hand, looks prohibitively high.

If the odds were to move meaningfully, certain triggers would precede the shift. A formal statement from the State Council or the People’s Bank of China establishing a legal pathway for licensed exchanges or brokers to operate domestically would be the clearest signal.

Banking permissions allowing renminbi accounts to settle transactions for crypto platforms would be another. Language shifts in official notices, from “illegal financial activity” to “regulated activity,” would indicate a conceptual reframing.

Free-trade zone announcements explicitly permitting the purchase of renminbi with Bitcoin within designated geographic areas could satisfy Polymarket’s resolution criteria without requiring nationwide legalization. None of these signals has appeared.

The regulatory trajectory since late 2025 has been unidirectional: tighter controls, clearer prohibitions, and more explicit civil and criminal deterrents.

The real bet

Polymarket traders aren’t pricing whether China will “embrace crypto” or “become blockchain-friendly.” They’re pricing in the likelihood that Beijing will reverse a newly reinforced policy framework within a year, permit citizens to convert state currency into an asset the government deems illegal, and do so without any discernible political or economic catalyst.

What Beijing has constructed instead is a bifurcated system: permissioned digital finance under state oversight, and continued prohibition of decentralized trading.

Hong Kong can host experiments. Tokenization can proceed on controlled rails. Stablecoins can gain licenses under strict conditions. But onshore renminbi-to-Bitcoin purchases remain incompatible with the regulatory logic that China spent 2025 and early 2026 hardening into law.

The architecture isn’t ambiguous. It’s explicit, codified, and expansive. Betting on a reversal by December 2026 isn’t just betting against current policy, but betting against the framework China just finished building.