[ad_1]

Real Vision’s chief crypto analyst Jamie Coutts believes one catalyst could catapult Bitcoin (BTC) to nearly double its price in months.

Coutts says the total global liquidity has reached a new all-time high level of just under $140 trillion after a decades-long period of contraction.

According to Coutts, global liquidity is what has “historically fueled explosive asset price rallies.”

Source: Jamie Coutts/X

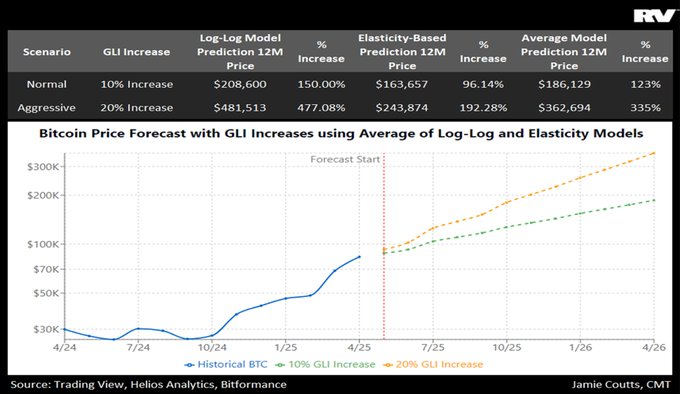

Real Vision’s chief crypto analyst says the total global liquidity is set to continue climbing and this could trigger an increase of around 98% in the price of Bitcoin.

“With central banks clearly behind the curve, we could see global liquidity rise by approximately 10% or $13 trillion over the next 12 months. This would equate to $186,000 BTC using a blended regression model.

Those who held steady and accumulated during recent market turbulence should be better for it in what comes next.”

Source: Jamie Coutts/X

Bitcoin is trading at $93,772 at time of writing.

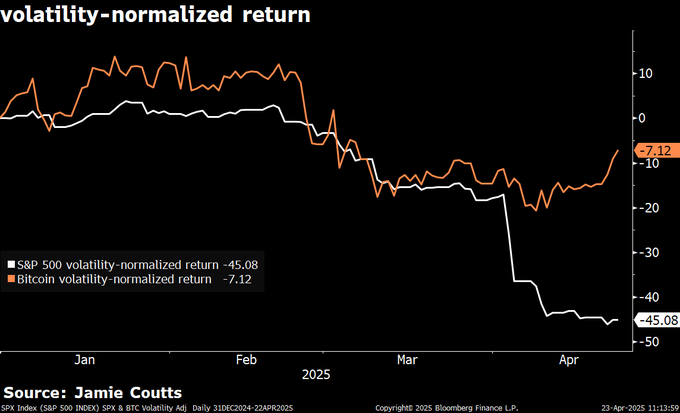

The crypto analyst further says that Bitcoin’s volatility levels are moving in an inversely correlated manner relative to traditional assets.

“It has been patently clear to me since 2022 that while Bitcoin’s volatility is decreasing, what is more striking is that traditional assets are becoming more volatile. Volatility isn’t the enemy, by the way, provided you’re being compensated by higher returns.

That is not the case for Bonds and Equities relative to Bitcoin. And this has massive implications for asset allocation and portfolio construction going forward.”

According to Coutts’ chart, based on data from the last four months, Bitcoin has recorded a volatility-normalized return of -7.12 compared to the S&P 500 index’s -45.08. The volatility-normalized return is a performance metric that compares the return on investment of an asset to its volatility – the higher the figure, the better the risk-adjusted return.

Source: Jamie Coutts/X

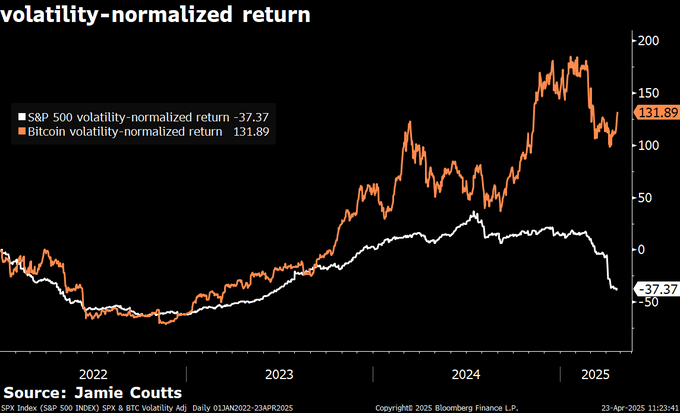

Since 2022, Bitcoin has recorded a volatility-normalized return of 131.89 compared to the S&P 500 index’s -37.37.

Source: Jamie Coutts/X

Generated Image: Midjourney

[ad_2]