CAN is back above the $1 mark after trading below it for months. With a landmark 50,000-unit ASIC order and new partnerships with SLNH and Luxor, sentiment is shifting fast. So is this a smart entry point now?

The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Oct. 15, 2025, by Cindy Feng.

A few weeks ago, some of my followers pinged me about Canaan Inc. (NASDAQ: CAN). They argued its share price was a bargain compared to its OG peers – many of whom have posted triple-digit gains this year. While those names have dominated headlines, Canaan has been quietly staging a comeback since last week.

Known primarily for its Avalon ASIC mining machines, Canaan spent most of 2025 out of sync with the market’s fixation on HPC and AI infrastructure. On top of that, the ongoing U.S.-China tariff war pushed its stock below $1 for months, raising real concerns about a potential Nasdaq delisting.

But something shifted recently. Since September 30, the stock has clawed its way back above $1 and kept climbing, thanks to a wave of corporate developments. Despite still showing a -12.19% YTD performance, the momentum is clearly turning. So the real question is whether this is the smart time to jump in. Let’s break it down.

Company Overview: More Than Just an ASIC Maker

Founded in 2013, Canaan Inc. is a technology company headquartered in Singapore, with deep roots in China’s semiconductor ecosystem. Best known for designing and manufacturing Avalon-branded ASIC Bitcoin mining machines, Canaan has gradually transformed from a pure-play hardware provider into a more diversified participant in the crypto mining sector.

Self-Mining

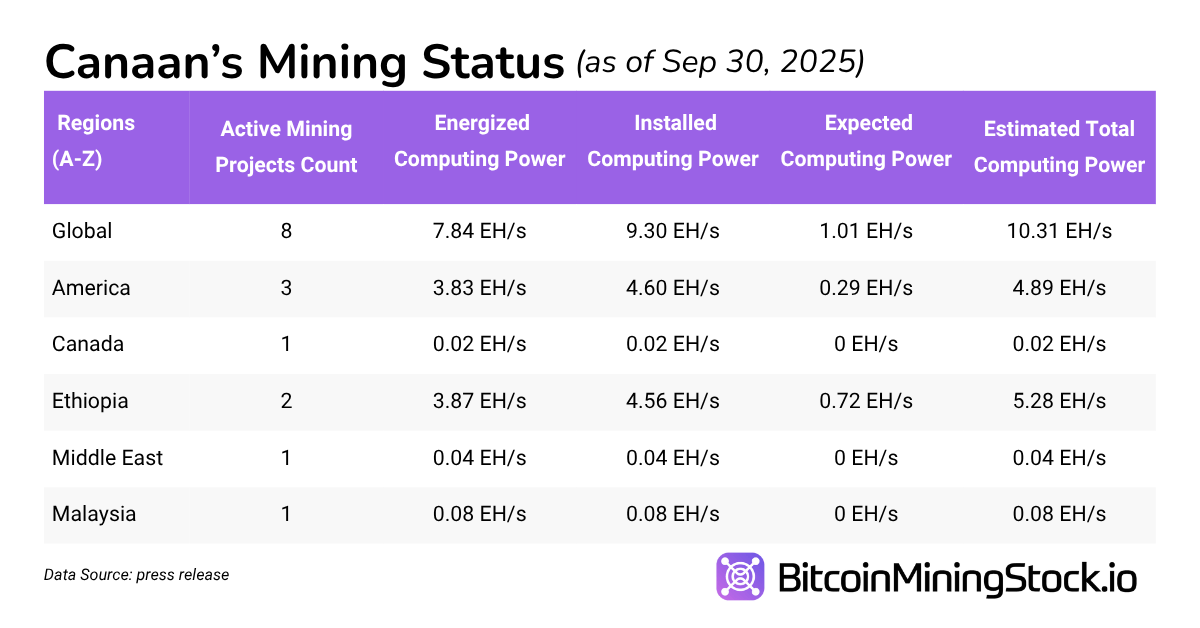

As of September 2025, Canaan operates 9.30 EH/s of hash rate, primarily in the U.S. and Ethiopia. The self-mining capacity can scale to 10.31 EH/s once pending ASICs deliveries are installed. Since January this year, Canaan reported ~87 bitcoin mined per month. The revenue from this business segment has been increasing consistently since Q2 2024.

Bitcoin Treasury

Canaan holds 1,582 BTC as of September 30, 2025. According to its Q2 earning presentation, BTC is accumulated through a mix of self-mining, hardware sales payments, and spot market purchases. The company also actively uses its Bitcoin holdings as collateral to fund R&D and hardware production, and even allocates a portion to short-term interest-bearing accounts to generate yield. Its Bitcoin treasury is still in the early stages, per CFO James Jin Cheng. Anyway, its Bitcoin treasury already ranks as the 35th largest among public companies globally on our website. In terms of exposure, Canaan’s Bitcoin holdings represent 20.29% of its market cap, a ratio that’s similar to some larger players like Riot Platforms and CleanSpark.

Retail Home Mining Equipment

Canaan has recently introduced pre-assembled Avalon Miner kits targeted at home miners and small-scale operations. These kits are designed for easy deployment and include plug-and-play containerized units. While current revenue from this line remains marginal, it could strengthen brand visibility and help reduce reliance on volatile institutional demand cycles.

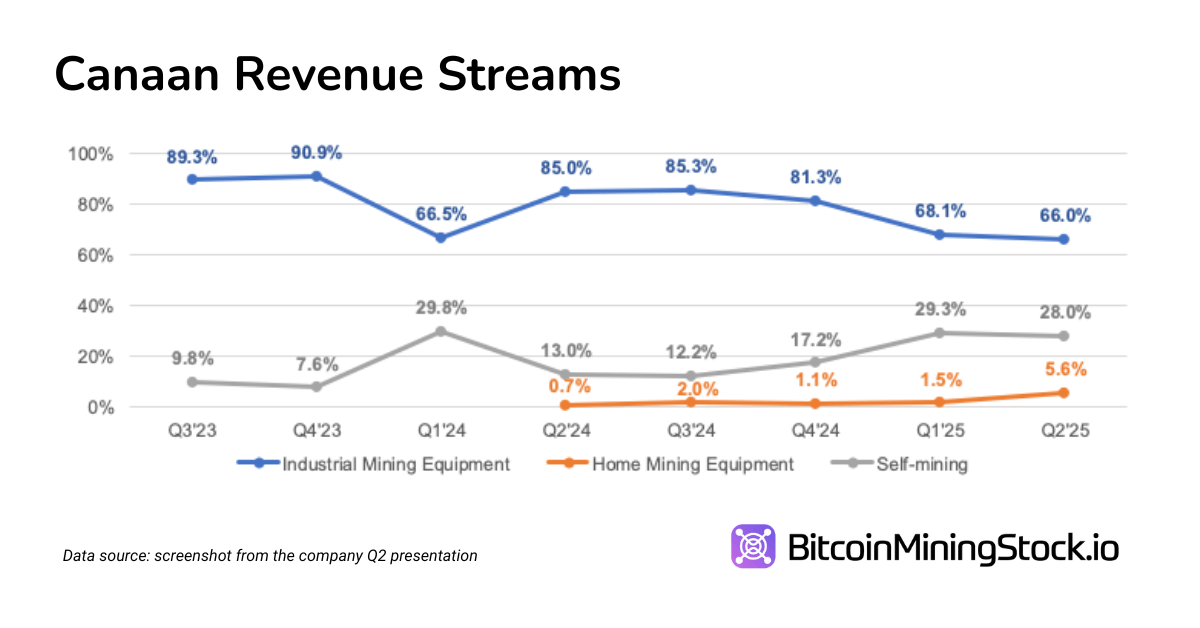

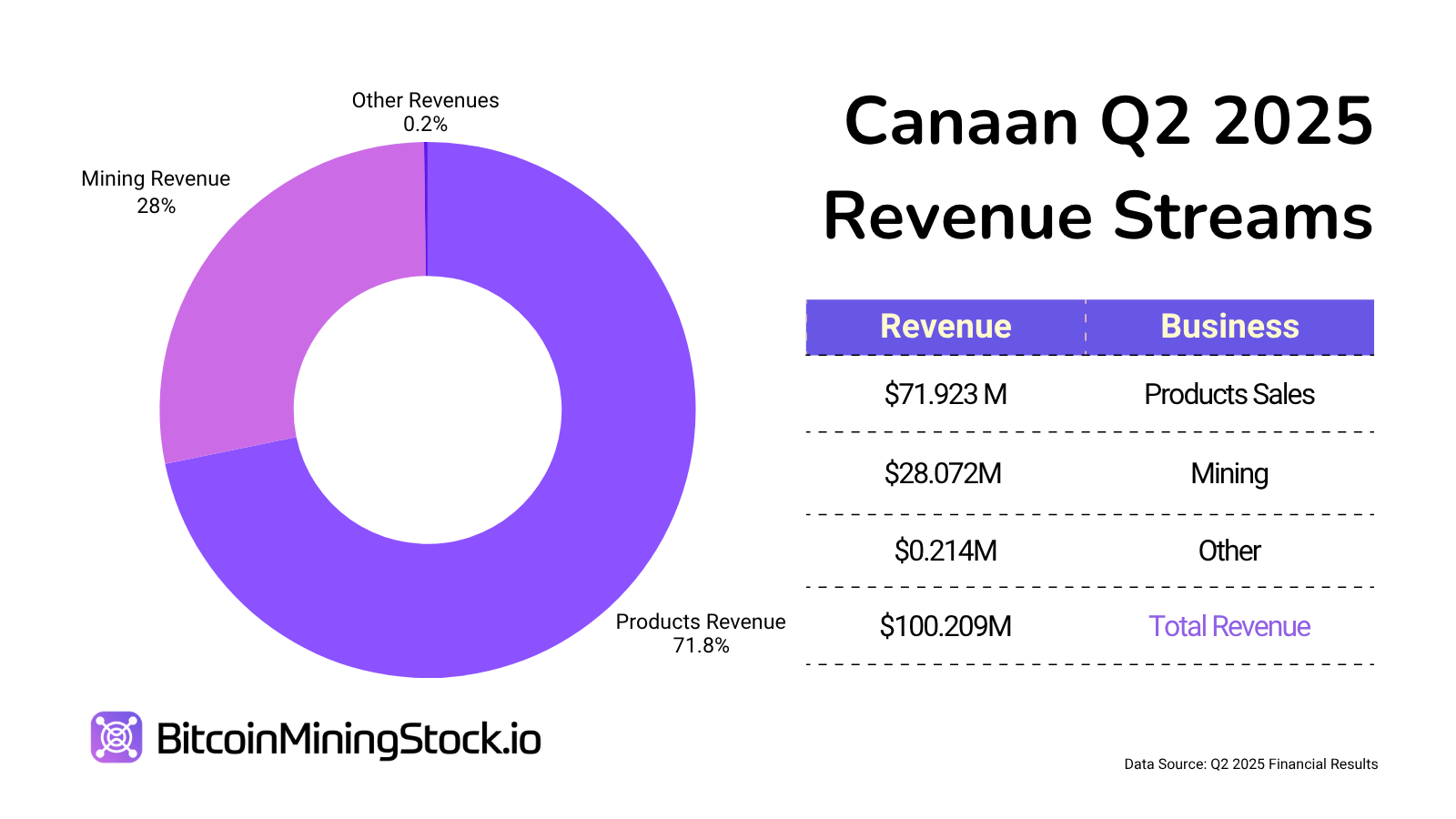

In Q2 2025, Canaan generated $73.9M in total revenue. Of that, 71.7% came from hardware sales, 28.1% from mining operations, and less than 1% from other services.

Recent Catalysts: The Momentum Is Building

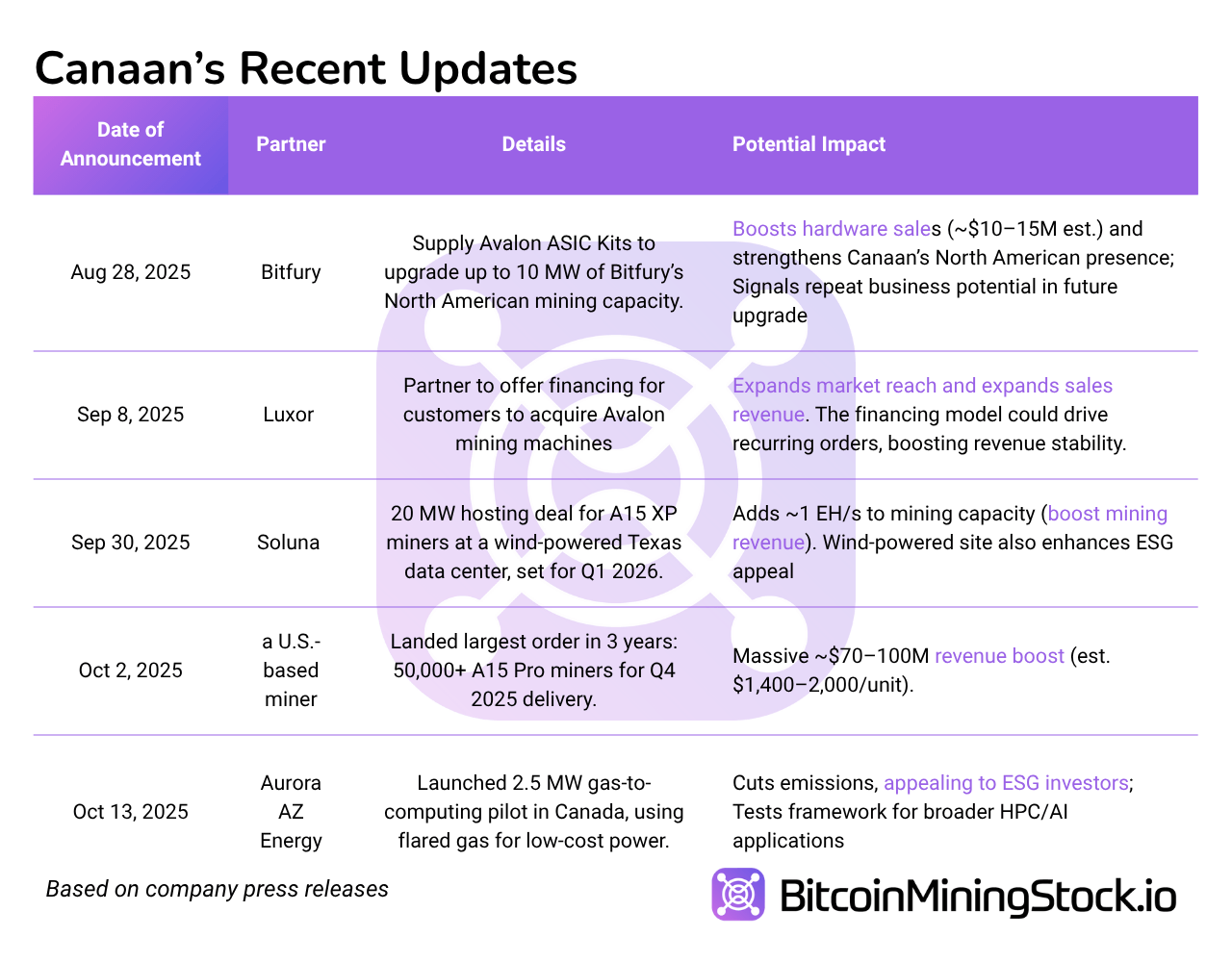

Investor sentiment around Canaan is shifting, thanks to a string of business wins and strategic partnerships. The recent updates paint a picture of a company gaining traction, each deal not only adds to top-line potential but also helps fuel renewed investor interest. To make things easier to track, here’s a timeline of key business updates:

Viewed together, these developments suggest that Canaan is doubling down on North America. Several deals point to a renewable energy pivot, which could appeal to ESG-focused investors. Most importantly, these moves will show up in the numbers. The company is guiding for $125–145M in Q3 revenue, presenting 25%-45% QoQ growth.

Is CAN Stock a Bargain at $1.80?

At $1.80, Canaan’s valuation looks compelling compared to peers, but let’s see whether it’s still a bargain.

As of Oct 15, 2025, Canaan holds a market cap of $881.96 million. After adjusting for $179 million in Bitcoin (1582 BTC x $112,833) and 11.63 million in Ethereum (2830 ETH x $4111) , $65.9 million in cash, and $268.5 million in debt, the enterprise value (EV)* sits at around $894 million. This provides a cleaner view of the company’s core operating value, excluding treasury assets.

*For my calculation: EV = Current Market Cap + Total Debt – Cash & Cash Equivalents – Fair Value of Bitcoin Holdings – Fair Value of Ethereum Holdings. Debt and cash figures are sourced from the latest quarterly report, while the fair value of crypto assets is based on current spot prices and the company’s most recent disclosed holdings.

Canaan has a guided Q3 2025 revenue between $125–145 million, implying an annualized revenue run rate of $500–580 million. Based on these projections, the company trades at an EV/revenue multiple of 1.5x–1.8x, below the 2.5x–4x range often seen among U.S.-listed peers during bullish cycles.

From a profitability lens, Canaan posted $25.3 million in adjusted EBITDA in Q2, annualizing to roughly $100 million. This translates to an EV/EBITDA multiple of ~8.9x, modest compared to top-tier miners trading at 10–20x under favorable market conditions. That leaves room for multiple expansion, if margins hold or investor sentiment strengthens.

On an asset basis, the company reported ~$484.5 million in net assets excluding crypto and $592.1 million including its crypto holdings. This results in a price-to-book (P/B) ratio of 2.7x to 4x depending on treatment of digital assets. These are not deep-value levels, but they’re also not overstretched, especially given that much of Canaan’s recent partnership deals haven’t fully hit the financials.

Ultimately, at $1.80, the stock is not deeply discounted but also not aggressively priced. The market is recognizing improved fundamentals and near-term revenue visibility, but has not yet assigned a premium for growth or broader strategic upside.

Final Thoughts

Canaan is evolving from a hardware supplier to a more vertically integrated crypto mining player, with growing self-mining operations, a meaningful crypto treasury (1,582 BTC and 2,830 ETH), and expanding global partnerships. The recent 50,000-unit miner order should boost revenue meaningfully in the coming quarters and help improve valuation metrics..

That said, challenges remain. Canaan posted an $11.1 million net loss in Q2, and unless Bitcoin prices stay elevated or cost efficiencies kick in, bottom-line profitability may remain under pressure. High operating costs and depreciation continue to weigh on margins.

Geopolitical risks also linger, particularly around U.S. tariffs on Chinese tech exports. While Canaan is working to mitigate this through new manufacturing lines in the U.S. and Malaysia, execution risk remains.

Ultimately, the next few quarters-particularly Q3 results (guiding $125–145M), Bitcoin price direction, and network difficulty trends, will likely determine whether Canaan earns a market rerating. For investors betting on a broader crypto bull cycle, this stock offers potential-but not without its risks.