[ad_1]

Bitcoin’s price fell 3.07% to $95,086 on Feb. 21, 2025, as markets reacted to a $1.4 billion hack at Bybit and technical indicators signaled bearish pressure.

Bearish Signals Dominate Bitcoin Charts Amid Security Breach Fallout

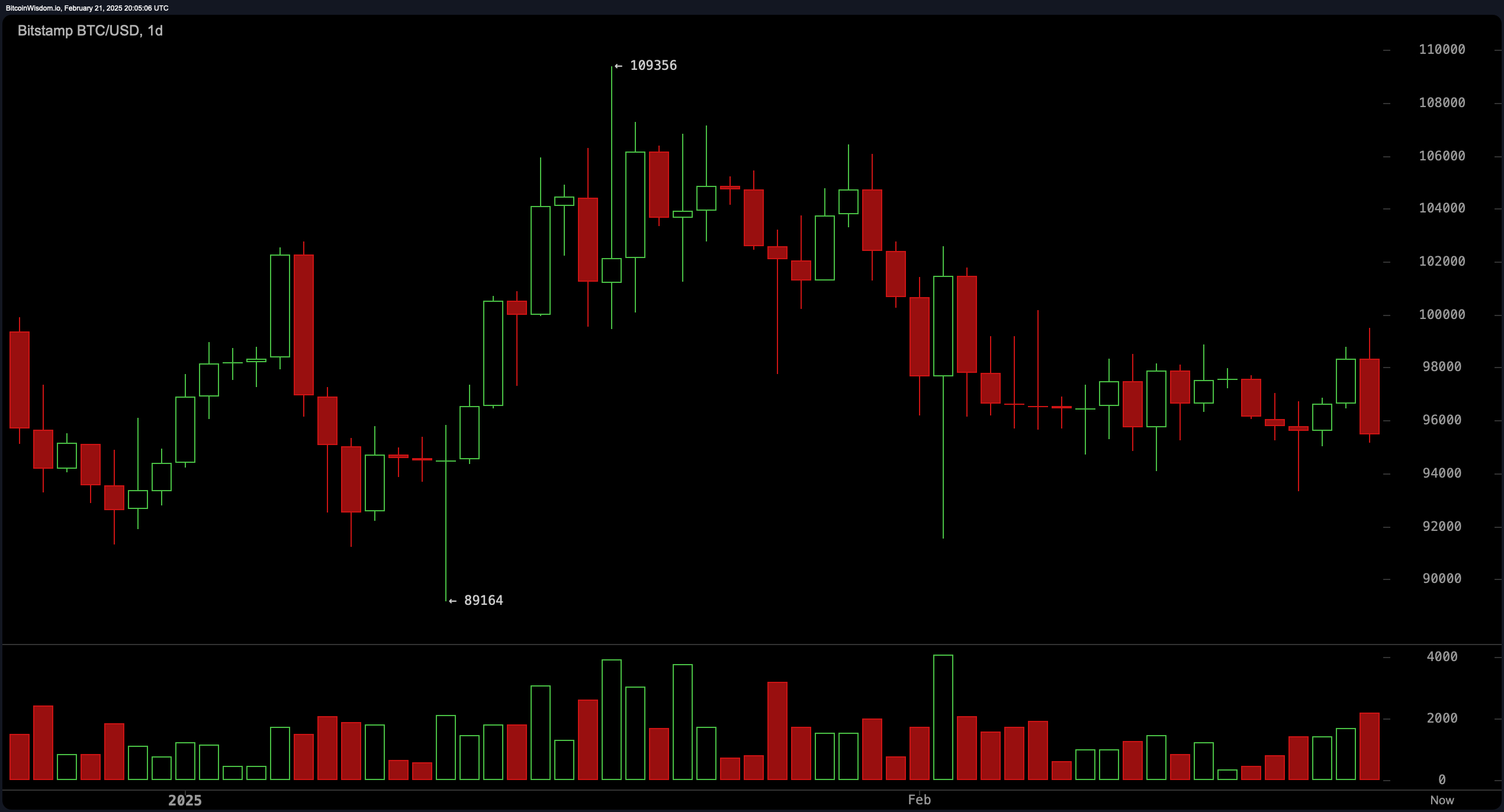

Bitcoin traded within a 24-hour range of $95,086 to $99,504, reflecting heightened volatility following the breach of Bybit’s Ethereum cold wallet. The exchange confirmed customer funds remained secure, but the incident amplified investor caution. Bitcoin’s market cap held at $1.88 trillion despite a $45.55 billion daily trading volume, underscoring the tug-of-war between panic selling and bargain hunting. The breach’s timing exacerbated existing technical weaknesses, with prices struggling to reclaim $100,000 resistance.

Oscillators painted a mixed but cautious picture. The relative strength index (RSI) at 44 and Stochastic at 52 both signaled neutrality, while the moving average convergence divergence (MACD) at -887 flashed a rare buy signal. However, momentum at -180 and the awesome oscillator at -3,288 reinforced bearish near-term sentiment. The commodity channel index (CCI) at -25 and average directional index (ADX) at 32 further highlighted indecision, urging traders to await clearer signals as things pan out.

The daily chart revealed consolidation between $95,000 and $100,000, with lower highs and lows eroding bullish momentum. A critical support zone near $92,000–$94,000 emerged as a potential rebound area, while resistance loomed at $100,000–$102,000. Notably, higher volume on red candles indicated persistent selling pressure.

BTC/USD 1D chart via Bitstamp on Feb. 21, 2025, following the Bybit hack.

The 4-hour chart showed a sharp rejection at $99,500, followed by a plunge to $95,000 and tentative stabilization near $93,300 support. High-volume red candles underscored panic selling, though buyers attempted a recovery. Similarly, the 1-hour chart confirmed a downtrend with a $99,500 lower high and weak defense of $95,000. Traders eyed a breakdown below $94,500 or a reclaim of $97,000+ with volume to confirm directional bias.

BTC/USD 4H chart via Bitstamp on Feb. 21, 2025, following the Bybit hack.

All short-term exponential moving averages (EMA 10, 20, 30, 50) and simple moving averages (SMA 10, 20, 30, 50) issued sell signals, with EMAs between $96,749 and $97,906 capping upside. Longer-term EMAs (100, 200) and SMAs (200) at $94,029, $85,348, and $80,929, respectively, provided buy signals, hinting at eventual bullish reversals. However, the dominance of bearish near-term MAs suggested continued pressure unless bulls decisively breach $97,000.

Bitcoin’s trajectory hinges on holding $95,000 or breaking lower toward $92,000. A reclaim of $97,000–$98,500 could revive bullish momentum, but traders must prioritize risk management amid post-hack uncertainty. Confirmations via volume and price action are critical before entering trades. While long-term indicators suggest eventual stability, short-term strategies should align with bearish technicals and heightened market sensitivity to negative catalysts.

Bull Verdict:

A sustained bitcoin price above $95,000, coupled with the moving average convergence divergence (MACD 12, 26) buy signal and long-term support from the exponential moving average (EMA 200) at $85,348, could fuel a bullish reversal. A decisive breakout above $97,000–$98,500 with volume may invalidate the lower-high pattern, targeting $100,000 resistance. Longer-term EMAs and SMAs (100, 200) suggest underlying strength, offering a foundation for bulls to regain control if macroeconomic and technical headwinds ease.

Bear Verdict:

Dominant sell signals from short-term moving averages (EMA 10, 20, 30, 50 and SMA 10, 20, 30, 50), combined with bearish momentum (10) and panic-selling volume, favor downside momentum. A breakdown below $95,000 risks accelerating losses toward $92,000–$93,300 support. The failure to reclaim $99,500 and the daily chart’s lower-high structure reinforce bearish control. Until bulls reclaim $97,000, the path of least resistance remains skewed toward further consolidation or declines amid post-hack risk aversion.

[ad_2]