[ad_1]

Bitcoin (BTC) is in its final stretch before breaking the $100K milestone. Near that price, the available coins for sale are becoming rare.

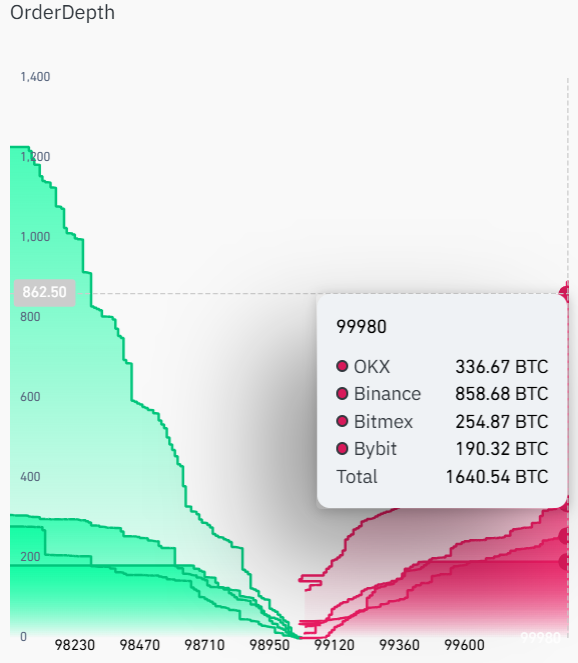

Bitcoin (BTC) is facing a minor supply shock at ranges near $100K. The leading coin traded at $99,258.22, after briefly peaking above $99,600. At this range, coins available for sale on big exchanges are becoming more rarified. Only a few hundred BTC are in the sell wall standing between the current price level and a new all-time high.

Bitcoin sell orders show a small availability on most major centralized exchanges. | Source: Coinglass

In the range between 99,000 and 100K, there are around 1,700 BTC available on the spot market for most major centralized exchanges. On the demand side, Tether minted another 1B tokens and made them available on Bitfinex, potentially adding another boost to break the $100K range.

BTC faces potential scarcity shock

On Coinbase Prime, only 1,000 BTC are available for sale, with similar ask orders of 1,000 coins at slightly higher prices. This batch of coins is similar to the daily buying of Bitcoin ETF, though demand may shift at the higher price range.

The low availability of coins for sale coincides with an all-time low of available coins on exchanges. Exchange reserves are down to 2.3M coins, but even that metric does not guarantee that the actual coin owners would be willing to sell.

On-chain activity showed more than 810K transactions in the past 24 hours, at a level similar to the March price peak. The new price record also reawakened one old whale wallet with a 50 BTC block reward, though uncertain if the coins moved with the intention to sell. The outflows from exchanges also compensated for recent whale and miner profit-taking.

The latest price expansion led to some selling from miners, as they managed to realize profits and sell above the breakeven price of producing new coins. Miners retained 2.03M BTC, down from 2.19M in September. The miner selling activity shows there are still enough buyers at each recent record price level, with strong holding demand.

During the latest market rally, BTC had a more significant share of trading against the US dollar, carrying 27.33% of volumes. Instead of a premium on South Korean exchanges, BTC traded at a discount, down to the $97,000 range against the Korean won.

BTC market absorbs bearish selling pressure

For BTC, this sell wall is nowhere near pressure coming from bear whales. Profit-taking at this level is still happening, though at a much lower rate compared to previous price ranges. The market has shown that even during less active periods, buyers can eat through as much as 50K BTC in days, as in the case of the selling by the German government.

In the short term, the selling may cause slippage, as the last $1,000 turned out relatively hard to cross. BTC continued to fluctuate by a few hundred dollars, often dipping under the $99,000 range. The rally above $99,000 followed the uneventful expiry of $2.7B in options, where even whale sellers failed to bring the price down to maximum pain levels of $85,000.

BTC is yet to face a $9B options expiry event at the end of November, scheduled for next Friday. The event may add to price volatility as whales try to sway the spot price.

Even at close to $100,000, BTC is still in the accumulation stage, according to the Rainbow Chart model. The expectation that $100K would be a minor pit stop to a higher repricing may lead whales to keep holding.

In addition to short-term traders, BTC is still finding its way into the wallets of MARA Digital and Microstrategy. Both corporations announced large-scale purchases, with MARA buying more than 5,000 coins for its reserves.

The Bitcoin Fear and Greed index is at 94, a level not seen since the price recovery of 2020. The index shows trading behaviors linked to market optimism, expecting the rally will last. Bitcoin open interest on major centralized exchanges is still near its all-time high of $32B, with almost balanced ratios of longs to shorts. At this stage, price wars keep happening, though not with the same dramatic liquidations.

[ad_2]