[ad_1]

Bitcoin is trading at $95,700 with an overall market capitalization of $1.89 trillion, a 24-hour trading volume of $13.51 billion, and an intraday price range between $94,805 and $96,684, reflecting a consolidation phase amid mixed technical signals.

Bitcoin

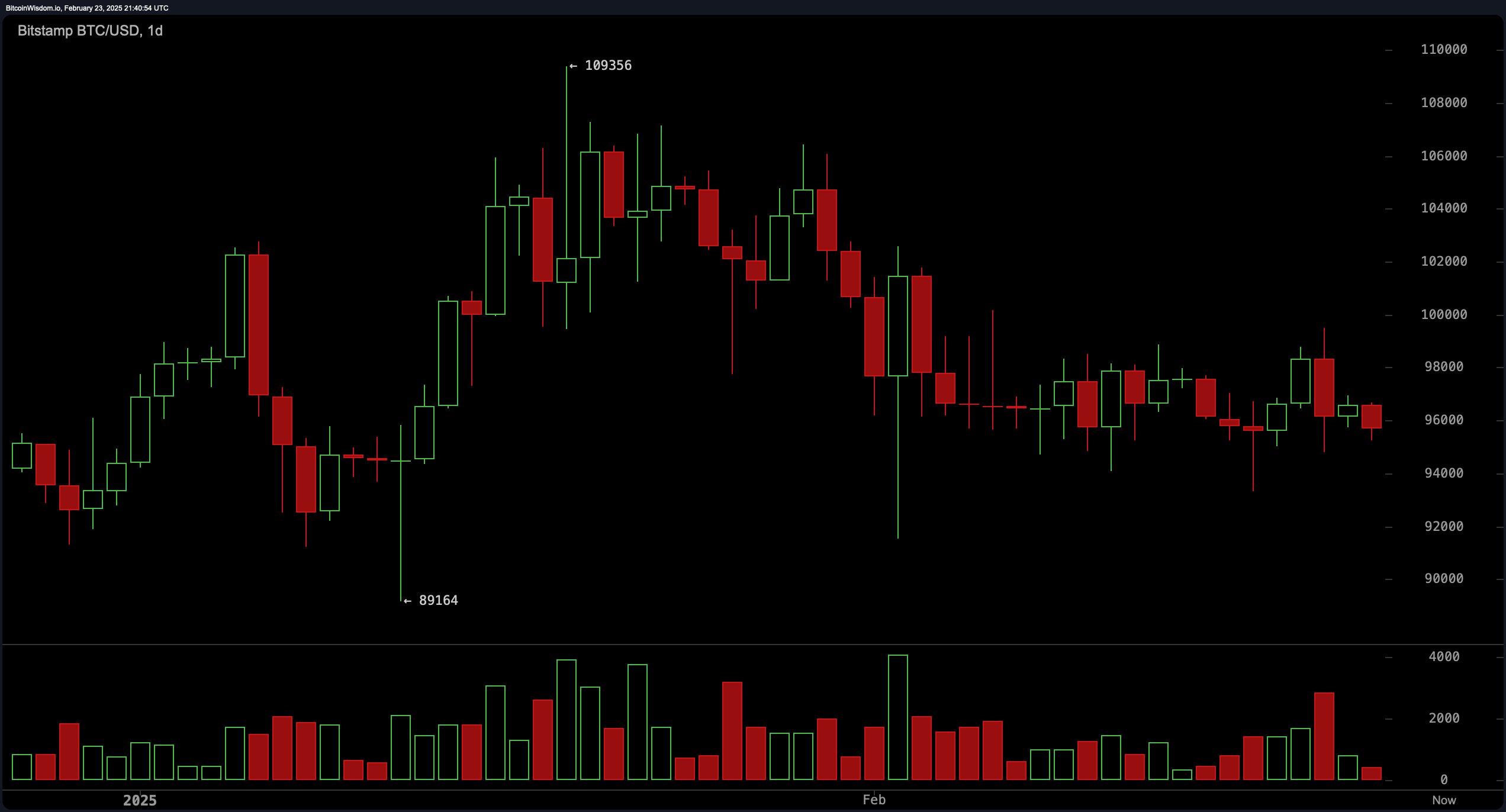

Bitcoin’s daily chart shows BTC previously peaked near $109,356 before experiencing a pullback to approximately $89,164, followed by consolidation around the $96,000 level. The $89,000 to $91,000 range serves as a key support zone, while resistance remains strong near $109,000. A declining volume trend on the pullback indicates potential exhaustion of selling pressure. If bitcoin reclaims $98,500 with strong volume, an upside move toward the $104,000 to $109,000 range is possible. However, failure to hold above current levels could push prices lower toward the $89,000 region.

BTC/USD via Bitstamp on Feb. 23, 2025, 1D chart.

On the BTC/USD four-hour chart via Bitstamp, bitcoin attempted a recovery after a drop to $93,340, rallying to $99,508 before failing to sustain momentum and retreating toward $96,000. Resistance remains firm at $98,000 and $99,500, while support is seen near $93,000 and $94,000. A retest of the $94,000 to $95,000 zone may provide a long opportunity targeting $98,000. Conversely, a price breakdown below $93,000 per BTC could open the door for further downside toward $90,000 to $91,000.

BTC/USD via Bitstamp on Feb. 23, 2025, 4H chart.

The one-hour chart highlights short-term weakness as bitcoin fell sharply from $99,508 to $94,805 before stabilizing. Resistance is quite evident at $96,500 and $98,000, while immediate support lies between $94,000 and $95,000. Traders may look for dip-buying opportunities around $94,500 to $95,000 with tight stop-loss levels. A failure to reclaim $96,500 could lead to renewed selling pressure, targeting the $94,500 region.

BTC/USD via Bitstamp on Feb. 23, 2025, 1H chart.

The daily chart’s oscillators provide neutral to mixed signals, with the relative strength index (RSI) at 44, Stochastic at 45, and the commodity channel index (CCI) at -100, all in the neutral territory. The momentum indicator at -932 and the moving average convergence divergence (MACD) level at -848 both signal upbeat conditions.

Moving averages (MAs) indicate a bearish trend on lower timeframes, with the 10-period exponential moving average (EMA) at $96,599 and the simple moving average (SMA) at $96,601 both signaling gloomy conditions. The 20-period and 30-period moving averages also remain in depressed territory, while the 100-period and 200-period MAs suggest longer-term bullish potential.

Bitcoin’s immediate price trajectory depends on whether it can reclaim resistance levels or if selling pressure resumes. A decisive break above $98,500 could pave the way for a move toward $100,000 to $104,000, while a drop below $94,000 may increase downside risks toward $89,000. Traders should watch volume levels closely to confirm the next significant move.

Bull Verdict:

Despite short-term resistance, bitcoin’s ability to hold above key support levels, combined with buy signals from the moving average convergence divergence (MACD) and momentum indicators, suggests a potential breakout. If bitcoin reclaims $98,500 with strong volume, it could trigger a rally toward $104,000 to $109,000, reinforcing a bullish outlook.

Bear Verdict:

The dominance of sell signals across multiple moving averages, coupled with bitcoin’s failure to sustain higher levels, points to continued downside pressure. If bitcoin drops below $94,000 and breaks key support at $93,000, it could accelerate losses toward $89,000, confirming a bearish continuation.

[ad_2]