[ad_1]

Ethereum approaches major resistance at $1,865 amid resurging institutional support. Can ETH break through to $2,489?

Ethereum is gradually gaining momentum as Bitcoin holds the $94k level. Currently, Ethereum is trading at $1,799, rising from its 24-hour low of $1,753.

The biggest altcoin faces strong overhead resistance, with the confluence of multiple bearish factors. Will the bullish struggle near $1,864 lead to a positive outcome?

Ethereum Price Recovery Faces Multiple Bearish Challenges

Ethereum’s price trend on the daily price chart shows a bullish recovery run, challenging a long-standing resistance trendline. The recovery accounted for a nearly 13% surge last week.

However, the bulls face strong resistance near the $1,850 supply zone, extending to the 23.6% Fibonacci level at $1,864. This has led to a sudden halt in the bullish trend. Moreover, the drop in momentum warns of a potential negative crossover in the MACD and signal lines.

Along with the supply zone resistance trendline and the key Fibonacci resistance, the declining 50-day EMA at $1,865 serves as a crucial resistance level.

As the recovery faces a high supply pressure area, a potential breakout could unleash trapped momentum.

Derivatives Traders Anticipate Breakout Run

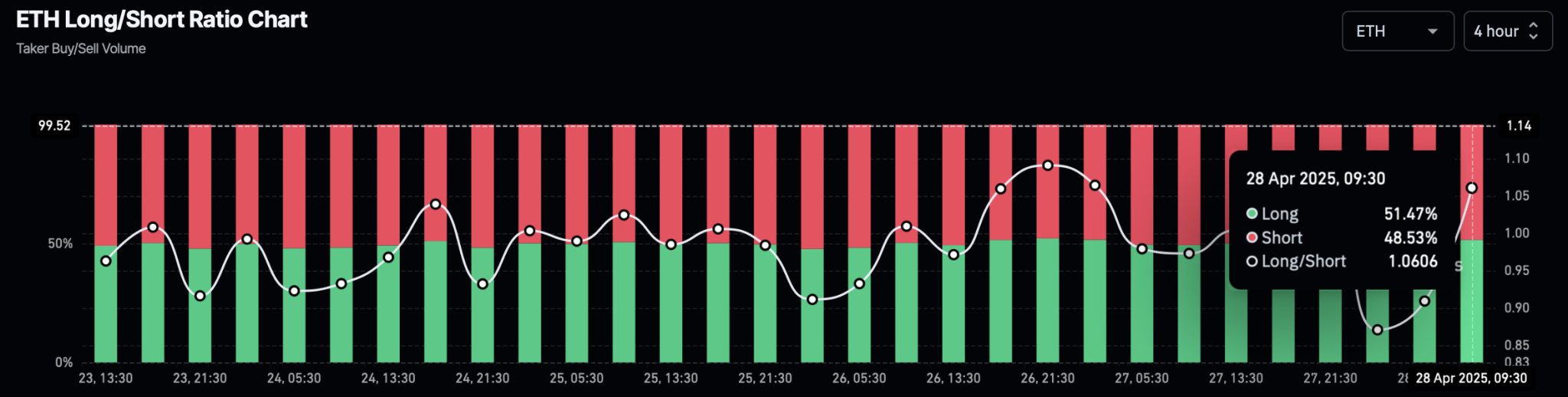

Despite the strong overhead resistance, the derivatives market shows traders anticipate a major breakout rally. According to Coinglass, long positions are increasing.

Over the past 8 hours, long positions have increased by 51.47%, pushing the long-to-short ratio above the 1 threshold.

Ethereum LongShort Ratio Chart

Pectra Upgrade And Rising Ethereum Buyers

The broader market sentiment for Ethereum is gradually improving with the upcoming Pectra upgrade on May 7. If the Pectra upgrade is successful, the Ethereum network will likely witness a spike in mass adoption.

With the new upgrade, the network will witness faster transactions, lower gas fees, a boost in scalability, and a potential boost in its ecosystem. As the Pectra upgrade nears, large entities are acquiring major amounts of Ethereum.

After eight consecutive weeks of net outflow, Ethereum ETFs have finally turned green. According to SoSoValue, the resurgence of institutional investment resulted in a weekly total net inflow of $157 million last week.

On Friday, April 25, the daily total net inflow stood at $104 million, with BlackRock recording an inflow of $54.43 million. BlackRock holds $2.18 billion worth of Ethereum, reflecting a strong confidence in the biggest altcoin.

Recently, a whale purchased 30,000 ETH worth $54 million in an over-the-counter deal on Wintermute. Additionally, the hacker behind the Bitrue incident recently sold $2.88 million worth of HOT and SHIB tokens.

The hacker later purchased 1,511 ETH tokens at an estimated price of $1,911. The hacker has also sent 1,050 ETH through Tornado Cash and continues to hold 16.34 million DAI tokens and 5,111 ETH tokens in a different wallet.

Ethereum Price Targets

As the broader market sentiment for ETH improves, the price analysis highlights significant upside potential for ETH. If the uptrend surpasses the 50 EMA line near $1,865, the bulls will likely target the 200-day EMA line.

Currently, the 200-day EMA stands at $2,489, slightly closer to the 50% Fibonacci level at $2,424. Therefore, a potential breakout could unlock an upside potential of nearly 40% for ETH prices. Conversely, the crucial support remains at the $1,500 psychological mark.

[ad_2]