[ad_1]

Crypto Daybook Americas will not be published tomorrow owing to Thanksgiving. It will return on Friday.

By Omkar Godbole (All times ET unless indicated otherwise)

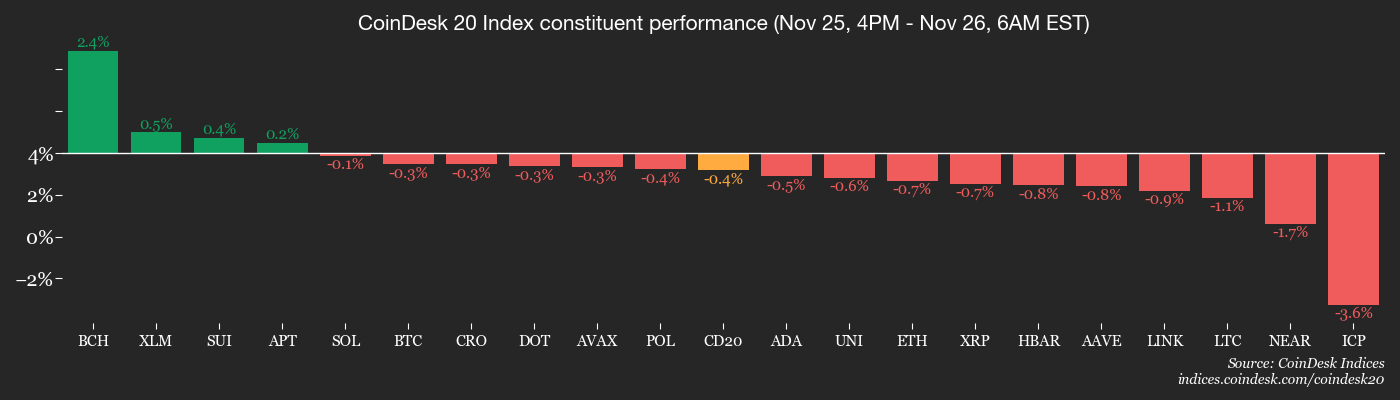

The crypto market hit “snooze” over the last 24 hours. Bitcoin BTC$87,830.49 shuffled aimlessly between $86,000 and $88,000 and the CoinDesk 20 Index (C20) barely budged. Meanwhile, the CoinDesk 80 Index managed a modest flex with a 1% gain, indicating pockets of strength in the broader altcoin market.

Zooming out, the picture looks even more lackluster. Bitcoin is down 7% year-to-date, while the U.S. 10-year Treasury note, that unexciting, fixed-income instrument is up 2.5%.

What this means is that parking your cash in boring old bonds would have been the smarter move this year. And that’s despite truckloads of BTC buying by digital asset treasuries. Sorry, maximalists.

From a macro perspective, the outperformance of the 10-year bond, a perennial safe haven, rings alarm bells for other risk assets, including stocks. This plays right into the theme we discussed last week: Institutional outflows from the spot bitcoin ETFs may be the smoke before the expected macro firestorm.

Sure, the script could change ahead of the year-end, especially if the Federal Reserve delivers an outright dovish message with the expected 25 basis point rate cut early next month, sending the Dollar Index (DXY) lower. For now, however, the index is looking to establish a foothold above its 200-day simple moving average (SMA), unfazed by the dovish Fed hopes.

It’s not as though options flows are offering any directional clarity.

Early this week, we saw a spike in hedging activity around the $80,000 bitcoin put, followed by hefty block trade hinting at a possible range reboot above $100,000 by year-end. On Tuesday, a wild $220,000 call purchase seemed bullish at first, but it was paired with a $40K call buy, signaling the trader’s real bet is on volatility fireworks, Greeks.Live told CoinDesk.

All this points to a challenging trading environment in the near-term.

That said, one piece of positive news has gone largely unnoticed: the new U.S. bank rule reducing capital requirements for low-risk assets like Treasuries. The capital reduction is seen freeing up liquidity at banks, potentially boosting lending and boosting dealers’ ability to intervene in government bond markets during times of stress.

James Thorne, the chief market strategist at Wellington-Altus Private Wealth, described the move as a clear sign of “deregulation on the way.” Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Crypto

- The Bitwise Dogecoin ETF (BWOW) is expected to start trading on NYSE Arca.

- CTC-1, the first satellite constellation running the Spacecoin (SPACE) protocol, will launch from Vandenberg Space Force Base in California.

- Macro

- 7:30 a.m.: Rachel Reeves, the U.K.’s Chancellor of the Exchequer, will deliver the 2025 Budget Statement in the House of Commons, setting tax and spending plans for the 2026-2027 U.K. tax year. Watch live.

- 8:30 a.m.: U.S. Sept. Durable Goods Orders MoM Est. 0.3%.

- 8:30 a.m.: U.S. Initial Jobless Claims for week ended Nov. 22 Est. 225K, Continuing Jobless Claims for week ended Nov. 15 (Prev. 1974K).

- Earnings(Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Governance votes and calls

- Nomina (NOM) to host a trader call on cross-DEX opportunities and perps market outlook at 10.30 a.m.

- Unlocks

- Token Launches

- Minswap (MIN) lists on Bitrue with MIN/USDT pair.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead.”

- Day 2 of 3: Finance Magnates London Summit 2025

- Nov. 26: Digital Securities and Digital Cash Summit Frankfurt

- Day 1 of 3: Excellence in Digital Banking International Summit 2025 (Amsterdam)

Market Movements

- BTC is down 0.28% from 4 p.m. ET Tuesday at $86,779.61 (24hrs: -0.48%%)

- ETH is down 0.91% at $2,903.77 (24hrs: +0.81%)

- CoinDesk 20 is down 0.31% at 2,857.32 (24hrs: -0.17%)

- Ether CESR Composite Staking Rate is up 2 bps at 2.86%

- BTC funding rate is at 0.0069% (7.5303% annualized) on Binance

- DXY is up 0.14% at 99.81

- Gold futures are up 0.41% at $4,194.40

- Silver futures are up 2.15% at $52.74

- Nikkei 225 closed up 1.85% at 49,559.07

- Hang Seng closed up 0.13% at 25,928.08

- FTSE is up 0.21% at 9,629.60

- Euro Stoxx 50 is up 0.58% at 5,606.20

- DJIA closed on Tuesday up 1.43% at 47,112.45

- S&P 500 closed up 0.91% at 6,765.88

- Nasdaq Composite closed up 0.67% at 23,025.59

- S&P/TSX Composite closed up 0.97% at 30,900.65

- S&P 40 Latin America closed up 1.32% at 3,094.79

- U.S. 10-Year Treasury rate is up 0.6 bps at 4.008%

- E-mini S&P 500 futures are up 0.33% at 6,803.75

- E-mini Nasdaq-100 futures are up 0.46% at 25,201.00

- E-mini Dow Jones Industrial Average Index are up 0.19% at 47,268.00

Bitcoin Stats

- BTC Dominance: 58.61 (+0.19%)

- Ether-bitcoin ratio: 0.0335 (-1.12%)

- Hashrate (seven-day moving average): 1,040 EH/s

- Hashprice (spot): $36.10

- Total fees: 3.14 BTC / $274,424

- CME Futures Open Interest: 131,460 BTC

- BTC priced in gold: 20.9 oz.

- BTC vs gold market cap: 5.83%

Technical Analysis

Dollar index’s daily chart, with the 200-day simple moving average (SMA). (TradingView)

- The chart shows the Dollar Index’s daily price swings, along with its 200-day simple moving average (SMA) line.

- The DXY is looking to establish a foothold above the 200-day SMA despite the string of weak U.S. economic data, including the ADP payrolls, and the sharp rise in the odds of the Fed rate cut in December.

- It’s a classic bullish scenario: a market that shrugs off bad news, often signaling that a major rally might be on the horizon.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $254.12 (-0.72%), unchanged in pre-market

- Circle Internet (CRCL): closed at $70.11 (-3.62%), +0.67% at $70.58

- Galaxy Digital (GLXY): closed at $25.48 (+2.82%), +0.82% at $25.69

- Bullish (BLSH): closed at $40.5 (-2.41%), +0.49% at $40.70

- MARA Holdings (MARA): closed at $11.17 (-0.36%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $14.39 (+3.67%), unchanged in pre-market

- Core Scientific (CORZ): closed at $15.55 (-1.27%)

- CleanSpark (CLSK): closed at $11.82 (+2.96%), -1.86% at $11.60

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $43.65 (+1.23%)

- Exodus Movement (EXOD): closed at $14.65 (-3.49%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $172.19 (-3.83%), -0.57% at $171.21

- Semler Scientific (SMLR): closed at $20.32 (-2.66%)

- SharpLink Gaming (SBET): closed at $9.93 (-1.49%), -0.1% at $9.92

- Upexi (UPXI): closed at $2.99 (+6.41%)

- Lite Strategy (LITS): closed at $1.84 (+0.55%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $128.7 million

- Cumulative net flows: $57.59 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: $78.6 million

- Cumulative net flows: $12.83 billion

- Total ETH holdings ~6.2 million

Source: Farside Investors

While You Were Sleeping

- Essential Bitcoin Price Points Traders Should Track Now (CoinDesk): Traders are watching key price levels around $88,000 and $102,000 as indicators of trend reversal, while a drop below $83,000 could confirm further downside risk for bitcoin.

- Bitcoin Dip in 2026, Surge in 2028: JPMorgan’s IBIT-Linked Structured Note Fits Halving Cycles (CoinDesk): The bank’s new investment product ties potential payouts to bitcoin’s four-year cycle, offering capped protection if BTC drops in 2026 and amplified gains if it rallies by 2028.

- Traders Are Flooding Markets With Risky Bets. Robinhood’s CEO Is Their Cult Hero. (The Wall Street Journal): By prioritizing high-risk, high-reward products like options, crypto and prediction markets, the firm has regained momentum and helped turn co-founder Vlad Tenev into a retail trading icon.

[ad_2]