[ad_1]

U.S. spot bitcoin exchange-traded funds amassed $3.06 billion in inflows last week, according to newly published figures. Meanwhile, Blackrock’s IBIT fund edges closer to the 600,000 BTC threshold, requiring just 11,314 BTC to eclipse this significant benchmark.

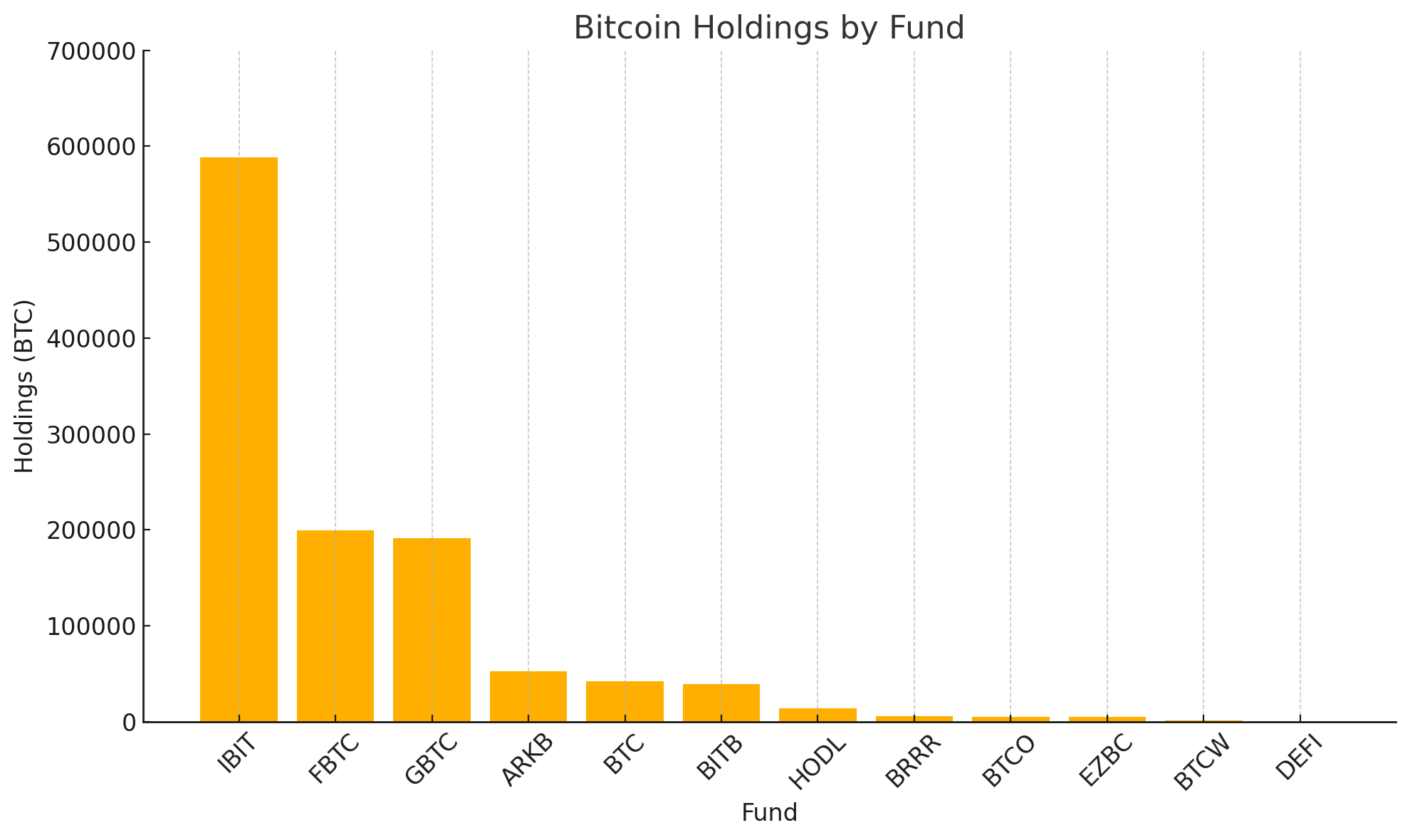

Three Bitcoin ETFs Now Hold Almost 1 Million BTC Combined

Data compiled by sosovalue.com reveals that since Jan. 11, 2024, U.S. spot bitcoin ETFs have attracted $38.43 billion in inflows, with last week’s addition contributing $3.06 billion to that total. On Friday alone, Blackrock’s IBIT garnered $240 million, further bolstering its reserves. As of April 27, 2025, figures drawn from Blackrock’s own portal show IBIT holding 588,686.91 BTC, translating to $55.3 billion based on Sunday’s bitcoin valuation.

With approximately 19.85 million BTC currently in circulation, IBIT commands 2.97% of the outstanding supply. Fidelity’s FBTC maintains a holding of 199,684.83 BTC, valued at $18.76 billion, while Grayscale’s GBTC stockpiles 191,190.971 BTC, equating to roughly $17.9 billion as of Sunday, April 27. These three funds are the only ETFs surpassing the 100,000 BTC mark, collectively overseeing 979,562.711 BTC valued at $92 billion. Together, IBIT, FBTC, and GBTC collectively steward 4.93% of bitcoin’s circulating quantity.

Beyond these, just three other funds possess more than 35,000 BTC apiece, including Ark Invest’s ARKB with 52,604 BTC. Grayscale’s Bitcoin Mini Trust holds 42,079.29 BTC, and Bitwise’s BITB maintains a reserve of 39,020.06 BTC as of April 27. Combined, the trio accounts for 133,703.35 BTC, estimated at $12.5 billion, representing a comparatively smaller 0.67% of the current 19.85 million supply. An additional six funds—HODL, BRRR, BTCO, EZBC, BTCW, and DEFI—together hold 32,646.156 BTC, valued just north of $3 billion based on prevailing exchange rates.

Altogether, U.S. spot bitcoin ETFs hold a combined total of 1,145,912.217 BTC, amounting to $107.70 billion as of April 27. This trove corresponds to 5.77% of the existing 19.85 million BTC in circulation. When factoring in international ETFs alongside holdings by public and private companies, the volume of bitcoin committed to long-term storage grows substantially larger.

[ad_2]