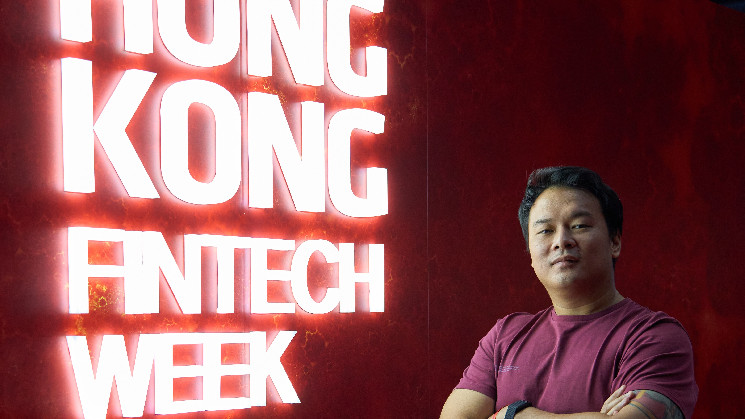

Darius Sit, QCP Capital’s co-founder and chief investment officer, says BlackRock entering crypto is more important than Republican candidate Donald Trump re-taking the White House.

A crypto-friendly White House would benefit the industry globally, Sit said.

HONG KONG — The winner of next week’s U.S. presidential election doesn’t really matter to Darius Sit, the chief investment officer of QCP Capital, a Singapore-based crypto trading firm.

While there may be some short-term volatility in crypto markets depending on whether Donald Trump or Kamala Harris becomes the leader of the world’s largest economy, what’s more important is the broader integration of crypto, especially bitcoin (BTC), into American finance. For example, the widespread adoption of bitcoin exchange-traded funds (ETFs), with BlackRock (BLK), the world’s largest asset-management firm, running the biggest.

“The biggest change this year has been BlackRock,” Sit said in an interview. “Suddenly we have bitcoin being distributed in BlackRock’s extensive network.

“When you have [BlackRock CEO] Larry Fink on CNBC talking about how bitcoin is a store of value, that’s when you know crypto has become a part of the American investing narrative,” he said. “BlackRock has brought crypto from frontier to mainstream.”

Trump has made part of his election campaign ensuring that U.S. crypto rules are attractive to projects so they can stay onshore, which earned his crypto policy a rare endorsement from CoinDesk. Bettors on Polymarket give Trump a more than 60% chance of winning the election.

One might wonder if a U.S. without a hostile Securities and Exchange Commission (SEC) led by Gary Gensler might raise concerns in jurisdictions like Hong Kong, which have courted American companies to set up shop in places where rules are more certain.

It’s not just East Asia. Earlier this year, QCP opened in Abu Dhabi, and Sit says he’s a fan of the regulator’s approach to crypto, explaining that the regulator there “didn’t see crypto as a carve-out of capital markets.” Instead, he said, Abu Dhabi views “digital assets as part of the capital market.”

Still, a rising tide lifts all ships.

“Bitcoin becomes even more of a cornerstone asset if Trump comes in and has more friendly policies,” Sit said, arguing that U.S. growth would likely fuel global opportunities rather than stifle them.

Bitcoin is currently trading above $72,000, up 19% from a month earlier, according to CoinDesk Indices data, coming close to challenging its all-time high.