[ad_1]

Corporate bitcoin adoption is exploding as institutions pour billions into BTC, signaling the end of altcoin hype and the rise of crypto’s fundamental-driven future.

‘No More Alt Season’: Bitwise CIO Declares End of Speculation Era in Crypto

Bitwise Asset Management executives are signaling a shift in the crypto landscape, as their newly released Corporate Bitcoin Adoption report for Q1 2025 highlights accelerating institutional interest. CEO Hunter Horsley posted on social media platform X this week:

By the end of 2025 people are going to be surprised by how many famous tradfi institutions have crypto products and offerings. The work is underway. The mainstream era has started.

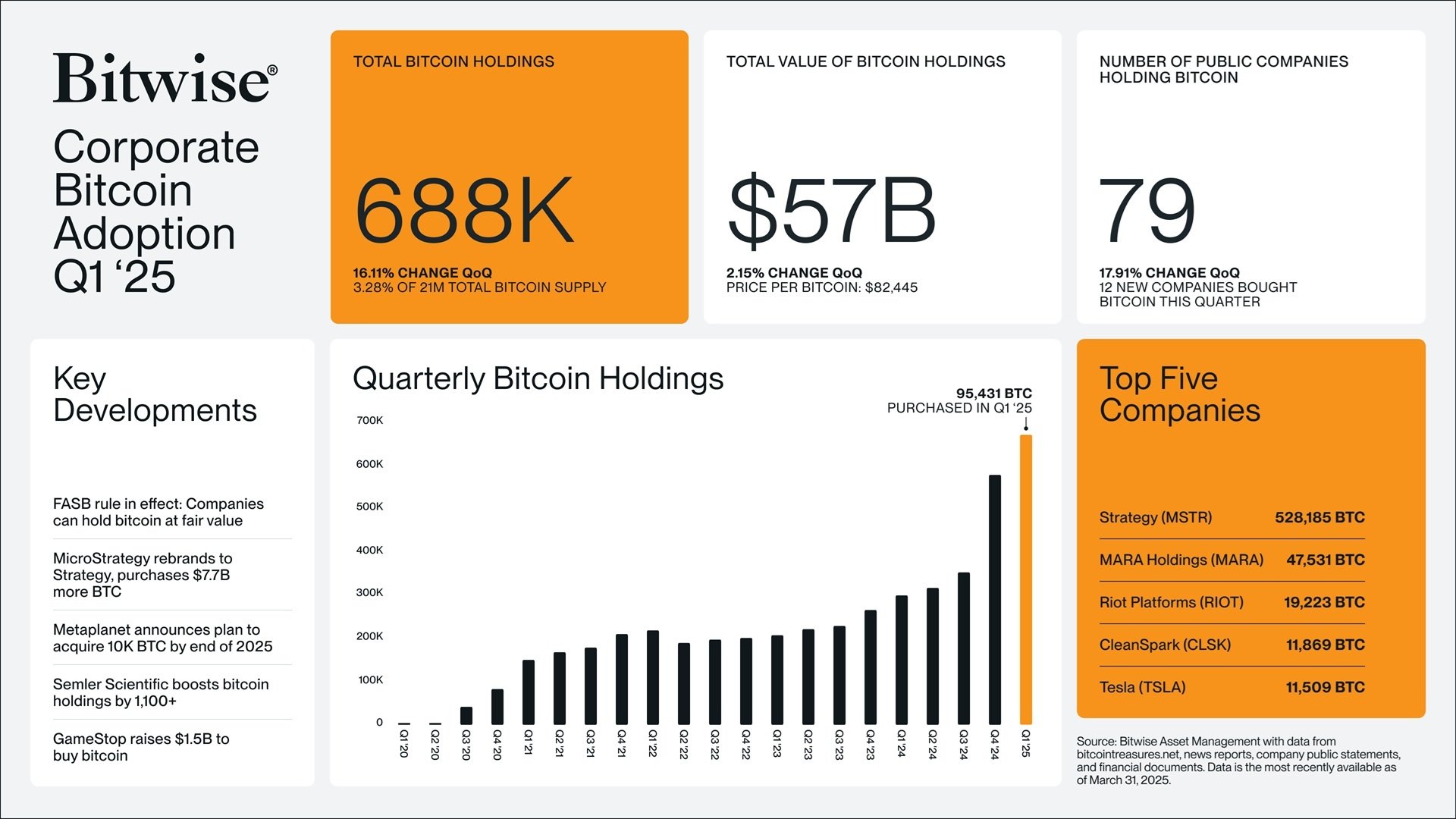

The report shows that public companies collectively held 688,000 bitcoin in the first quarter, representing a 16.11% increase over the previous quarter and accounting for 3.28% of bitcoin’s fixed 21 million coin supply. The total value of these holdings has climbed to $57 billion, based on a per-bitcoin price of $82,445. The number of companies participating grew to 79, as 12 new firms added bitcoin to their balance sheets. In total, 95,431 BTC were purchased in Q1, marking the largest single-quarter acquisition to date. Strategy, aka Microstrategy, remains the top holder, followed by MARA Holdings. Riot Platforms, Cleanspark, and Tesla round out the top five corporate holders.

The growth coincides with favorable regulatory developments. The U.S. Financial Accounting Standards Board’s decision to allow bitcoin to be reported at fair value has opened the door for more transparent accounting, which some believe reduces risk for public firms. Gamestop is raising $1.5 billion to buy bitcoin, Semler Scientific added BTC to its treasury, and Metaplanet unveiled plans to acquire 10,000 BTC by the end of the year. While skeptics continue to flag volatility and regulatory uncertainty, advocates point to increasing institutional buy-in and rule changes that suggest a maturing market poised for long-term integration.

Echoing this momentum, Bitwise’s Chief Investment Officer Matt Hougan stated on X this week:

We are no longer entitled to an ‘alt season.’ That concept arose in an era when the primary value of crypto was speculative. We’ve entered into the fundamental era of crypto, which means more dispersion in individual asset returns.

[ad_2]