[ad_1]

Bitnomial Clearinghouse LLC received approval from the US Commodity Futures Trading Commission (CFTC) to clear fully collateralized swaps, enabling its parent company, Bitnomial, to launch prediction markets and offer clearing services to other platforms.

According to Friday’s announcement, Bitnomial’s prediction market will cover crypto and economic events, alongside its existing Bitcoin (BTC) and crypto derivatives products. The contracts are designed to allow traders to take positions on outcomes, such as token price levels and macroeconomic data.

The approval expands the umbrella of the trading products offered by Bitnomial. Based in Chicago, the company’s exchange and clearing arms offer perpetuals, futures, options contracts and leveraged spot trading. The company’s clearinghouse also supports crypto-based margin and settlement, allowing approved products to be margined and settled directly in digital assets.

Bitnomial president Michael Dunn said the approval allows the company to serve “both our own exchange and external partners, building a clearing network that strengthens the entire prediction market ecosystem.”

Bitnomial Clearinghouse operates as an infrastructure-only clearing provider, rather than a retail competitor, giving approved partners access to its margin and settlement systems and allowing collateral to be converted between US dollars and cryptocurrency.

The approval follows a recent green light to launch a CFTC-regulated spot cryptocurrency trading platform in the US, allowing customers to buy, sell and trade leveraged and non-leveraged crypto products on a federally supervised exchange.

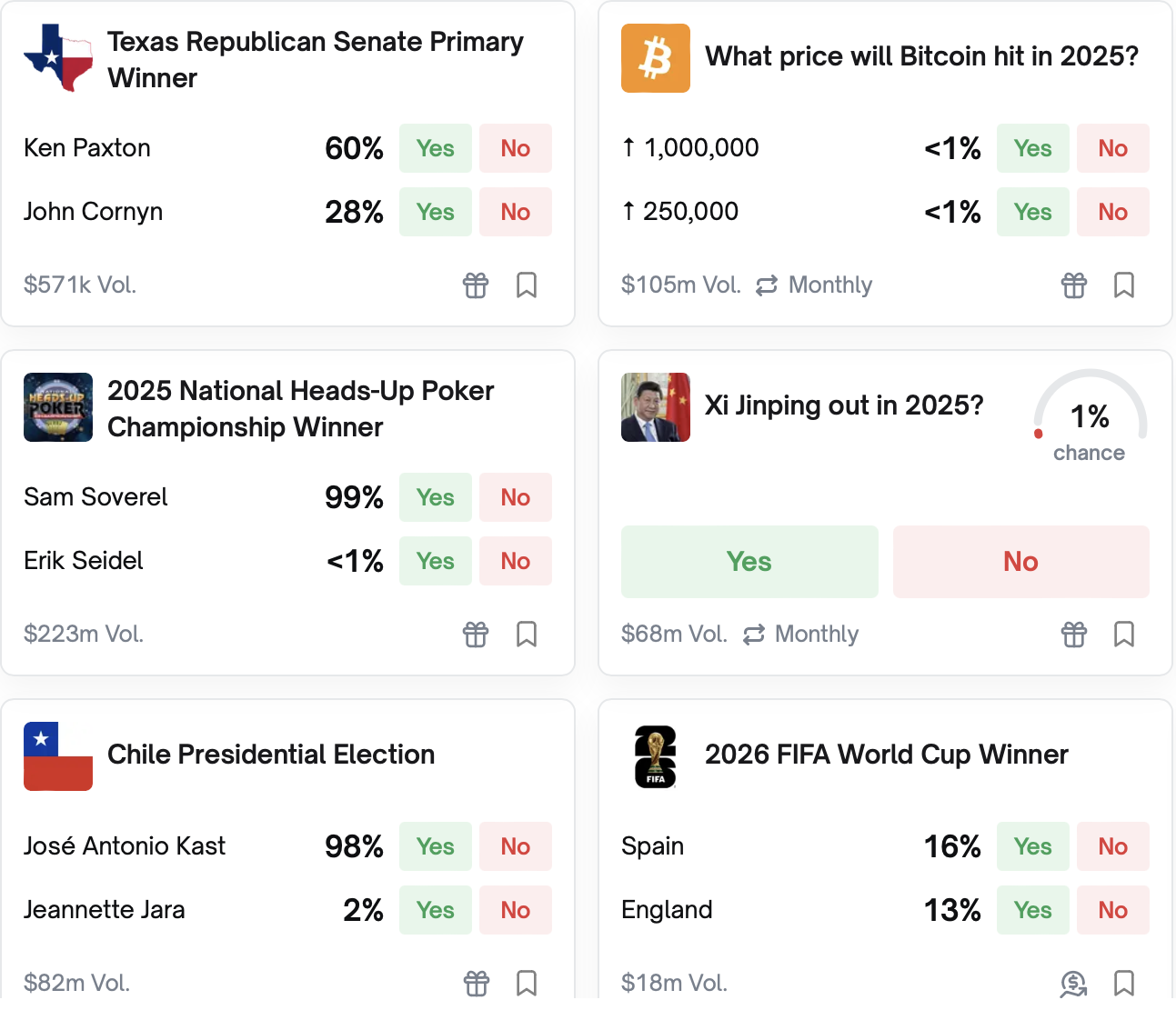

Event contracts on Polymarket. Source: Polymarket

Related: Coinbase may debut prediction markets, tokenized stocks on Wednesday: Report

Polymarket gains momentum in the US

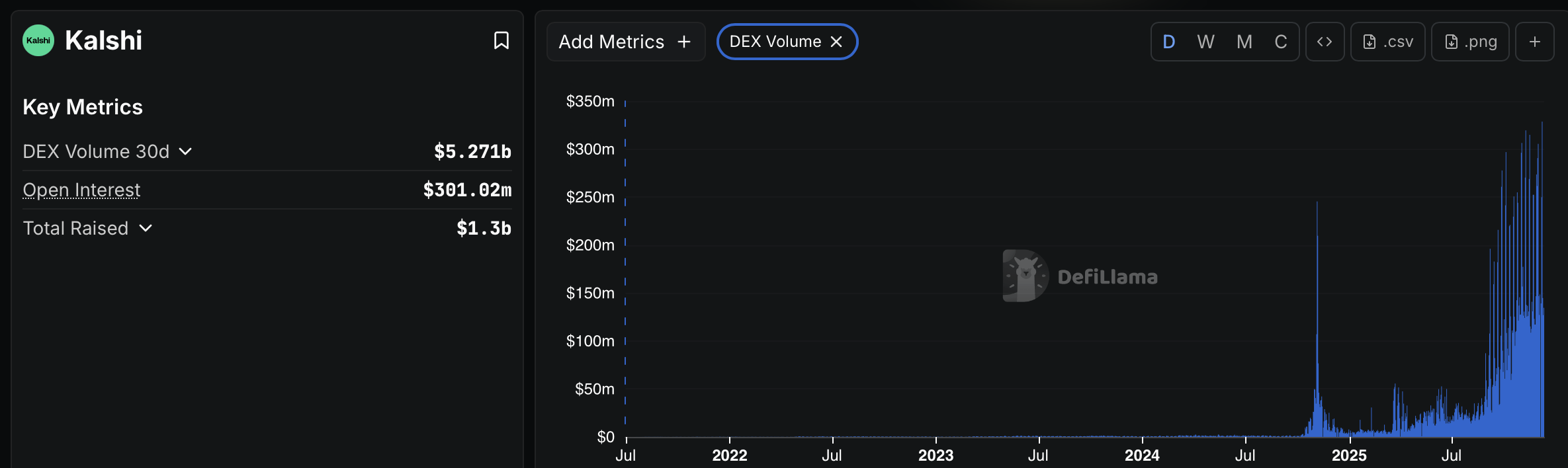

Prediction markets have emerged as a major trend in 2025. According to DefiLlama data, prediction market Kalshi has generated $5.27 billion in trading volume over the last 30 days, while blockchain-based Polymarket recorded just under $2 billion over the same time period.

Kalshi trading volume. Source: DefiLlama

In November, Polymarket received regulatory approval from the CFTC to operate an intermediated trading platform, allowing access through registered brokers under the rules governing US markets.

The approval followed the closure of an investigation in July led by the CFTC and US Department of Justice into whether Polymarket had allowed trading by US users, a probe that included an FBI search of founder Shayne Coplan’s home.

Polymarket, which settles contracts on the Polygon blockchain using the USDC (USDC) stablecoin, has also secured several partnerships in recent months, including the UFC and Zuffa boxing and fantasy sports operator PrizePicks in November.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

[ad_2]