[ad_1]

Bitfinex, one of the longest-standing crypto exchanges in the world, is collaborating with the Thalex platform to expand its offering of derivative instruments.

Thanks to this partnership, it will be able to offer its users new opportunities to invest in the crypto market, leveraging perpetual futures and complete options.

The whole is served with ample liquidity for trading, low latency, and reduced commission costs. All the details below.

Bitfinex considers new derivative investment products with Thalex

Bitfinex has just announced the strategic integration of the Thalex platform into its trading section for professional users “Bitfinex Derivatives”.

Questo partnership allows Bitfinex to expand its set of derivative products by leveraging the highly specialized infrastructure of the partner.

Users of the exchange will soon be able to trade seamlessly full options on a wide range of cryptocurrencies, as well as futures and perpetual contracts.

Thalex is indeed known in the crypto ecosystem for its competitive offering of derivatives regulated by stablecoin guaranteed by Bitcoin (BTC), Ether (ETH), and Tether (USDT).

It is clear that its union with Bitfinex lays the foundations for a lasting mutual strengthening, while simultaneously unlocking new investment options.

By doing so, the typical obstacles to adoption in the crypto world are removed, opening the doors to traders and institutions towards a series of secure, reliable, and diversified products.

We remind you that only users who are not residents of the United States, South Africa, United Kingdom, Spain, Canada can take advantage of these services.

Paolo Ardono, CTO of Bitfinex, expressed his optimism for this great news:

“We are excited to announce the full integration of Thalex into the Bitfinex Derivatives platform. Crypto derivatives, particularly options and futures settled via stablecoin, are essential for creating a more stable and mature market. This integration allows our clients to access these critical tools, all while benefiting from the streamlined user experience and robust liquidity provided by Thalex.”

Bitfinex Derivative is a platform managed by the major iFinex Financial Technologies Limited, based in the British Virgin Islands

Thalex is provided by Thalex Digital Trading Platform Ltd, an international trading company incorporated in the Republic of Seychelles.

New features coming for Bitfinex customers

Soon, users of Bitfinex Derivatives will be able to enjoy linear options, futures, and perpetual contracts with native support for combined operations.

Users of the exchange can now onboard, deposit, and trade on Thalex using existing verification information.

The commitment of Thalex guarantees advanced trading, which uses a universal margin account as portfolio margin and atomic order execution.

Traders can manage multiple different positions starting from a single account as collateral, with settlement in stablecoin.

Some of the most interesting advantages introduced with this integration concern the efficiency of derivative exchanges, with low latency, high liquidity, and reduced commission costs.

Furthermore, the infrastructure features solid connectivity and a reliable risk system.

In all this, Thalex also offers a unique method to reduce the expenses of trading for participants thanks to an internal “Market Quality” program.

Any trader who adds liquidity and contributes to the quality of the contracts traded and the success of the platform will receive exclusive rewards.

In the same way under the “Market Velocity” program, the most active users will receive rewards based on trading volumes and fees paid.

We remind you that this news follows the completion of a series of private tests where both live trading options and paper trading options were tested.

The collaboration between Bitfinex Derivatives and Thalex is expected to foster significant growth in the bull and bear markets of crypto options and expiring futures.

These markets, despite offering a degree of complete and professional operation, are often overlooked by users of the crypto world and remain underutilized.

The crypto derivatives market: a look at options and futures

After the latest announcement from Bitfinex, we cannot overlook the landscape of the crypto derivatives markets. First, we distinguish between those types of platforms that offer futures and perpetual products and those that offer exposure to options.

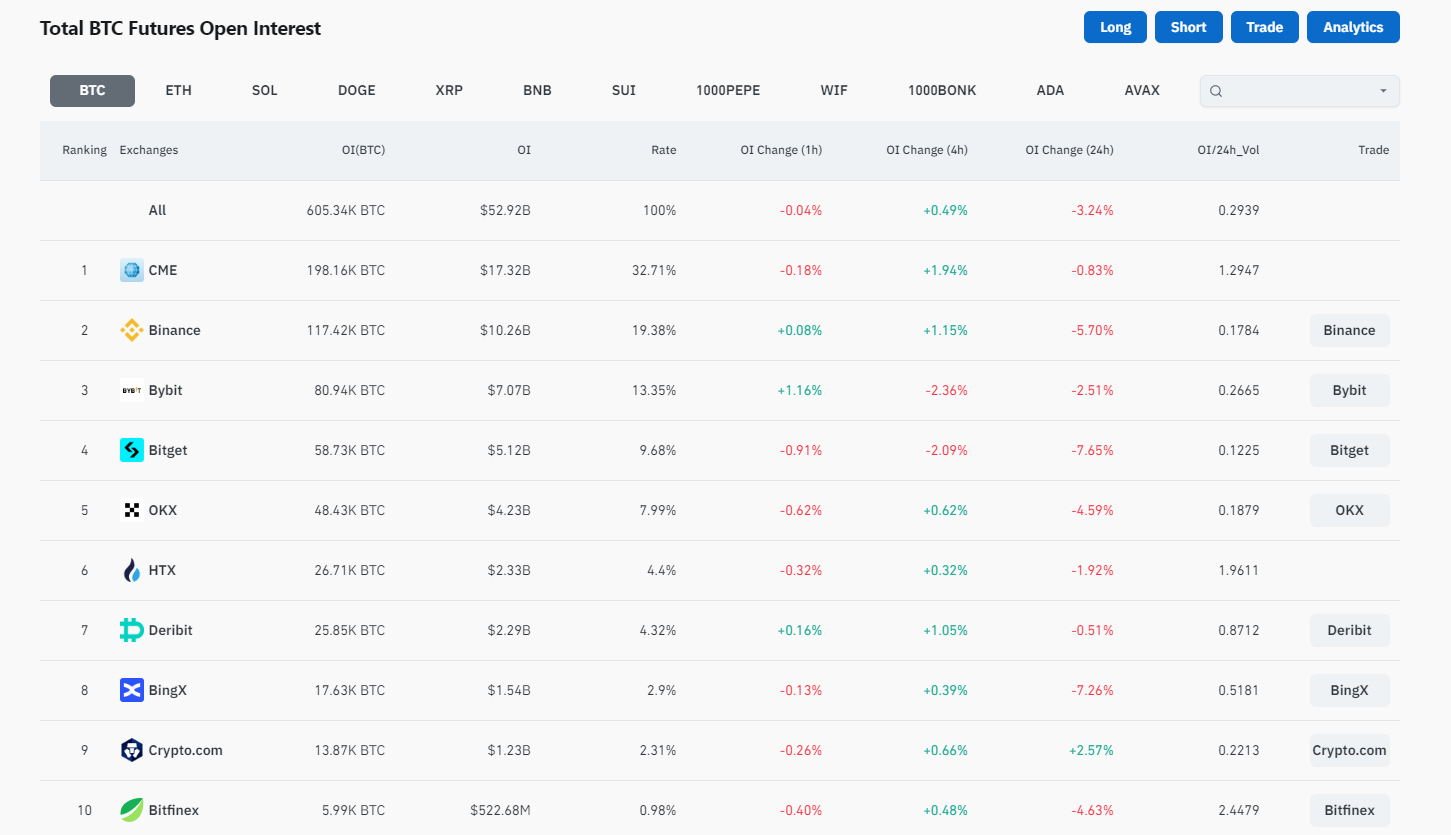

Regarding the trading of Bitcoin futures, we observe from Coinglass data that the CME represents the largest market in terms of open interest.

The Chicago exchange currently has open positions for a total of 198,160 BTC, almost a third of the total size of the bull sector.

Next, we find the crypto exchange Binance with an open interest of 117,420 BTC and the competitor Bybit with 80,940 BTC.

Completing the scenario are the brokers Bitget, Okx, Htx, Deribit, Bingx, and Crypto.com.

Bitfinex is in the tenth position in the ranking, with just 6,000 BTC in open futures positions, demonstrating its current low appeal for traders.

Thanks to the integration of Thalex, it is possible for the platform to partially climb the rankings and attract new exchanges.

Source: https://www.coinglass.com/BitcoinOpenInterest

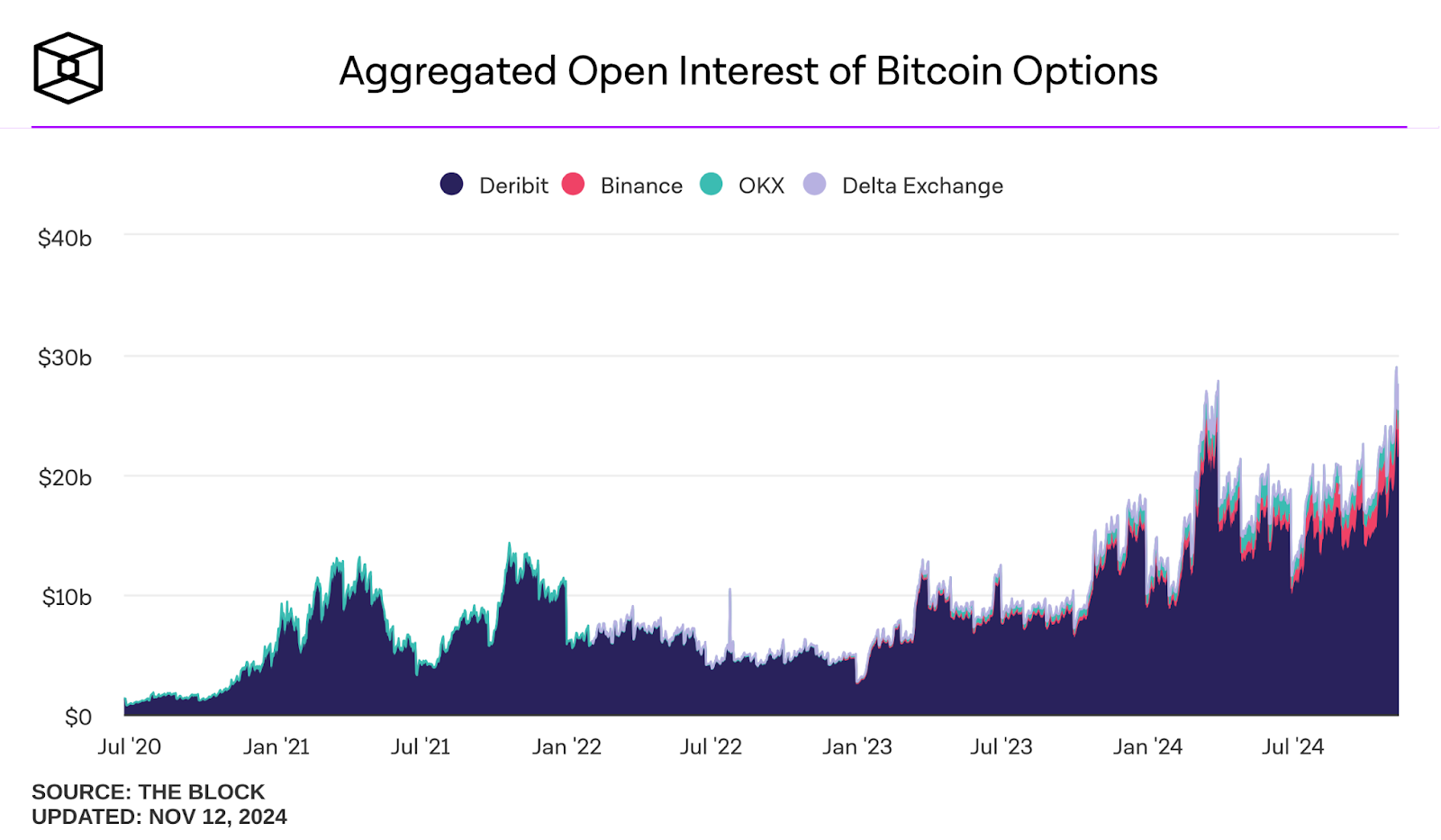

On the front of options, however, the outlook is completely different.

The Derbit platform reigns supreme in the world of Bitcoin options boasting a market share of 84% according to data from The Block.

Currently, of the 33 billion dollars in open positions, Deribit manages about 27.5 billion, highlighting the immense size of its market.

In second place we still find Binance, which controls options for 2.5 billion dollars, equal to 9% of the overall market share.

Closing the podium is the exchange Okx, with 2.2 billion dollars of open interest, equal to 7% of the market share.

Bitfinex does not yet offer options to its users.

[ad_2]