BITF has taken off and the momentum isn’t fading. Is there a development the market’s quietly pricing in? Or is it time to re-rate the stock altogether?

The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies.

Bitfarms Stock Surges – Re-Rating Phase Next?

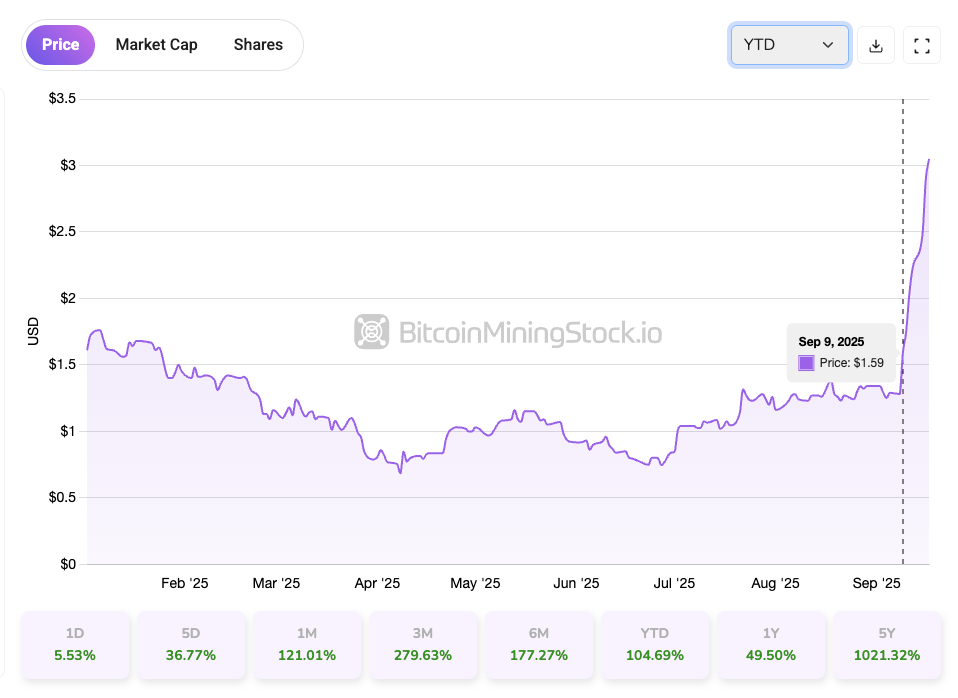

Bitfarms (Nasdaq: BITF) closed last week as the top-performing Bitcoin mining stock tracked by BitcoinMiningStock.io, posting a stunning 72.86% gain over a 5-day trading period. The rally began around September 9th and shows little sign of slowing at the time of writing. Notably, this run-up occurred in the absence of any company news release announcements. Instead, investor sentiment seems to have been driven by a renewed understanding of Bitfarms’ business transformation, amplified by CEO Ben Gagnon’s presentation at the H.C. Wainwright 27th Annual Global Investment Conference.

While the presentation wasn’t widely broadcast, investor discussion on X picked up pace and social feeds became noticeably more bullish on BITF. For those familiar with my December 2024 report, this marks a shift. Back then, I wrote:

“While Bitfarms’ financial and operational strategies are aligned with industry trends, the company struggles to stand out due to a lack of a clear, unique competitive advantage.”

Nine months later, it seems that the company has found an edge – to become a North American energy and compute infrastructure company. And this evolving strategy is finally getting investor attention.

So I want to go back to the fundamentals of Bitfarms’ recent developments, and determine whether it’s time to re-rate the stock.

What Bitfarms’ CEO Said at the H.C. Wainwright Conference

At the H.C. Wainwright event, Gagnon positioned Bitfarms as a future “North American energy and compute infrastructure company.” He framed the company’s 18 EH/s Bitcoin mining operation as a “low-cost bridge financing tool” to support its transition into HPC and AI infrastructure. While mining still covers all operating expenses and contributes to capex, no further miner purchases or fleet expansions are planned. Instead, the existing fleet, benefiting from low-cost electricity and high operational efficiency, is expected to generate stable free cash flow through 2026 under most BTC pricing scenarios. In short, Bitfarms intends to unlock the potential of its energy portfolio, once built to support mining, to serve the emerging HPC/AI market.

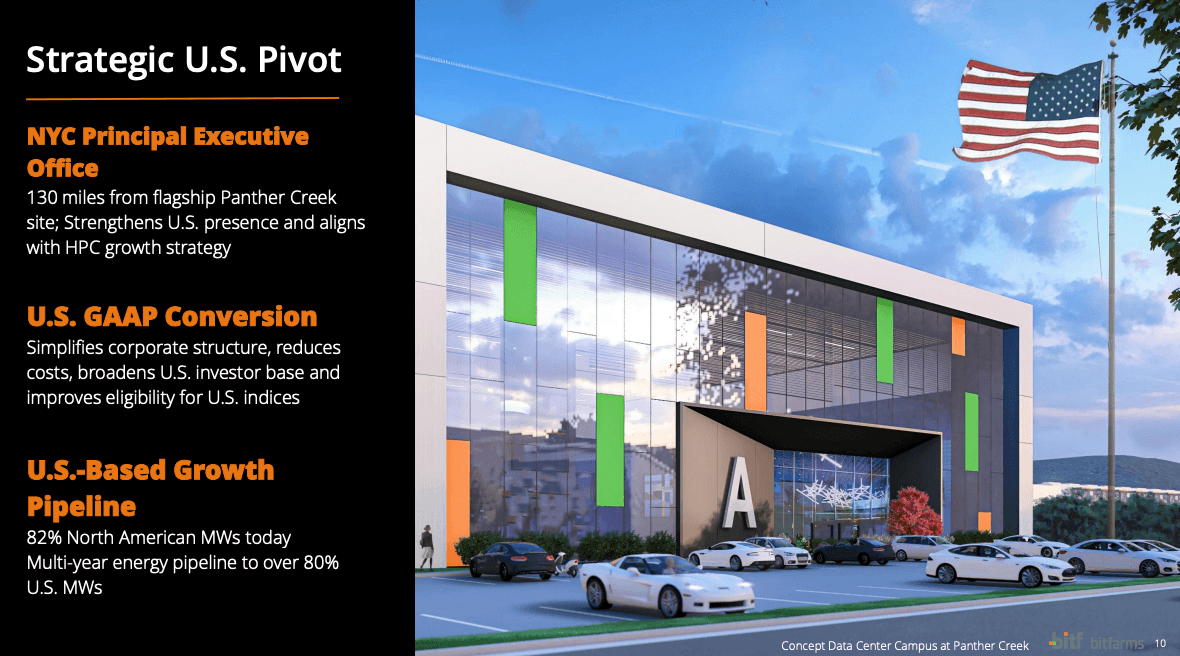

Bitfarms’ geographic footprint has also shifted to support this strategy. When Gagnon became CEO, just 45% of the company’s footprint was in North America. Today, that number stands at 82%, with nearly all future growth concentrated in the U.S. The eventual exit from Latin America, particularly Argentina, by November 11, 2025, marks a decisive pivot toward becoming a U.S.-focused platform.

Screenshot from Bitfarms presentation.

In North America, the company now has a 1.2 GW power pipeline. Key sitesinclude Panther Creek in Pennsylvania, its established operations in Quebec, and a growing footprint in Washington state. These sites are located near major fiber optic corridors, enabling them to support data center workloads across North America and potentially across the Atlantic. With favorable power economics and improved Power Usage Effectiveness (PUE), Bitfarms believes it can deliver higher compute yields per megawatt which gives a critical edge in HPC markets.

This evolving narrative of mining today, infrastructure tomorrow, is aligned with investor sentiment. Markets are showing a clear preference for long-term, stable revenue from AI infrastructure hosting.

Bitfarm’s HPC Development: Hype or Real Progress?

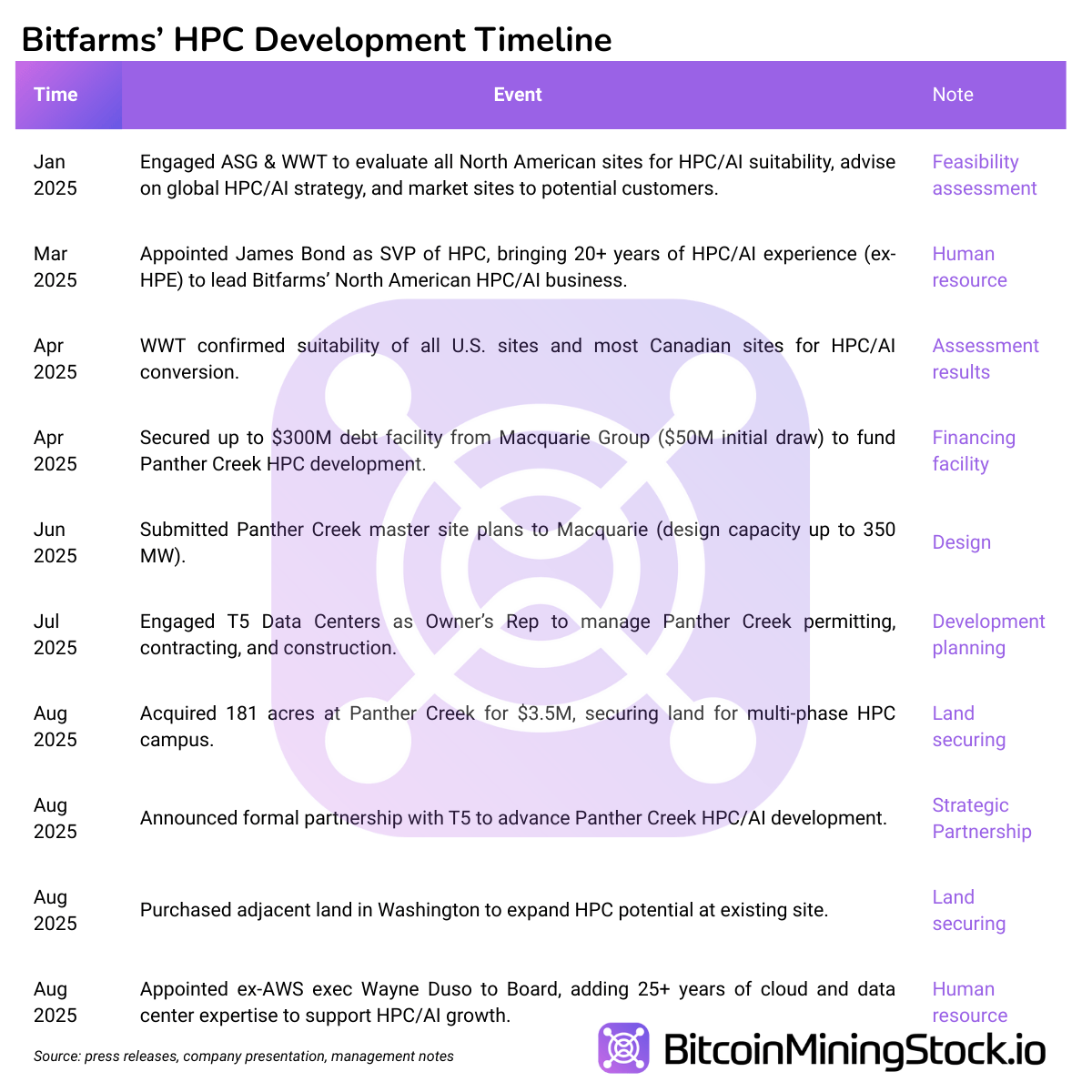

Bitfarms’ HPC development is beginning to take tangible shape, though it remains in the early stages. Over recent quarters, the company has initiated site-level feasibility assessments, secured permits and capacity, strengthened its team with relevant expertise and established strategic partnerships to market the sites to potential customers.

To the surprise of many, even the long-criticized Stronghold acquisition, once deemed as overpriced, has turned out to be a strategic asset. The acquisition provided Bitfarms with a large, scalable footprint in Pennsylvania, an emerging hub for AI and HPC data center development. This increases the chances of the company to attract future AI and HPC clients.

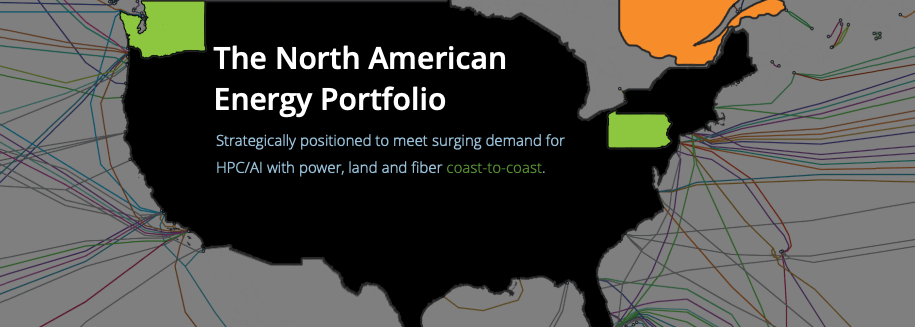

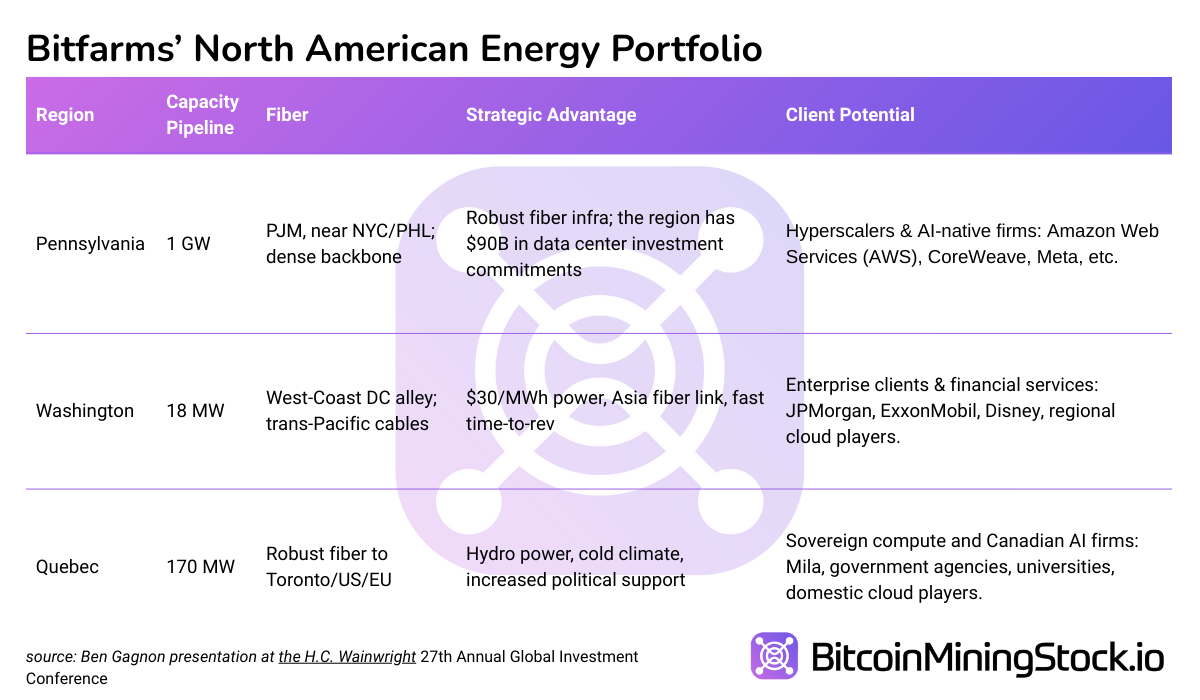

In fact, Pennsylvania, part of the PJM interconnection, is now Bitfarms’ primary region for AI/HPC buildout (the company has a 1 GW energy pipeline there). According to its latest investor presentation, Bitfarms is positioned to meet surging HPC and AI demand with coast-to-coast infrastructure: east (Pennsylvania), west (Washington) and north (Quebec).

Screenshot from the Bitfarms’ presentation.

Together, these fiber connected sites enable Bitfarms to serve latency-sensitive workloads on both U.S. coasts and link them with Europe. This networked architecture is a key differentiator as the company pivots toward HPC infrastructure.

The following table summarizes the characteristics of each region:

In short, Bitfarms has laid meaningful groundwork for its HPC and AI pivot, but the initiative remains firmly in the pre-commercial phase. The next few quarters will be critical in determining whether this strategy matures into a scalable revenue engine, or instead becomes a capital-intensive distraction that strains the balance sheet without near-term payoff.

Financing the Pivot

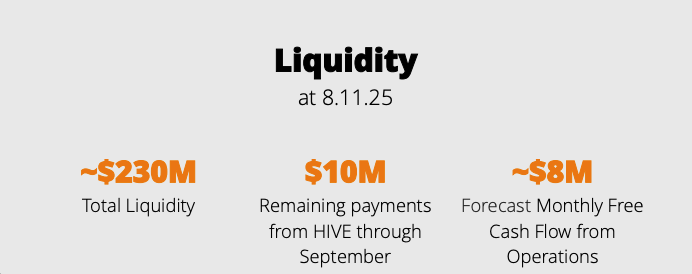

Bitfarms is financing its transition to HPC through a combination of internal cash flow, asset optimization, and a new credit facility. Its 17.2 EH/s mining fleet generates ~$8M/month FCF under the current market. Management continues to sell Bitcoin to fund capex and opex while still holding 1,005 BTC on their balance sheet. Bitfarm’s exit in Argentina by November 11, 2025 will unlock approximately $18 million through lease releases, liability reductions, and the sale of recently imported S21+ miners.

As of August 11, the company held ~$230 million in liquidity (cash plus unencumbered BTC), with an additional ~$10 million expected from the Yguazu/HIVE sale and pending miner sales.

Bitfarms Liquidity Position (screenshot from the company presentation).

In addition, Bitfarms secured a up to $300 million credit facility from Macquarie to fund its Panther Creek site. The first $50 million has been drawn to support early development, with the remaining $250 million available in tranches tied to construction milestones. Upon activation, the structure converts to non-recourse project debt. The facility carries an 8% interest rateand includes warrant coverage, $25 million minimum cash requirements, and BTC-price-linked covenants. The next tranche is expected in Q4 2025, contingent on permitting progress.

While such a funding structure preserves flexibility and limits dilution, it has a timing gap to manage. HPC revenue remains quarters away (potentially mid-2026 or later). Meanwhile, peers like Core Scientific, TeraWulf, Applied Digital are already onboarding clients. Execution speed, cost control, and customer acquisition will be critical to closing the gap.

Final Thoughts

Bitfarms is actively pivoting from a global Bitcoin miner to a North American energy and compute infrastructure company. Its U.S. sites are near major fiber lines, giving them the technical viability to support AI hosting workloads from coast-to-coast* and even, hypothetically, to Europe due to low power costs and favorable geolocation.

*While “coast-to-coast” reach sounds compelling, some grounded perspective is needed: Bitfarms’ West Coast presence in Washington only has 18 MW of capacity, which is well below the typical 100+ MW size seen in previous HPC colocation deals. Its North (Quebec) sites, while sizable, are subject to regulatory approval before being repurposed for HPC workloads. That leaves the East (Pennsylvania), with sites like Panther Creek, as the company’s only HPC-ready asset with clear roadmap for now.

That said, the transition is early. The company has yet to have any purpose built data center ready or land a material HPC deal. Until then, much of the upside remains aspirational. But insider behavior adds some confidence: the company initiated a share buyback program and CEO Ben Gagnon has increased his personal holdings.

For investors with a 12-24 month horizon and appetite for early-stage infrastructure growth at deep-value entry points, Bitfarms may now present an asymmetrical opportunity. Its developments, from senior hires to fiber-ready properties and staged financing, offer tangible reasons to revisit the thesis.

Ultimately, it’s your call whether to re-rate the stock. But if Bitfarms delivers on even part of its infrastructure narrative, the upside case could look quite different from the typical Bitcoin mining play.