The Crypto Fear & Greed Index stays in the “greed” zone.

Key Takeaways

- Bitcoin’s ascent over $69,000 marks a new high, influencing a broad market rally.

- The rally is driven by heightened institutional interest and positive regulatory developments.

Bitcoin is back in the spotlight after breaking past $69,000 on Sunday. The latest rally has ignited a broad-based rally across the crypto market with altcoins moving higher over the last 24 hours.

The flagship crypto has risen almost 2% in a day, now trading at around $69,400, CoinGecko data shows. It seems poised to hit $70,000 amid ongoing market optimism as the Crypto Fear & Greed Index, which analyzes market participants’ sentiments, stays in the “greed” zone.

Bitcoin’s strong performance has inspired a rally across the broader market. Several altcoins, which began their ascent yesterday, have continued to post gains, while the majority are now mirroring Bitcoin’s upward trajectory.

ApeCoin (APE) is the biggest winner in the last 24 hours, rising over 60%. The surge comes after the launch of ApeChain, a new layer 3 blockchain developed by the ApeCoin DAO. Not only does the launch boost APE’s price but it also triggers an increase in its market volume, which saw a nearly 3000% increase, breaking the $1 billion mark.

Ethereum (ETH), the second-largest crypto asset, put in gains of 4% after conquering the $2,700 mark on Saturday, data shows.

Ethereum layer 2 tokens have also witnessed a substantial surge in the past 24 hours. Optimism (OP), Arbitrum (ARB), and Starknet (STRK) each rallied by more than 8%. Immutable (IMX) saw a 6% increase, while Polygon rose by 4%.

Apart from Bitcoin and Ethereum, top coins like Binance Coin (BNB) and Solana (SOL) have also made major strides. BNB reclaimed the $600 mark while SOL soared to $170.

Tokens in the artificial intelligence field, one of the most promising catalysts this season, are again in the limelight. Bittensor (TAO) is leading the AI tokens, soaring 7% to $600 during the day.

The widespread crypto rally has boosted the total market cap to $2.5 trillion, up 1% in the last 24 hours.

Bitcoin chases new highs ahead of the US presidential election

According to Standard Chartered, Bitcoin may revisit its previous all-time high of $73,800 before the next US president is selected. The bank expects Bitcoin’s price to surge as institutional interest in Bitcoin ETFs grows and Donald Trump’s election odds improve.

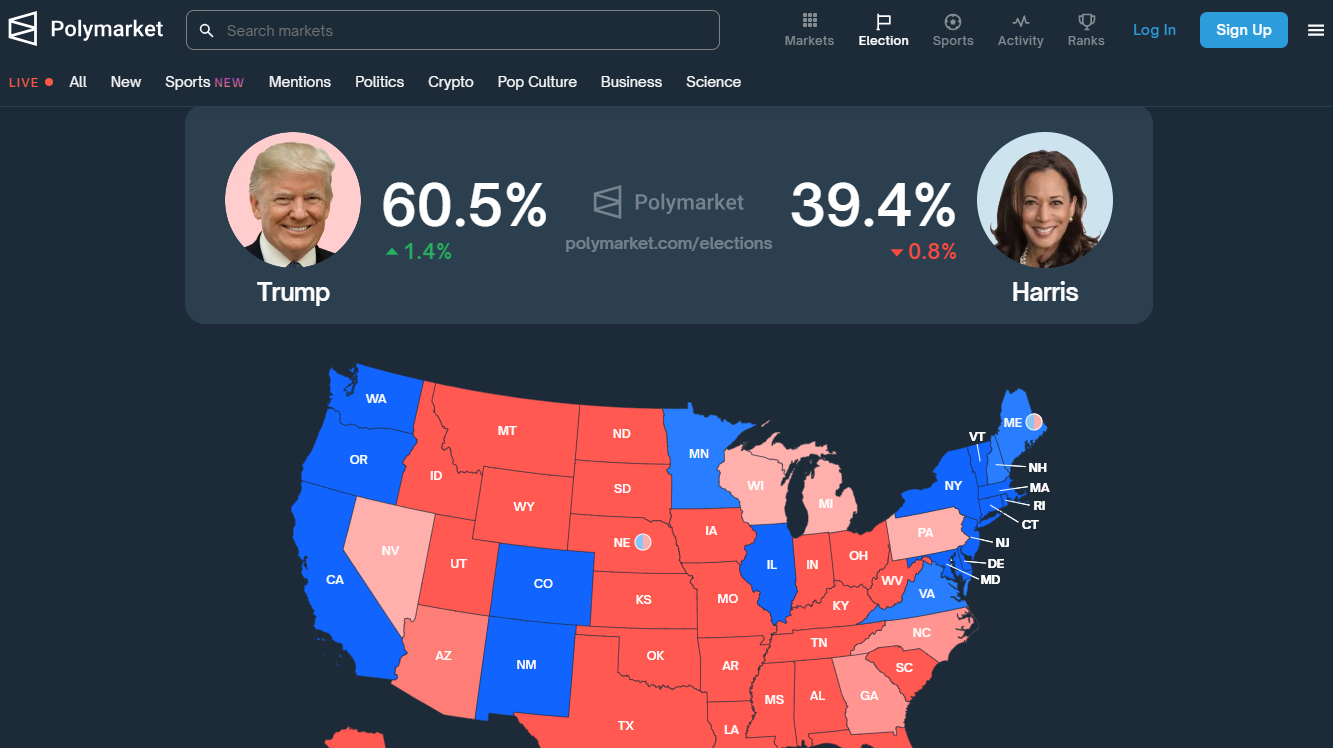

Data from Polymarket indicates that traders prefer Trump to Kamala Harris for the next American president. Trump currently leads the poll with over 60% chance while Harris’ odds are around 39%.

Bitcoin’s value could increase in the near term if Trump wins, Standard Chartered suggests. Trump has departed from his previous anti-crypto stance and positioned himself as one of the most pro-crypto candidates, while Harris has just begun to show her support.

Bitwise CIO Matt Hougan also sees the upcoming election and strong ETF demand, coupled with other key factors like increased whale accumulation, reduced supply post-halving, and global economic factors, as bullish catalysts for Bitcoin’s price actions.

As of October 20, US spot Bitcoin ETFs have logged over $21 billion in net inflows—a milestone that took gold ETFs years to achieve.