[ad_1]

This is a segment from the Supply Shock newsletter. To read full editions, subscribe.

Bitcoin’s first Ponzi scheme was nothing special — but it was early.

After the 1906 inception of the international reply coupon, it took 14 years for Charles Ponzi to come along with his legendary scheme, which he peddled across Boston society to the tune of $20 million at the time ($319 million in today’s money).

Meanwhile, it only took Trendon Shavers, aka Pirateat40, less than three years to pull off something similar on the Bitcoin blockchain: Bitcoin Savings & Trust.

On This Day – Bitcoin Savings & Trust

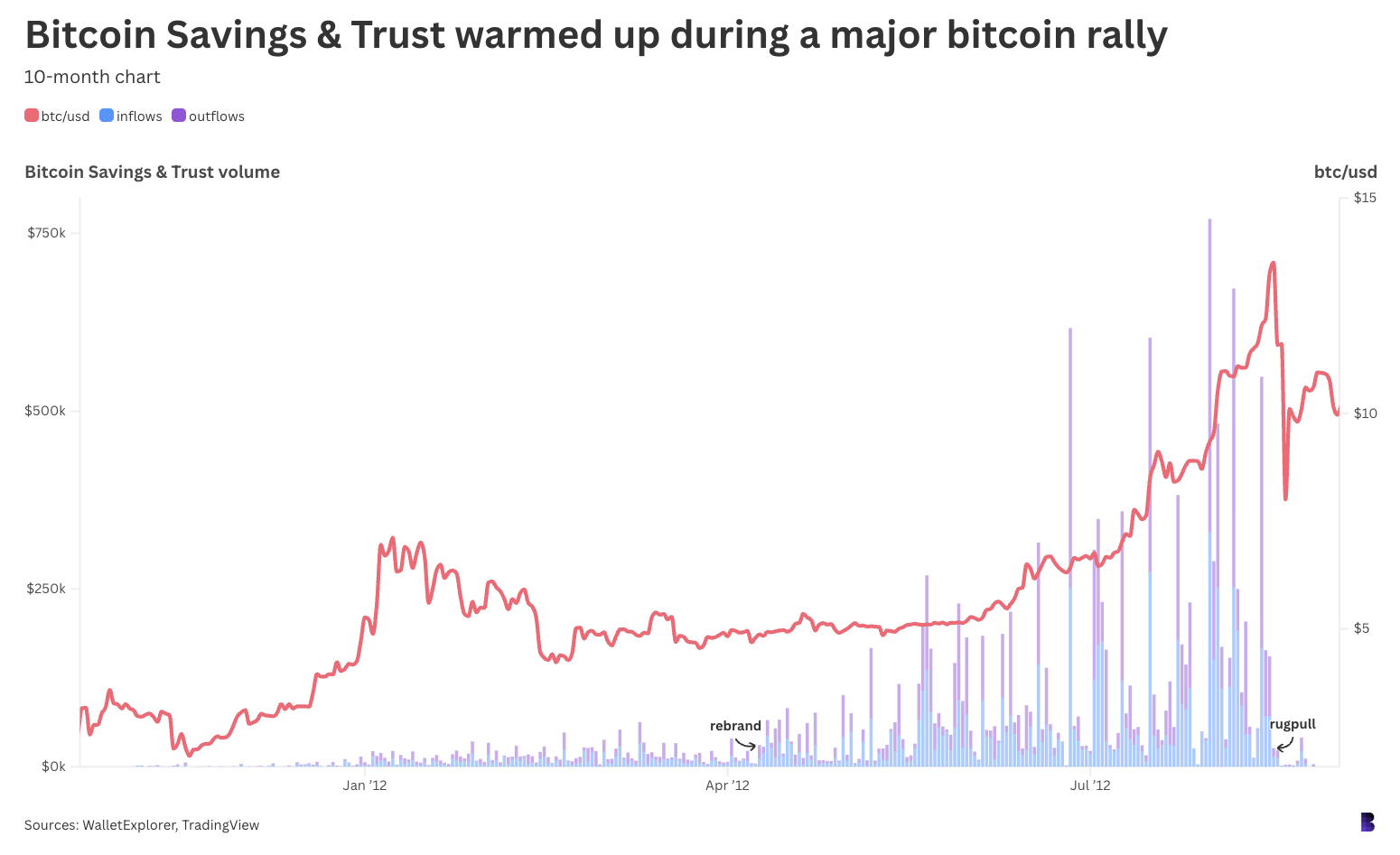

Shavers originally launched the scheme as First Pirate Savings & Trust in November 2011, having cultivated an online persona of a savvy over-the-counter bitcoin trader in IRC channels and on Bitcointalk.

Bitcoin had opened the year at $0.30, hit $30 in June, and had since settled at around $3. Shavers’ supposed OTC desk was now running dry, with requests for more coins only “getting larger and more frequent.”

“Over the last few months I have been selling BTC to a group of local people,” Shavers wrote in his launch post. “Now this is a ‘don’t ask don’t tell’ group of people, so I can’t tell you exactly where and to whom the coins ultimately end up with, but so far it’s been pretty painless.”

To help source liquidity, he devised two ways to inspire early adopters to send him their bitcoin, starting at a minimum of 50 BTC ($150 then, $4 million now).

- The “on-demand” tier would pay a 3.5% fee for filling buy orders over what the desk has available.

- The “storage” tier would pay 1% per day for bitcoin sent to First Pirate Savings & Trust, with a promise that “you can withdraw your balance at any time.”

As was the case with the original Ponzi scheme, initial inflows were rather small, only $60,000 in total over the first two months.

But after rebranding it to “Bitcoin Savings & Trust” on this day in 2012 (with a new website) Shavers’ wallets saw that much on an average day, despite repeated warnings of the community, including from Vitalik Buterin.

Bitcoin’s push to $15 was interrupted by Bitcoin Savings & Trust’s sudden closure, but BTC quickly rebounded.

Just like the real Charles Ponzi almost a century earlier, Shavers never really did any of what he said. To go back in time a bit: Ponzi had promised up to 100% returns to investors who’d backed his wacky plan to arbitrage postage stamps between Italy, where they were cheap in the wake of World War I, and the US, where they were still expensive.

Ponzi couldn’t actually redeem his stamps for cash, or ship enough of them from Europe in any case. Still, he easily paid out interest with the waves of fresh capital, splitting the difference with a mansion, luxury car and a honeymoon vacation. Ponzi was sentenced to five years in prison.

Similarly, Shavers was simply selling coins to cover rent, car payments, shopping and casino gambling. Both plans were over and done in under 12 months.

Shavers’ username is a reference to a Jimmy Buffett song, “A Pirate Looks at 40,” which laments about a man born too late in history to get away with adventurous crimes.

The Feds calculated that Shavers, drawing from about 100 investors, had siphoned 193,000 BTC for himself, worth up to $1.5 million back then and $16 billion today (coincidentally similar to the BTC supposedly held by the US government). He was fined $40 million and sentenced to 18 months in prison.

Look onchain and you can still spot the robbing of Bob to pay Alice: On every other day, total flows for Shavers’ wallets would be divided fairly evenly between inflows and outflows. Coins in from new investors, coins out to older ones.

And you can still see almost 1.18 million BTC flowing through wallets linked to Bitcoin Savings & Trust in its short history — the equivalent of around 10% of the entire circulating supply at the time.

At risk of searching for a silver lining in the fraud, there’s this: Whereas actual physical records of Charles Ponzi’s scheme are presumably long gone, we’ll at least forever have a perfect account of Bitcoin’s first-ever imitation.

[ad_2]