Bitcoin is stepping beyond its role as a store of value and into DeFi. BTCFi is bringing lending, staking, and yield opportunities directly to the Bitcoin network without middlemen. This shift not only unlocks new financial use cases for Bitcoin holders but also helps secure the network by keeping miners incentivized.

To understand where BTCFi stands today and where it’s headed, BeInCrypto spoke with industry leaders from 1inch, exSat, Babylon and GOAT Network. They shared insights on the current landscape, key challenges, and what’s needed for BTCFi to reach its full potential.

Key trends and explosive growth in 2024

The year 2024 marked a pivotal period for BTCfi, characterized by remarkable growth metrics. According toDefiLlama, the Total Value Locked (TVL) in Bitcoin-based DeFi protocols experienced an unprecedented surge, escalating from $307 million in January to over $6.5 billion by December 31, 2024, a staggering increase of more than 2,000%. This surge reflects a burgeoning interest and confidence in Bitcoin’s DeFi capabilities.

Source: DefiLlama

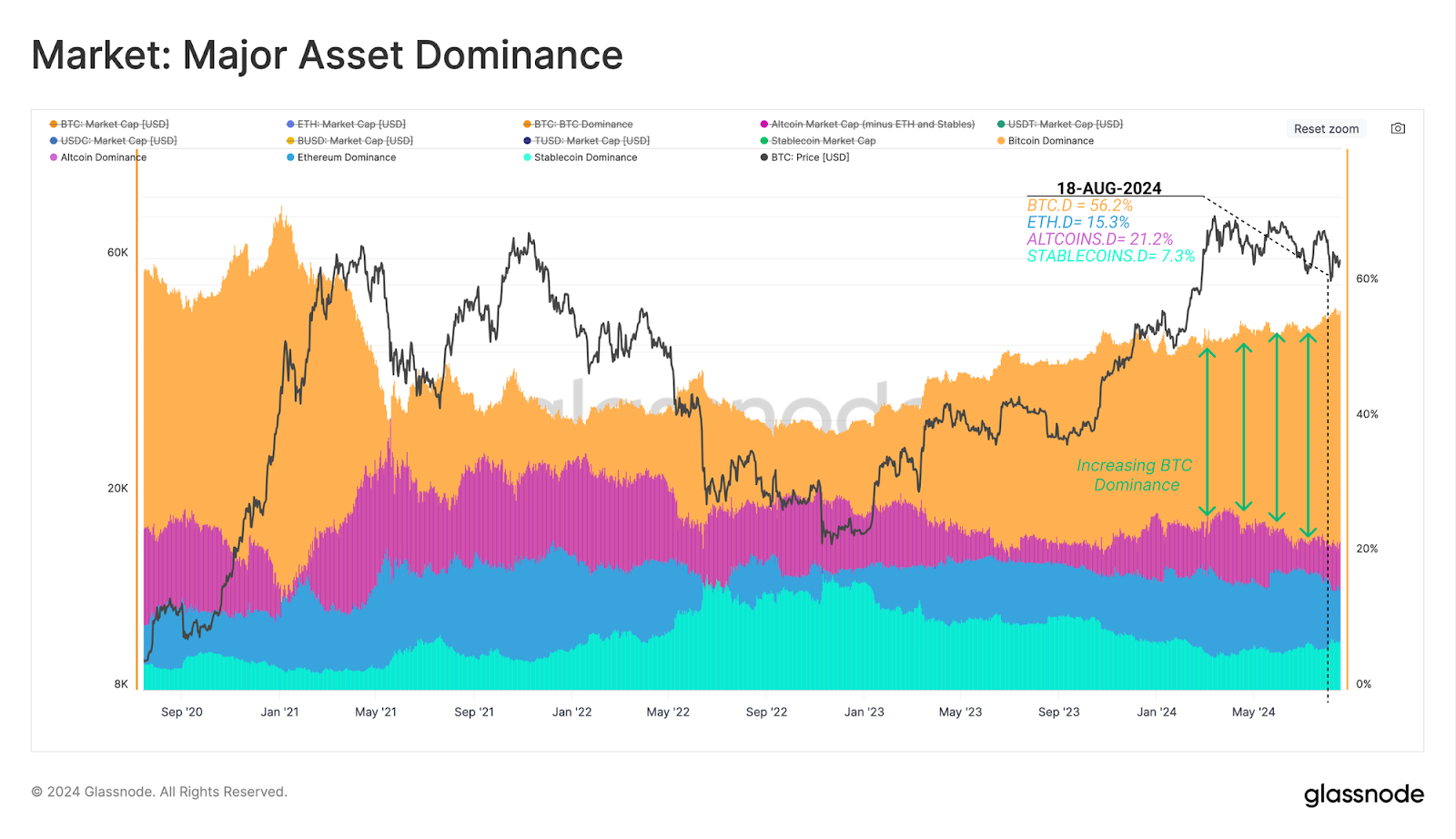

BTCFi’s growth is driven by a mix of institutional adoption, market performance, and technological advancements. The approval of Bitcoin ETFs has fueled institutional interest, pushing BTCFi’s total value locked (TVL) higher. Major exchanges like Binance and OKX are integrating BTCFi services, improving accessibility and liquidity. Bitcoin’s strong market performance, hitting an all-time high of $108,268 in December 2024 before closing at $93,429, has further boosted confidence.

Source: Glassnode

At the same time, innovations like Bitcoin-native assets, wrapped BTC, and staking solutions are expanding Bitcoin’s role in DeFi. Projects such as exSat, GOAT Network, Babylon and 1inch are leading the way with new protocols that enhance Bitcoin’s DeFi potential.

As BTCFi continues to evolve, one fundamental truth remains unchanged – demand for Bitcoin itself. Kevin Liu, co-founder of GOAT Network, encapsulates this sentiment: “All of us want more BTC, because it’s the king of all tokens. Whichever projects succeed in delivering real BTC yield will flourish, because they’re giving people exactly what they want. This is true now, and it will be true 3-5 years from now.”

The Impact of U.S. Political Decisions on BTCFi

Although Donald Trump’s announcement of a US Crypto Reserve featuring XRP, Cardano, and Solana triggered a massive surge in their prices, Bitcoin remains the world’s largest and most sought after cryptocurrency. However, the passive holding of this “digital gold” is gradually falling out of favor as market dynamics evolve.

Shalini Wood, CMO of Babylon, captures this shift, stating: “We’re seeing a shift where Bitcoin is no longer just something you HODL. Innovations in Bitcoin staking, lending, and trustless interoperability will define the next wave of BTCFi. BTCFi will evolve beyond traditional DeFi models, leveraging Bitcoin’s security to support sovereign applications, cross-chain liquidity, and more scalable, trust-minimized financial products. The goal is to carve out a distinct, Bitcoin-native approach that enhances security and decentralization across the entire crypto ecosystem.”

Tristan Dickinson, CMO exSat Network: “Enabling Bitcoin yield and DeFi-based strategies without sacrificing control of native Bitcoin is crucial. Bitcoin has fulfilled its original purpose as a store of value, evolving it into a tool for value creation requires meeting some very specific criteria: preserving native Bitcoin security, ensuring interoperability between ecosystems, and supporting complex smart contracts.

At the same time, regulatory developments in the U.S. are reshaping the BTCFi landscape. The prospect of a government-backed Bitcoin reserve lends legitimacy to BTC as a financial asset, potentially attracting institutional investors. However, as Sergej Kunz, co-founder of 1inch, points out, regulation remains a double-edged sword: “Some policies support innovation, while others could tighten controls on BTCFi. Clear regulations on existing DeFi and smart contracts will be crucial for its growth.”

The next phase of BTCFi will be defined by the balance between innovation and regulation. While Bitcoin’s decentralized nature makes it resistant to government interference, regulatory clarity could provide the stability needed for mainstream adoption. The question remains — will policymakers embrace BTCFi as a transformative financial force, or will they attempt to contain its potential?

How Much Starting Capital Do You Really Need?

The world of Bitcoin Finance (BTCFi) is evolving rapidly, offering opportunities for both institutional investors and everyday users. But how much capital do you actually need to get started?

Shalini Wood, emphasizes that “BTCFi is not just about individual participation—it’s about unlocking capital efficiency for Bitcoin at scale. BTCFi is designed to maximize security and reward opportunities while keeping Bitcoin’s core principles intact.” Platforms like Babylon, which holds “$4.4 billion in Total Value Locked (TVL),” are driving liquidity and accessibility.

One of the most significant advantages of BTCFi is its accessibility. Traditional finance often has high entry barriers, requiring investors to put down substantial capital to participate in meaningful ways. In contrast, BTCFi allows users to start with much smaller amounts, thanks to the efficiency of Bitcoin sidechains and second-layer solutions.

Sergej Kunz, highlights this shift, stating that “BTCFi platforms have low entry barriers, with some allowing participation with as little as $100 thanks to Bitcoin sidechains like Rootstock and Lightning-based protocols.” This means that retail investors, who may have previously been excluded from financial opportunities, can now leverage Bitcoin’s growing DeFi ecosystem without needing deep pockets.

This low entry threshold is particularly important in regions where traditional banking infrastructure is weak or inaccessible. BTCFi can provide people in emerging markets with new ways to save, earn yield, and access financial services without relying on intermediaries.

Kevin Liu, explains this philosophy: “The best BTCFi solutions won’t require users to be whales; rather, they’ll give both whales and guppies the opportunity to earn real BTC yield. A well-designed BTCFi-focused ecosystem will allot the exact same annual returns (by percentage) to a user who stakes $1 million, vs. another who stakes $100.”

This principle is crucial because it aligns with Bitcoin’s original ethos of financial fairness and open participation. In a world where traditional financial products often favor the wealthy with better interest rates and lower fees, BTCFi is aiming to level the playing field.

Ultimately, whether you’re a small investor or a deep-pocketed institution, BTCFi platforms are increasingly designed to accommodate all levels of participation, ensuring that Bitcoin’s financial ecosystem remains open and rewarding for everyone.

BTCFi: A Gateway to Earning Without Leaving Bitcoin

With the rise of Bitcoin Finance (BTCFi), crypto users now have more ways to earn from their BTC without relying on centralized platforms. “BTCFi is becoming more accessible, enabling users to lend, stake, and trade BTC without relying on centralized platforms,” explains Sergej Kunz. While APR programs and staking options on Ethereum or Solana may offer higher yields, he notes that “BTCFi allows users to earn on BTC without leaving the Bitcoin ecosystem, making it a strong alternative for long-term holders.”

Tristan Dickinson, highlights the rapid expansion of Bitcoin’s Layer 2 ecosystem: “Today, there are over 70+ Bitcoin L2 projects working to expand access to and from the Bitcoin ecosystem, but the ecosystem is immature. Basic DeFi instruments like staking are emerging, yet only a few players, maybe three to five, offer true staking with token and APY programs.”

He emphasizes that Bitcoin DeFi is on an inevitable growth trajectory: “First comes staking, then re-staking, followed by diversified yield, collateralized lending and borrowing, and eventually an explosion in structured financial products. Some projects are leading, others are following.”

exSat’s approach aims to accelerate this evolution by mirroring Bitcoin’s data while integrating it with DeFi innovations. “Creating a mirrored version of Bitcoin with identical (UTXO) data and similar partners is the first true scaling solution for the ecosystem. Combining the best parts of Bitcoin with the most powerful elements of DeFi is the only path to meaningful BTCFi growth,” Dickinson concludes.

As BTCFi continues to mature, its ability to offer decentralized yield opportunities without compromising Bitcoin’s core principles is positioning it as a compelling alternative for long-term BTC holders.

Kevin Liu, highlights the growing divide in user behavior: “We’ll likely see growth in both groups – people who simply buy BTC on centralized exchanges and either leave it alone or maybe ape into limited-time APR promotions on those CEXes, and people who watch centralized exchanges get hacked and/or appreciate the power of ‘not your keys, not your coins’ and thus seek out decentralized options.” As Bitcoin adoption increases, Liu predicts that more users will explore BTCFi solutions to generate yield without handing control of their assets to centralized exchanges.

With Bitcoin remaining “the single most powerful asset since it came into existence 16 years ago,” BTCFi is poised to attract both casual holders and those seeking decentralized earning opportunities, helping drive mass adoption in the process.

BTCFi vs. DeFi on Ethereum and Solana: Key Differences and Similarities

As Bitcoin Finance (BTCFi) continues to evolve, it is increasingly compared to the established DeFi ecosystems on Ethereum and Solana. While all three aim to provide financial opportunities beyond traditional banking, they differ in design, security, and user experience.

Ethereum has long been the dominant force in decentralized finance, known for its robust smart contract capabilities and extensive range of DeFi applications. “Ethereum has encouraged smart contract development and as many DeFi use cases as you can possibly imagine,” explains Kevin Liu. The ecosystem has fostered innovations in lending, automated market-making, and derivatives, making it the go-to platform for developers experimenting with new financial models. However, Ethereum’s strengths also come with challenges, high gas fees and network congestion can limit accessibility for smaller investors.

Solana, on the other hand, was designed with speed and efficiency in mind. Its high throughput and low fees make it an attractive choice for retail users and traders looking for fast execution times. “Solana stands out for its speed and low fees,” notes Sergej Kunz. This efficiency has allowed Solana’s DeFi ecosystem to flourish, with platforms like Raydium, Jupiter, and Kamino providing seamless trading and yield farming experiences. However, the trade-off comes in the form of higher hardware requirements for validators and periodic network outages, which have raised concerns about decentralization and stability.

Bitcoin, in contrast, follows a fundamentally different philosophy. It prioritizes security and decentralization above all else, which historically limited its ability to support complex smart contracts. “BTCFi is built on Bitcoin’s battle-tested PoW security, ensuring minimal trust assumptions and censorship resistance,” says Shalini Wood. Rather than trying to replicate Ethereum’s DeFi model, BTCFi is developing its own distinct approach, leveraging Bitcoin’s unparalleled security while introducing financial applications tailored for BTC holders.

“THORChain, Sovryn, and Stackswap are among the projects offering native BTC DeFi solutions, bridging the gap between Bitcoin’s security and Ethereum’s programmability,” adds Sergej Kunz. These platforms allow users to engage in decentralized trading and lending while keeping custody of their Bitcoin, avoiding the risks associated with wrapped BTC on other chains. As BTCFi infrastructure matures, it is expected to carve out its own niche, the one that remains true to Bitcoin’s principles while expanding its financial utility.

In the end, while Ethereum, Solana, and Bitcoin each offer unique strengths, BTCFi is proving that Bitcoin is no longer just a passive store of value. It is evolving into a fully functional financial ecosystem, leveraging its unmatched security to create decentralized applications that don’t compromise on decentralization or trust minimization.