A notable amount of bitcoin and ether open interest is set to expire “in-the-money” on Friday, setting stage for price swings, Deribit’s Luuk Strijers said.

Options beyond the Friday expiry exhibit a bullish bias for bitcoin and ether.

BTC’s max pain level of $59,000 may weigh over prices, analyst at Presto Research said.

The bitcoin (BTC) market may get busy in the next two days as options contracts worth several billion dollars are due to expire Friday at 08:00 UTC, cryptocurrency exchange Deribit told CoinDesk in a message Wednesday.

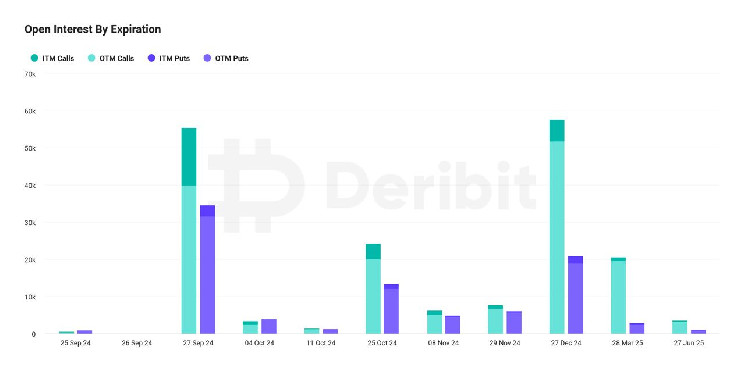

As of writing, 90,000 BTC options contracts worth $5.8 billion were due for settlement alongside $1.9 billion in ether options. One Deribit one options contract represents one BTC or one ETH. Deribit is the world’s leading cryptocurrency options exchange, accounting for over 85% of the global activity.

Of the total bitcoin open interest of $5.8 billion, about 20% was “in-the-money” or having favorable strike prices compared to the cryptocurrency’s going market rate. A similar positioning is seen in ether options. For call options, being in-the-money means having a strike price lower than the going market rate, while it’s the other way around for ITM puts. Both allow holders to exercise their right to buy or sell profitably, setting the stage for market volatility.

“Of the BTC options expiring, about 20% is in the money. This larger expiry is likely to heighten market volatility or activity as traders close or roll over their positions, which could also impact prices,” Luuk Strijers, chief executive officer at Deribit, told CoinDesk in an interview.

Rollover of positions means closing existing traders in the upcoming expiry and opening new ones in the subsequent expiries to extend the holding period. Profit-making positions are often rolled over as seasoned traders prefer to let winners run.

What next?

Activity is likely to remain robust in months ahead, as the U.S. SEC’s decision to green light options tied to BlackRock’s bitcoin ETF (IBIT) could accelerate institutional adoption.

“One of the largest potential drivers is the options on ETFs. The SEC has given its blessing, but OCC and CFTC have yet to approve it and are not likely to do so this week,” Strijers said.

The way options expiring in the coming months are priced suggests a bullish outlook.

“BTC and ETH put-call skew is negative after September expiry, which is a bullish indicator as calls are relatively more expensive than puts,” Strijers noted.

A call option provides buyer an asymmetric bullish exposure, protecting from price rallies while a put options provide insurance against market swoons.

The bullish bias in the options market is consistent with the consensus that the Fed’s renewed rate-cut cycle and similar moves from other central banks, including the People’s Bank of China, will underpin demand for bitcoin and ether. According to analysts at Birtfinex, the rally could gather pace once bitcoin tops the $65,200 level.

Max pain effect

The max pain is the price level at which option buyers suffer the most loss on expiry. A popular theory in traditional markets often cites the max pain level as a magnet while heading into the expiry. That’s because option sellers, usually large institutions with ample capital supply, trade the underlying asset to influence the spot price around the maximum pain point to inflict maximum loss on buyers.

Bitcoin’s max pain level for Friday’s expiry is $59,000.”The current max pain point of $59,000, approximately 8% below the spot price, does create some potential downward pressure as we approach expiry,” Rick Maeda, an analyst at Presto Research, told CoinDesk.

The max pain theory has been doing the rounds since 2021, although some believe the crypto options market is still relatively small to have a meaningful impact on the spot price.