[ad_1]

Yesterday, Bitcoin recorded the first correction candle after a long phase of increases that seemed unstoppable, causing liquidations on the futures markets for over 1 billion dollars.

Since this morning, prices have partially recovered from the dump, reaching above $66,500 and opening hopes for the continuation of the bull run.

Many are expecting a more pronounced reversal in the coming days, but will it really be so?

Below, analysis and forecast of future prices of the crypto.

Bitcoin rejected at all-time highs: flash crash to $59,000 and futures liquidations for $1 billion

Yesterday, Bitcoin seemed so strong that it was projected towards new historical highs, with the prices of digital gold getting closer and closer to the target of $69,000 reached only once in the past in November 2021.

Once the fateful level was reached, however, the offer really started to make itself felt, bringing prices below $67,000 in the same trading hour, and then continuing the dump in the following hours until it resulted in a flash crash collapsing to around $59,000.

Despite the fact that many market analysts predicted the possibility of a collapse of this magnitude, given the past price trends, many traders have been caught up in panic.

For European traders on Coinbase, the anxiety during the bearish maneuver was greater, so much so that Bitcoin dropped to 49,500 euros, plummeting by 23.5% in just 3 hours.

Hourly chart of Bitcoin price (BTC/USD), Coinbase market

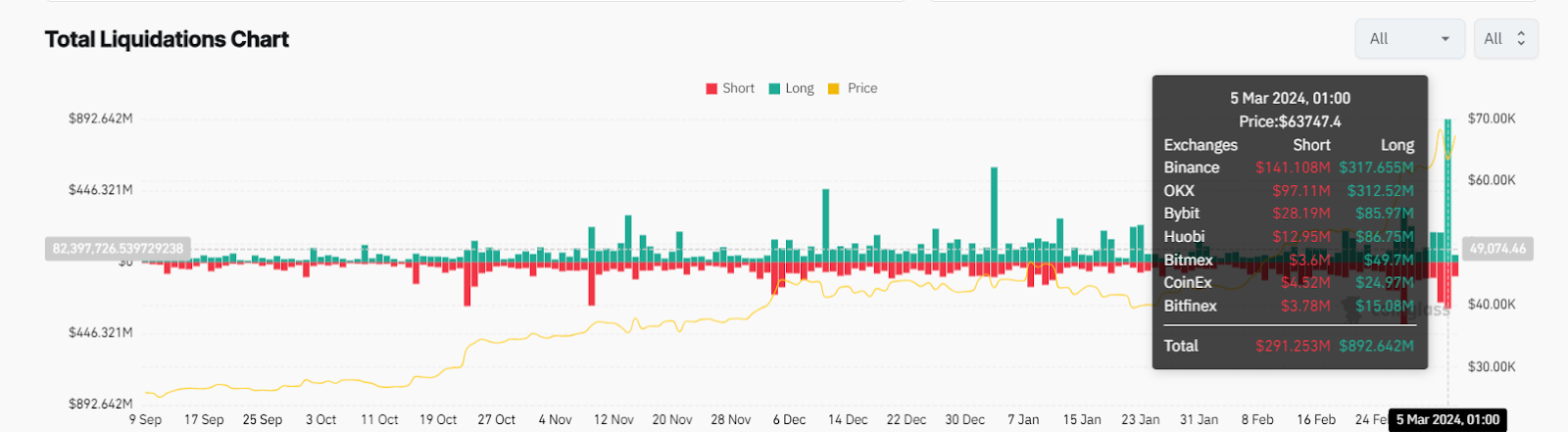

A price contraction of this magnitude triggered the liquidation of many leveraged futures positions on Bitcoin, for a total value of 1.18 billion dollars.

In particular, the long positions are 890 million dollars while the short positions are 290 million dollars.

Usually when the crypto market is “overleveraged”, it responds with candles that sweep away all the top speculators, restoring order and calm in the trading sessions.

Source: Coinglass

In yesterday’s article on liquidations, we talked about the intrinsic danger of a market with such a strong leverage demand, with the funding rate reaching up to 0.25% in some cases.

On Bitcoin and Ether we had reached above 0.1%, but already today the values have been almost halved, eliminating the market anomaly.

The longs still control the situation and are asking for most of the financial leverage from the market, but at the same time they are not as confident as they were yesterday.

Looking at the Coinalyze chart, we notice that even open interest has suffered a sharp slowdown, retracting by 2.8 billion dollars in a few hours, but immediately recovering 2 billion of lost ground and repositioning to make a new upward climb.

The volume on futures markets is up 40% in the last 24 hours, indicating strong interest in trading, amounting to 214 billion dollars according to Coinglass data.

Now the hardest part is to stay clear-headed and analyze the Bitcoin chart objectively, without being swayed by emotions and irrationality, and making a price prediction based on data.

Analysis and future price prediction: is the Bitcoin bull run already over?

After yesterday’s flash crash, several traders mistakenly shouted the end of the bull market convinced that after the outcome of a single daily candle it is possible to establish the reversal of a trend so strong that has been continuously rising since October 2023.

Although yesterday’s correction may certainly open the doors to a broader tracking phase, at the same time the medium-term bullish forecasts aiming for a clear surpassing of historical highs remain unchanged.

As long as the price of Bitcoin remains above $60,000, we find all the technical conditions necessary to continue to be bullish on the imminent future of the crypto.

The outcome of the negotiations in the coming hours will depend heavily on a possible new break of the highs or on a stagnation of prices below that figure.

In the first case, we could celebrate another bullish run, which would culminate this time in a phase of price discovery for BTC.

In the second case, however, we could expect another dump from here until the end of the week, which, however, will push down below the minimum touched yesterday with low probability.

At this point we must emphasize, to the joy of bears, that the market volumes in this post-dump phase of Bitcoin are very low, and not at all encouraging for another bullish acceleration.

If the volumes do not reach the opening of the US markets, the trend could be destined to decrease in the short term.

Anyway, the most likely forecast for the next few days is a ranging between $69,000 and $60,000, with crypto prices potentially fluctuating heavily within this range.

4-hour chart of Bitcoin price (BTC/USD), Coinbase market

The bull run is not over yet, and we still have months of pure fun ahead before the bears can truly take control of the situation.

However, in this phase of pause, where prices must settle at a fair value after large sessions of speculative trading, it is advisable not to expose oneself excessively on altcoins or on leveraged positions, as the risk of getting hurt is very high.

Medium and long-term forecasts always indicate a largely positive scenario for Bitcoin and the rest of the crypto market, but now is the time to stop and breathe, waiting for new candles to give us the right indication on short-term price action.

[ad_2]