[ad_1]

In a bold projection, Standard Chartered, the British multinational bank, envisions a substantial surge in the value of Bitcoin, anticipating it to reach $100,000 by the conclusion of 2024.

Observing Bitcoin’s impressive resurgence throughout the current year, the bank identifies the onset of what they refer to as the ‘crypto spring.’

This period of renewed vitality in the cryptocurrency market has sparked optimism, leading Standard Chartered to set an ambitious target for Bitcoin’s future valuation.

Bitcoin Surpasses $38,200, StanChart Predicts $100K By 2024

The world’s largest cryptocurrency, Bitcoin, attracted interest from institutional investors once again this week, as its price surpassed $38,200 on November 29.

Geoff Kendrick, Head of Crypto Research at Standard Chartered Bank, reiterated the company’s bullish forecast that the price of Bitcoin may reach $100,000 in 2024.

The projection is a continuation of the bank’s April outlook for this year. The April research stated that a number of reasons that might propel Bicoin’s ascent over $100,000 are already in action, and that the crypto winter has now come to an end.

The report emphasized that in March of this year, there was disruption in the financial system, which contributed to the “re-establishment” of Bitcoin’s use as a decentralized scarce digital currency.

Bitcoin market cap currently at $740 billion on the daily chart: TradingView.com

Kendrick and the Standard team expressed their optimism that the US government’s approval of multiple spot Bitcoin ETFs will be the next catalyst for the growth of cryptocurrencies, and that these developments will occur sooner than originally anticipated.

“We think that a number of spot ETFs will now be approved in the first quarter of 2024 for both Bitcoin and Ethereum, setting the stage for institutional investment,” they said.

Additionally, Standard Chartered highlighted another cause that can lead to future price increases: the upcoming Bitcoin “halving,” which would limit the currency’s supply and is expected to happen in late April 2024.

BTC seven-day price action. Source: CoinMarketCap

With its headquarters located in London, Standard Chartered caters to a global clientele of both individual and corporate customers. While it does not offer retail banking services in the United Kingdom, its multibillion-dollar operations across Asia, Africa, and the Middle East position it as one of the world’s most significant financial enterprises.

And it’s because of this significant role in the global financial system that Standard Chartered’s positive prediction for bitcoin earlier this month is all the more intriguing.

Record Hash Rate And Market Maturity Validate Standard’s Bullish Prediction

Bitcoin’s hash rate, the amount of processing power miners are using to secure the network, and a measure of the network’s strength—which recently reached an all-time high—all support Standard Chartered’s bullish stance.

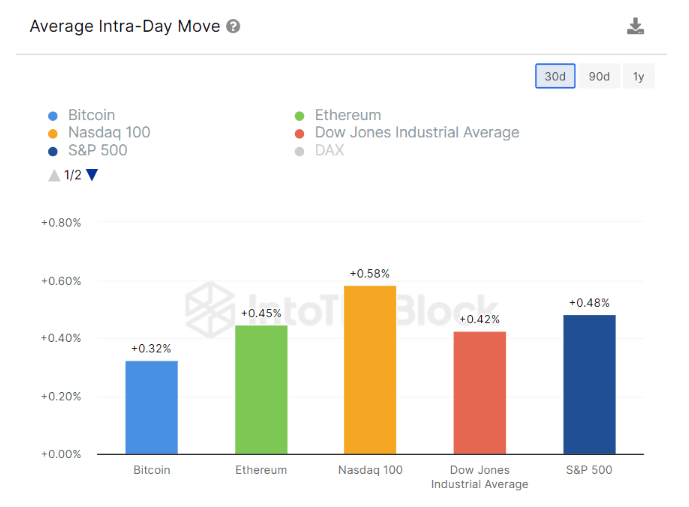

BTC Price Volatility Trends compared to Mega Cap Stocks (data as of Nov. 2023). Source: IntoTheBlock

Meanwhile, recent on-chain data from IntoTheBlock indicates that the Bitcoin market has displayed indications of increasing maturity and stability in comparison to large-cap stocks and index funds.

Standard Chartered’s forecast of a Bitcoin price surge has gained validation as Bitcoin has witnessed a remarkable 130 percent surge in 2023. According to the bank, everything is unfolding as anticipated.

BTC’s dominance in the digital assets market remains robust, having increased from 45 percent in April to a current 50 percent share of the overall market cap.

Bernstein analysts echoed Standard Chartered’s optimism, predicting that Bitcoin might reach $150,000 by mid-2025 for the same supply-related reasons.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

[ad_2]