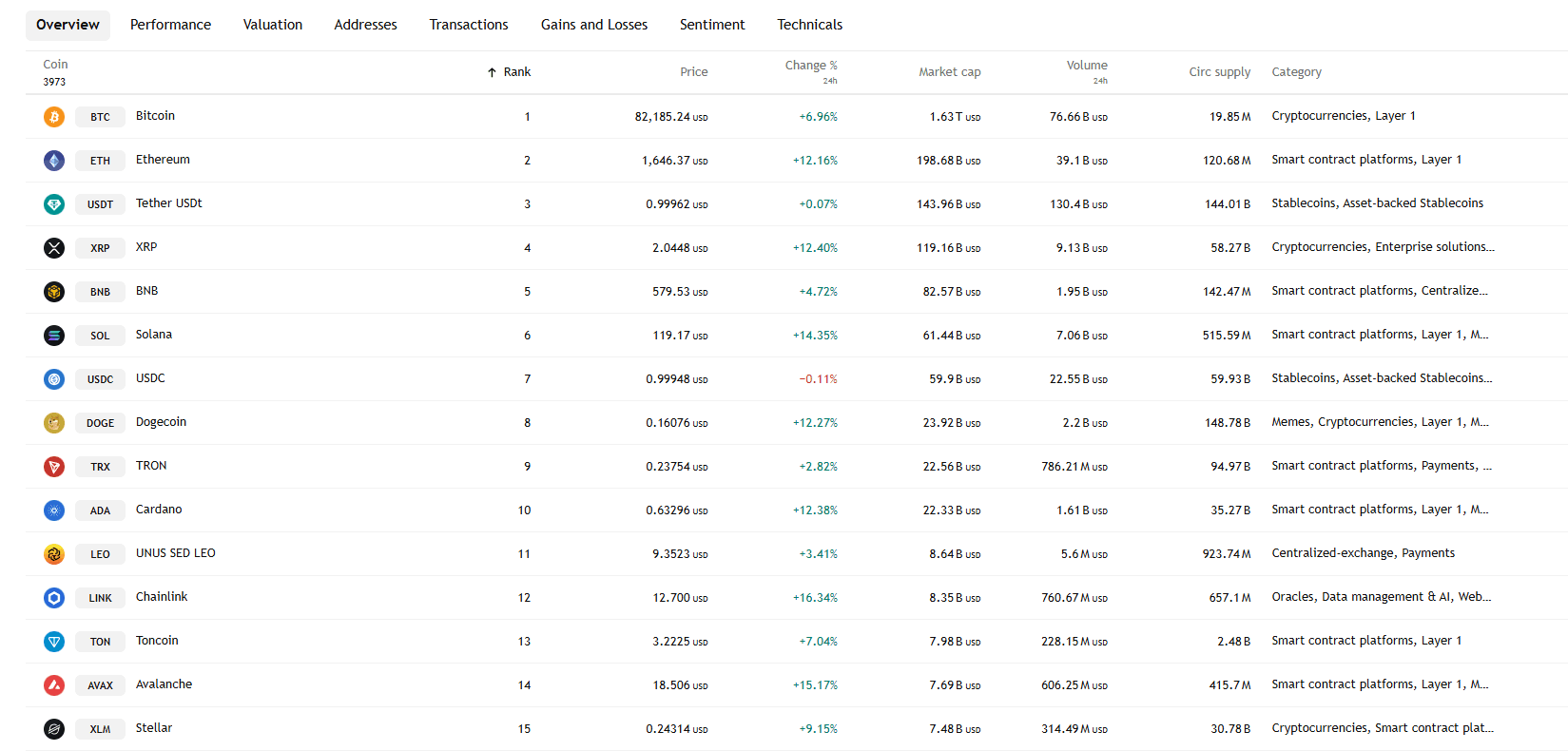

Trump’s Tariff Pause Ignites Bitcoin Hype—But at What Cost?

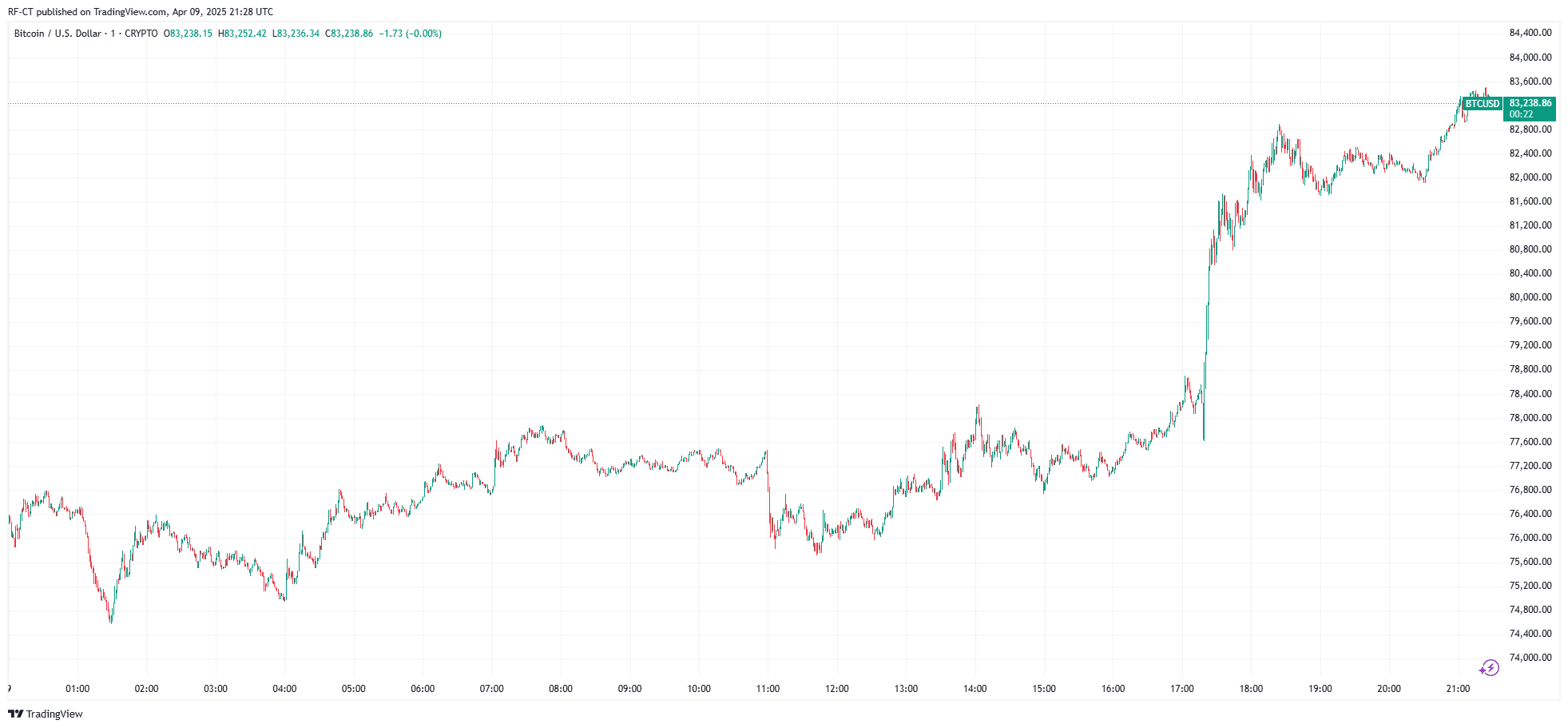

In a move that stunned both Wall Street and the crypto community, President Donald Trump announced a 90-day pause on tariffs for most nations—excluding China. Almost immediately, Bitcoin reacted with force, surging over 7% to hit $82,350, as global markets cheered the easing of trade tensions.

This unexpected policy shift has put the $100K Bitcoin narrative back on the table—but whether it holds or not remains one of the most heated debates in finance right now.

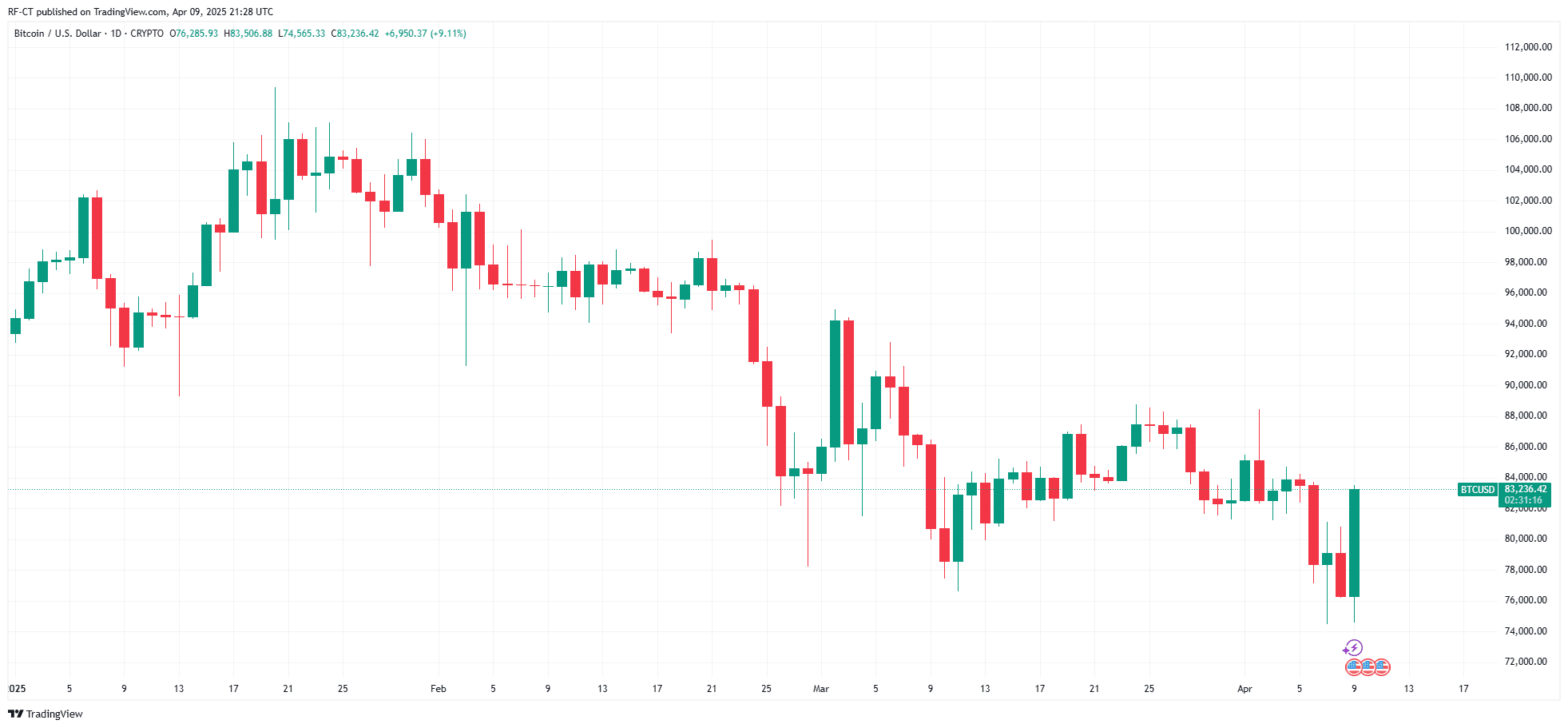

By TradingView – BTCUSD_2025-01-09 (5D)

Markets Rally, Crypto Explodes—But Is It Just Sentiment?

The market’s reaction was swift: Dow Jones hit a 5-year high, Nasdaq surged, and Bitcoin led the charge in crypto, reigniting altcoin activity and pushing Ethereum over $4,000.

Analysts say this bullishness is rooted in the perception that Trump’s tariff delay reduces short-term recession fears, encouraging risk-on behavior from institutional and retail investors alike. For Bitcoin, that’s a golden ticket.

But not everyone is buying it. Some warn that this is short-term euphoria masking deeper structural problems in both the economy and the crypto market.

By TradingView – All Cryptocurrencies Performance

$100K Bitcoin: A Real Possibility or Political Pipe Dream?

The $100,000 Bitcoin price target has long been a psychological milestone for Bitcoin. And now, with:

- A weakening dollar outlook,

- Fresh ETF inflows,

- An upcoming halving cycle, and

- Geopolitical uncertainty fueling alternative asset demand,

some believe Bitcoin could hit the mark as early as mid-2025.

Yet skeptics argue that relying on political headlines to fuel price momentum is dangerous. “This isn’t organic growth,” one analyst warned. “It’s stimulus-driven speculation, not a sustainable trend.”

By TradingView – BTCUSD_2025-01-09 (YTD)

Politics Now Drives Crypto—Is That Good or Bad?

Here’s where things get controversial: Bitcoin was built to resist central authority—but it’s now heavily influenced by government decisions and trade policies.

Trump’s tariff strategy, meant to stabilize traditional markets, has ironically become a bullish signal for decentralized finance. But if Bitcoin’s value hinges on who’s in office or what tariffs are applied, does that undermine its entire decentralized ethos?

Some see it as a necessary evolution. Others see it as a red flag.

Conclusion: Bullish Road to $100K or One Giant Head Fake?

There’s no denying that Trump’s move has reignited hope for a six-figure BTC. With momentum building and crypto narratives shifting back into mainstream headlines, Bitcoin is once again stealing the spotlight.

But whether it hits $100K—or crashes back under $70K—depends on more than one press conference. The fundamentals still matter. And if this is just a politically-fueled sugar high, the crash could be just as dramatic as the climb.

By TradingView – BTCUSD_2025-01-09 (1D)