[ad_1]

Bitcoin (BTC) starts the year with a shift in ownership. Even after 16 years have proven the long-term holding outlook, the new cohorts of buyers face the challenge of a higher cost basis.

Bitcoin is facing a shift in ownership, as long-term holders liquidated some of their holdings. The run-up to $108K caused some of the older holders to realize gains, as the assets moved into new wallets aged under three months.

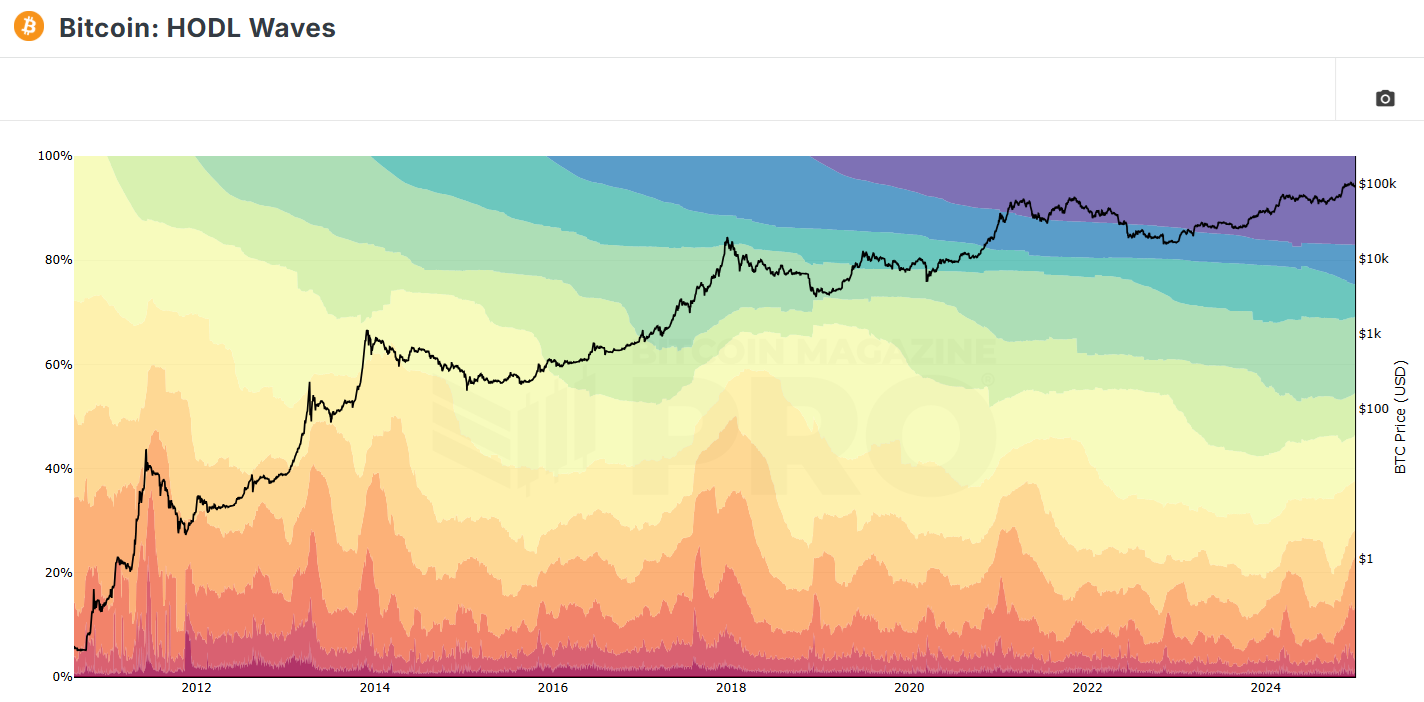

The overall trend for BTC is for wallets to trend to long-term accumulation. In December, that balance shifted, though only a small part of BTC changed hands. Even those coins, however, are enough to cause selling pressure, in case some of the buyers panic.

The past few weeks revealed the trend of shifting between long-term and short-term holders. In the past, a shift like that signaled a market local top, as more experienced traders took profits and locked in their gains.

This time around, BTC is also down from its peak, leaving a new cohort of holders to ride out the turbulence of 2025. In the short term, the BTC price is safely above the short-term holders’ realized price. Most of the buyers are in the money, with the exception of a small cohort buying above $98,000 per BTC.

In the past few weeks, buyers were a mix of unknown whales, ETF deals, as well as renewed buying by MicroStrategy and Mara Holdings. All of those buyers may have varied motivations and time horizons. The big unknown remains short-term whales aiming to lock in short-term gains.

In the second half of 2024, the average cost basis for all BTC holders increased to over $40K. Before that, the cost basis inched up to around $23,000 at the beginning of the year. The cost basis is rising more slowly, tampered by the long period of accumulation during the protracted bear markets.

The data by Cryptoquant also coincide with the ‘hodl wave’ trend, where the newest cohorts are rapidly expanding their holdings. All wallet cohorts newer than six months saw a rapid climb in reserves.

BTC new holders accumulated coins in the past three months, taking some of the supply from older cohorts. | Source: Bitcoin Magazine Pro

The short-term holders of wallets in the 1-3 months range had the most rapid expansion, recently making use of the dip toward $93,000 to accumulate more coins. The short-term buying behavior recalls the previous market local peak in March. For now, the trend of short-term buying has not broken or reversed and may signal bullish expectations for Q1.

Based on the long-term price outlook, independent of investor decisions, BTC is in another accumulation zone. The Rainbow Chart is nowhere close to a market top, signaling more new all-time highs. However, the recent cohorts can react to a drawdown, if the price approaches their pain zone.

Short-term holders still have 10% in profit

After a few slow days, BTC recovered to $98,513.40, rising to a dominance of 53.3%. At this price range, even short-term holders have an average unrealized gain of 10%, based on Glassnode data.

With the short-term holder index at 1.1%, the holders are not facing any pain, but are holding with a relatively thin margin. The index itself does not predict behavior, but the 1.0 level is closely watched.

In the past 12 months, the short-term holding index ranged between 0.85% and 1.44%, achieved during the March peak. During the November price peak, short-term holders had average gains of 35%.

The 1.0 level usually serves as a support for the price but has historically flipped to resistance. During the Q4 growth cycle, the 1.0 short-term holder index corresponds to a BTC price of $87,000, signaling the current levels are not causing pain to holders. That support level may be key for keeping BTC in its higher range and avoiding a drawdown to $70,000.

Miners remain some of the safest holders, still retaining over 1.9M coins. Miners have a much lower average cost basis, which is extremely low for some of the earlier farms and corporations. Despite the general bullish trend, most corporate BTC treasuries have stopped adding new coins in the short term, with the exception of recent buying announced by MicroStrategy and Mara Holdings.

[ad_2]