[ad_1]

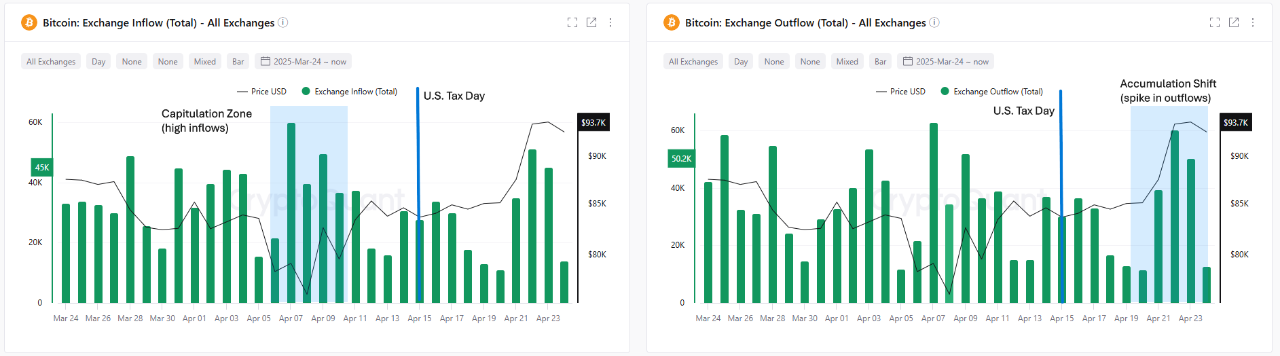

Recent data from Binance, the largest retail spot exchange by market share, is showing key shifts in Bitcoin trading behavior. Between April 19 and April 23, over 15,000 BTC were withdrawn from Binance, following a prior period where inflows had reached similar levels. The change in flow direction is notable, especially as Bitcoin’s price moved from the $85,000–$87,000 range to above $93,000.

Since April 18, exchange reserves have also been in steady decline. A lower reserve level generally points to fewer BTC available for immediate selling on the exchange. This tends to happen when investors remove assets to their self custodian wallets which decreases near term sell pressure. In other cases, it may mean that the investors start to show more confidence on the future price movement of the asset.

Whale Activity Declines as Retail Takes the Lead

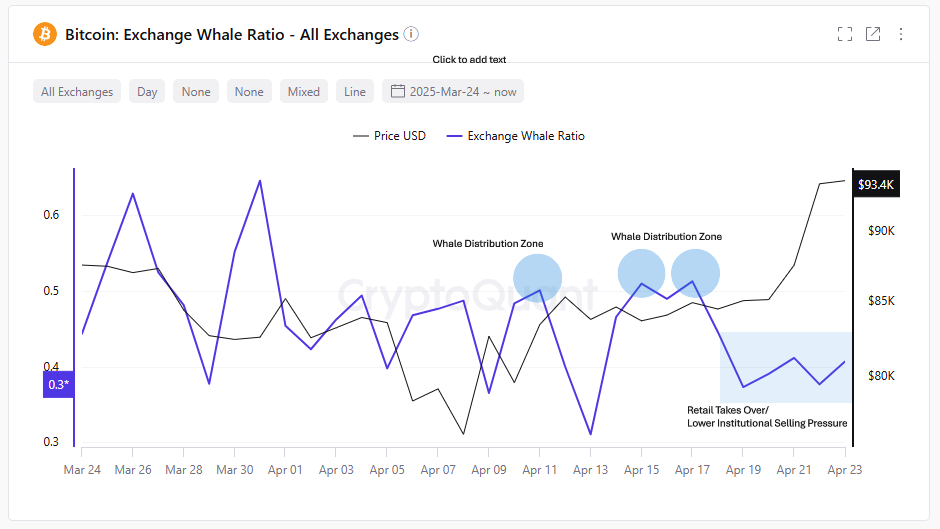

The Exchange Whale Ratio on Binance dropped below 0.3 as of April 23. This metric, which tracks the portion of large transactions in relation to total exchange volume, suggests that smaller traders are becoming more active compared to institutional participants. A lower ratio often indicates fewer large sell orders from whales, leaving room for more stable price action based on smaller trades.

Bitcoin Exchange Whale Ratio| Source: CryptoQuant

With fewer large-scale sell-offs, the market is currently being shaped more by retail behavior. This change can reduce volatility often caused by sudden large moves and provides a clearer look at overall market sentiment. Lower whale activity also limits the chance of manipulated price swings caused by single actors with large holdings.

Short Positions Show Vulnerability Above $92K

Short interest above $92,000 is pretty pumped up and could lead to a short squeeze. Prices jump dramatically, forcing traders who bet on the asset not going higher to abandon their position to cut a loss. It fuels the buying pressure, thus helping prices to increase even more.

Several signs point toward this possibility. According to data, during price stagnation, long positions with high leverage were flushed out between April 6th and 10th. With weak hands removed and a fresh resistance getting formed near $92,000, any bounce will put pressure on remaining shorts, now. This could lead to fast liquidations, especially if paired with external cheaters like ETF inflows or global financial conditions.

Source: CryptoQuant

Futures Volume and Funding Rates Support Short Squeeze Outlook

Futures trading volumes on Binance crossed $1.049 trillion in April, exceeding volumes recorded in February and March. This surge shows growing interest in Bitcoin derivatives and an active trading environment. Higher volumes on other exchanges like OKEx, Bybit, and Bitget further indicate participation from more market participants.

Binance Futures Volume for Each Exchange| Source: CryptoQuan

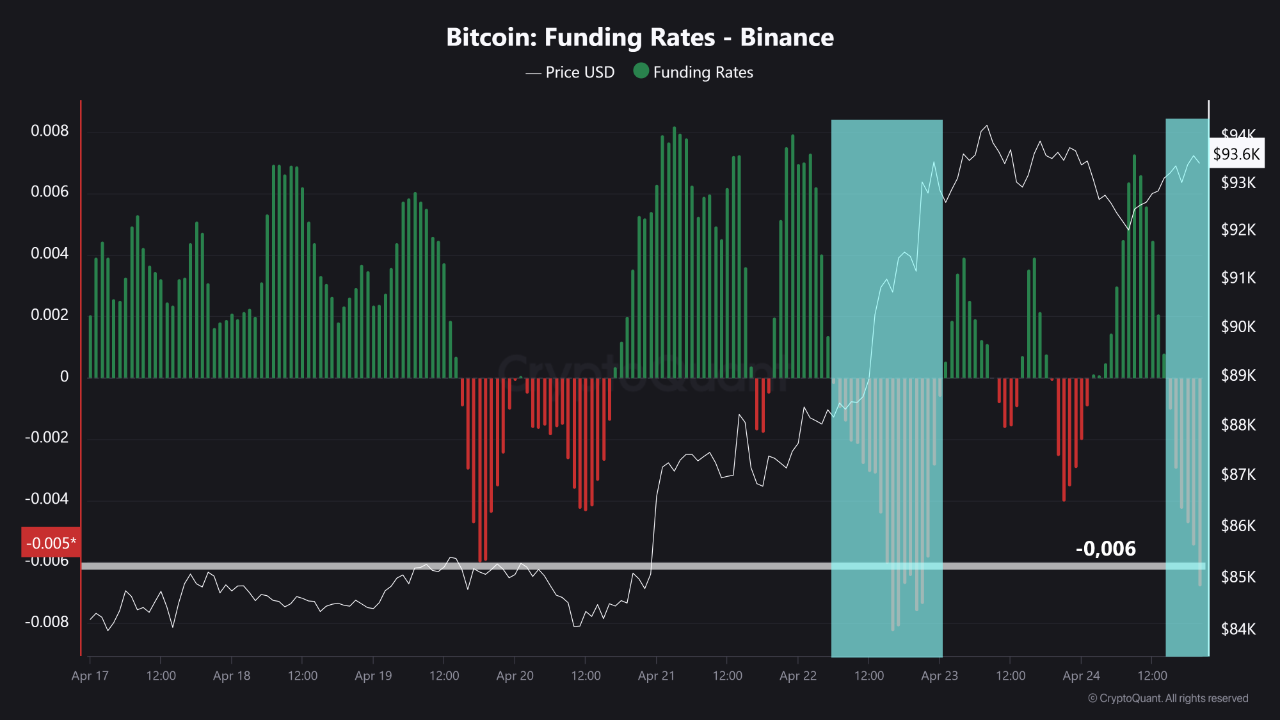

At the same time, Binance funding rates have dropped below -0.0060. This negative rate shows that more traders are betting against Bitcoin than for it. A level such this has been historically followed by sharp price upward movement due to short forced liquidations. On April 22, a similar pattern was seen when Bitcoin rose from $91,012 to $93,400 in less than 10 hours after the funding rate hit this mark.

When funding rates go negative while the futures volume is still high, you can be more certain of a possibility of price spike. If the market continues to move upward, this will expose short positions especially in a situation of thin liquidity whereby there are fewer sellers to quote buy orders.

Bitcoin Funding Rates| Source: CryptoQuant

Outlook Shaped by Market Structure and Participation Shifts

Current market data points to a more balanced and cleaner trading environment. As large leveraged positions continue to be cleared and whale activity disappears, the remaining open interest seems to be from smaller traders. This helps propping up a more organic price move: fewer big players rule the market.

Should Bitcoin (BTC) maintain its current trajectory and move above the $95,000–$98,000 range, short sellers could be forced to exit rapidly. This would create the conditions for a short squeeze, potentially pushing Bitcoin beyond $100,000. Lack of exchange reserves, strong accumulation, and changes in dynamic trading lead to volatility and upward movement to continue.

[ad_2]