By Francisco Rodrigues (All times ET unless indicated otherwise)

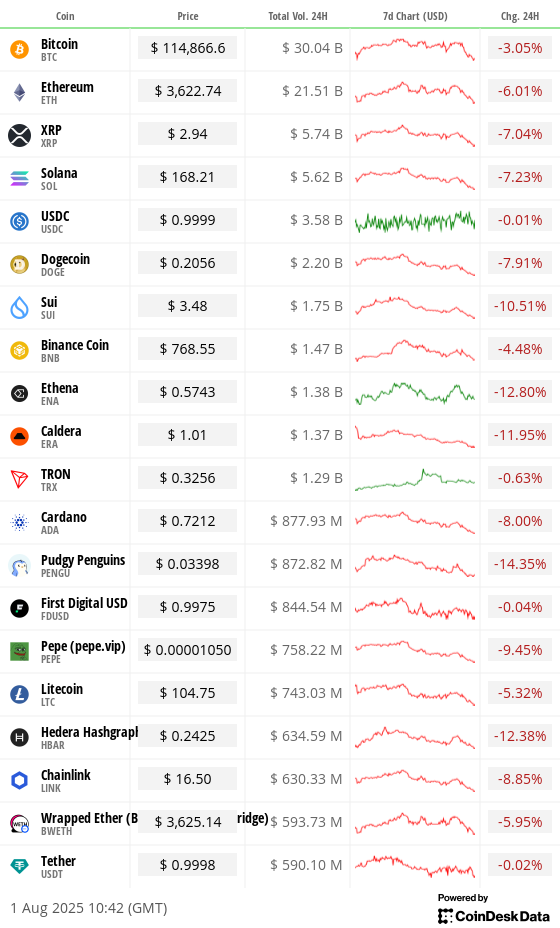

The wind seems to be coming out of the crypto market’s sails. Bitcoin

The CoinDesk 20 (CD20) index, a measure of the broader market, fell 6% with ether (ETH) down 5.7% after posting its strongest monthly gain in three years and XRP

losing more than 7%.

The drop comes as some of President Donald Trump’s tariffs started taking effect with more due to kick in on Aug. 7. The levies range from 10% to 41% on imports from key trading partners including Canada, the European Union and Japan.

That sent Asian equity markets to their worst week since April and fueled a rally in the U.S. dollar, sending the dollar index above 100 for the first time since May.

The tariffs also pushed up the Federal Reserve’s preferred inflation measure, the core PCE, to 2.8% year-over-year in June. That increase has dampened hopes for a reduction in interest rates in September. Polymarket traders moved from a perceived 56% chance of a rate cut to now 38%. The CME’s FedWatch tool shows a 39% chance.

“For crypto, looser financial conditions would be a major tailwind,” said 21Shares strategist Matt Mena in an emailed statement.

Today’s nonfarm payrolls data could be decisive. The report is expected to the U.S. economy created 110,000 jobs last month.

Options traders are already seeking protection from further declines.

“We’re seeing increased short-term bearish positioning on BTC with capped upside strategies,” said Jake Ostrovskis, an OTC trader at Wintermute. “ETH options into late August are notably different, with positioning balanced to even outright bullish.”

If economic data points to higher rates for longer, traders may pivot toward assets that benefit from tighter conditions. A stronger dollar and higher interest rates could nudge investors toward yield-bearing stablecoins or transparent ETH-based vaults, given the GENIUS Act’s passage into law. Stay alert!

What to Watch

- Crypto

- Aug. 1: The Helium Network (HNT), now running on Solana, undergoes its halving event, cutting annual new token issuance to 7.5 million HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing regime to regulate stablecoin activities in the city.

- Aug. 1: New Bretton Woods Labs will launch BTCD, which it says is the first fully bitcoin-backed stablecoin, on the Elastos (ELA) mainnet, a decentralized blockchain secured by merged mining with bitcoin and overseen by the Elastos Foundation.

- Aug. 4: Solana Mobile begins worldwide shipping of its Seeker Web3 mobile device.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 1, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 147K

- Unemployment Rate Est. 4.2% vs. Prev. 4.1%

- Government Payrolls Prev. 73K

- Manufacturing Payrolls Est. -3K vs. Prev. -7K

- Aug. 1, 9 a.m.: S&P Global releases July manufacturing and services data for Brazil.

- Manufacturing PMI Prev. 48.3

- Aug. 1, 9:30 a.m.: S&P Global releases July manufacturing and services data for Canada.

- Manufacturing PMI Prev. 45.6

- Aug. 1, 9:45 a.m.: S&P Global releases (final) July manufacturing and services data for the U.S.

- Manufacturing PMI Est. 49.5 vs. Prev. 52.9

- Aug. 1, 10 a.m.: The Institute for Supply Management (ISM) releases July U.S. services sector data.

- Manufacturing PMI Est. Est. 49.5 vs. Prev. 49

- Aug. 1, 10 a.m.: The University of Michigan releases (final) July U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 62 vs. Prev. 60.7

- Aug. 1, 11 a.m.: S&P Global releases July manufacturing and services data for Mexico.

- Manufacturing PMI Prev. 46.3

- Aug. 1 p.m.: Peru’s National Institute of Statistics and Informatics releases July consumer price inflation data.

- Inflation Rate MoM Prev. 0.13%

- Inflation Rate YoY Prev. 1.69%

- Aug. 6, 12:01 a.m.: A 50% U.S. tariff on most Brazilian imports, announced in President Trump’s July 30 executive order, goes into effect.

- Aug. 7, 12:01 a.m.: U.S. reciprocal tariffs outlined in President Trump’s July 31 executive order become effective for a broad range of trading partners that did not secure deals by the Aug. 1 deadline. These tariffs range from 15% to 41%, depending on the country.

- Aug. 1, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July employment data.

-

Earnings (Estimates based on FactSet data)

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Movement (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators must approve the proposal for it to pass and, if if it does, it could be implemented by late Q3. Voting ends Aug. 1.

- Venus DAO is voting on a 12-month renewal with Chaos Labs for the BNB Chain deployment at a cost of $400,000, focused on expanding the Risk Oracle system for real-time, automated risk parameter updates. Voting ends Aug. 1.

- Compound DAO is voting to select its next Security Service Provider (SSP). Delegates are choosing between ChainSecurity & Certora, and Cyfrin. Voting ends Aug. 5.

- Unlocks

- Aug. 2: Ethena to unlock 0.64% of its circulating supply worth $23.36 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $12.26 million.

- Aug. 12: Aptos to unlock 1.73% of its circulating supply worth $47.95 million.

- Aug. 15: Avalanche to unlock 0.39% of its circulating supply worth $36.52 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $14.42 million.

- Aug. 15: Sei to unlock 0.96% of its circulating supply worth $15.78 million.

- Token Launches

- Aug. 5: Keeta (KTA) to be listed on Kraken.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Francisco Rodrigues

- The non-fungible token (NFT) market recovery is well underway with CryptoPunks, the dominant collection, seeing its floor price in dollar terms hit a three-year high, according to NFTPriceFloor.

- The total market capitalization of NFTs has almost doubled to $6.4 billion in just a month, according to CoinGecko data.

- The rally was led by the CryptoPunks, which rose 33.3% over the period. Other collections, such as the Pudgy Penguins, also helped.

- CryptoPunks’ increase took it near 30% of the total market capitalization of the NFT sector. In ETH terms, the 52 ETH price is the highest in over a year.

Derivatives Positioning

- The number of open contracts in CME bitcoin standard futures has dropped to 27,699, representing 138,495 BTC, the lowest since April.

- The capital flight could be institutions preferring spot ETFs over futures or traders scaling back exposure as the dollar’s rally gathers speed.

- Open interest in ether futures has fallen to 32,903 contracts from the recent high of 41,636. The ether contract is sized at 50 ETH.

- BTC and ETH OI remains elevated near record highs in offshore perpetual futures, with funding rates receding to under 5%, a sign of weakening of bullish sentiment.

- On Deribit, the market sentiment has shifted against ether, with downside insurance premiums costlier than for bitcoin.

Market Movements

- BTC is down 1.32% from 4 p.m. ET Thursday at $114,962.47 (24hrs: -2.92%)

- ETH is down 3.09% at $3,619.49 (24hrs: -5.94%)

- CoinDesk 20 is down 3.26% at 3,764.26 (24hrs: -6.05%)

- Ether CESR Composite Staking Rate is unchanged at 2.94%

- BTC funding rate is at 0.0026% (2.8448% annualized) on Binance

- DXY is up 0.25% at 100.22

- Gold futures are unchanged at $3,345.70

- Silver futures are down 0.67% at $36.47

- Nikkei 225 closed down 0.66% at 40,799.60

- Hang Seng closed down 1.07% at 24,507.81

- FTSE is down 0.40% at 9,096.56

- Euro Stoxx 50 is down 1.36% at 5,319.92

- DJIA closed on Thursday down 0.74% at 44,130.98

- S&P 500 closed down 0.37% at 6,339.39

- Nasdaq Composite closed unchanged at 21,122.45

- S&P/TSX Composite closed down 0.40% at 27,259.78

- S&P 40 Latin America closed down 0.71% at 2,563.84

- U.S. 10-Year Treasury rate is up 3.6 bps at 4.396%

- E-mini S&P 500 futures are down 0.94% at 6,314.25

- E-mini Nasdaq-100 futures are down 1.03% at 23,125.00

- E-mini Dow Jones Industrial Average Index are down 0.91% at 43,900.00

Bitcoin Stats

- BTC Dominance: 61.98% (0.41%)

- Ether to bitcoin ratio: 0.03150 (-1.38%)

- Hashrate (seven-day moving average): 904 EH/s

- Hashprice (spot): $57.21

- Total Fees: 3.96 BTC / $468,378

- CME Futures Open Interest: 138,495 BTC

- BTC priced in gold: 34.8 oz

- BTC vs gold market cap: 9.85%

Technical Analysis

- The ether-bitcoin ratio’s daily chart shows a bearish divergence of the RSI. The pattern is marked by the indicator printing a lower high, decoupling from the rising price, and suggests a weakening of the bullish momentum.

- In other words, ether could underperform bitcoin in the coming days.

- The MACD histogram, a trend-following indicator, has also turned negative

Crypto Equities

- Strategy (MSTR): closed on Thursday at $401.86 (+1.73%), -4.2% at $385 at pre-market

- Coinbase Global (COIN): closed at $377.76 (+0.07%), -11.15% at $335.65

- Circle (CRCL): closed at $183.52 (-3.66%), -5.19% at $174

- Galaxy Digital (GLXY): closed at $28.41 (-1.68%), -7.97% at $26.15

- MARA Holdings (MARA): closed at $16.08 (-2.84%), -3.61% at $15.5

- Riot Platforms (RIOT): closed at $13.41 (-0.81%), -8.05% at $12.33

- Core Scientific (CORZ): closed at $13.54 (+3.72%), -4.21% at $12.97

- CleanSpark (CLSK): closed at $11.37 (-0.44%), -3.25% at $11

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.26 (+2.23%)

- Semler Scientific (SMLR): closed at $35.85 (-0.17%), -0.7% at $35.60

- Exodus Movement (EXOD): closed at $30.84 (+6.05%), -1.85% at $30.27

- SharpLink Gaming (SBET): closed at $18.81 (-3.83%), -6.11% at $17.66

ETF Flows

Spot BTC ETFs

- Daily net flows: -$114.8 million

- Cumulative net flows: $54.97 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $17 million

- Cumulative net flows: $9.66 billion

- Total ETH holdings ~5.73 million

Source: Farside Investors

Overnight Flows

Chart of the Day

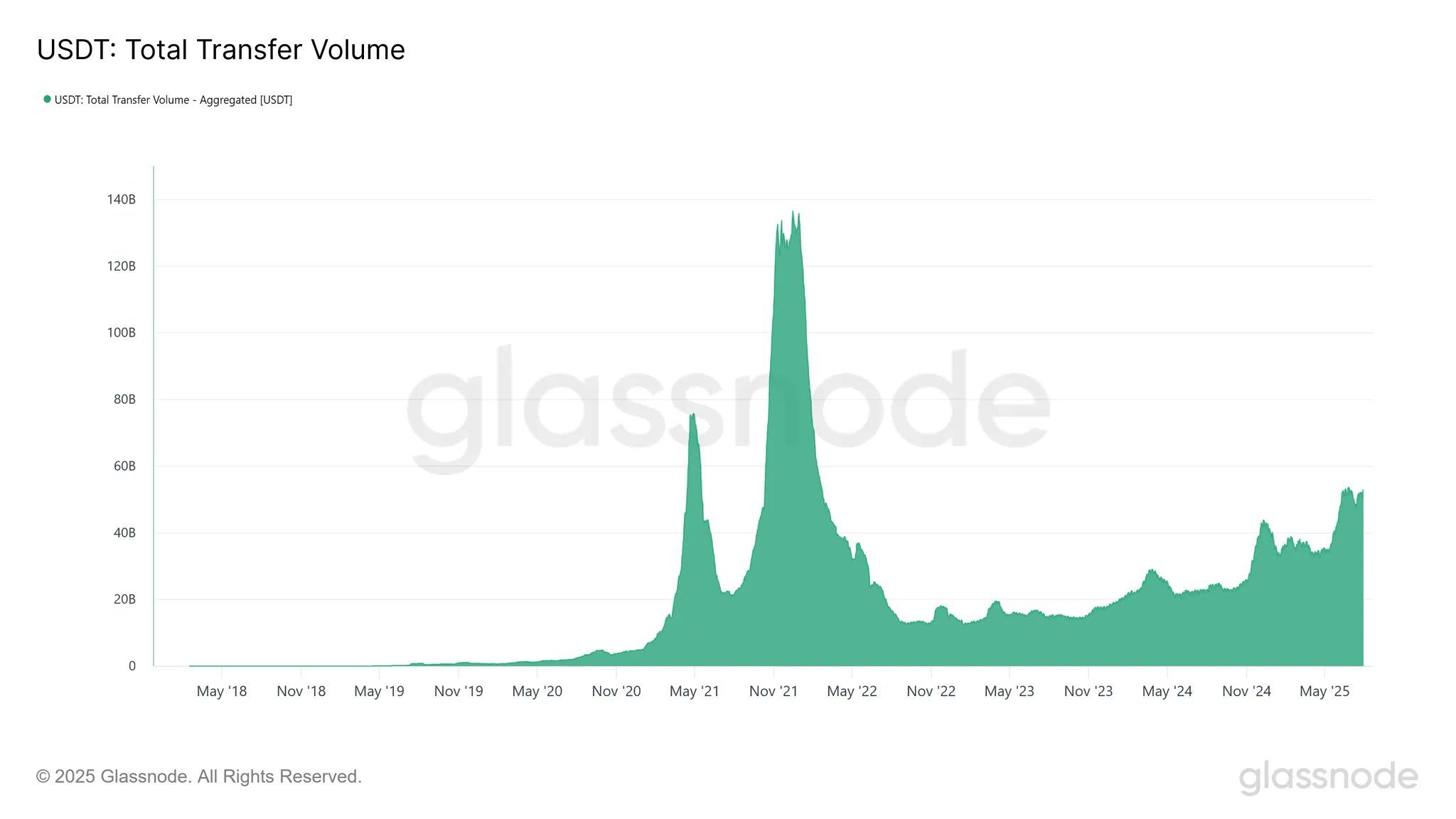

USDT: total on-chain transfer volume. (Glassnode)

- The total amount of USDT transferred on-chain has risen to $52.9 billion, the highest since early 2022.

- It shows that a slow but consistent recovery in stablecoin velocity and market activity, according to Glassnode.

- The 2021 crypto bull market peak was marked by sharp spikes in USDT velocity.

While You Were Sleeping

- Donald Trump Reignites Global Trade War With Sweeping Tariff Regime (Financial Times): A 35% tariff on Canadian non-USMCA goods begins Aug. 1, while broader tariffs announced in Thursday’s executive order take effect Aug. 7 to allow U.S. Customs time to implement them.

- Bitcoin, Ether Start August on a Shaky Note as Dollar Index Tops 100; Yen Hits 4-Month Low Ahead of Nonfarm Payrolls (CoinDesk): Major cryptocurrencies saw volatile trading as a stronger dollar followed the new tariffs, which may worsen inflation and complicate the Fed’s path to cutting interest rates.

- Are Traders Done With Ether? Options Market Now Prices Higher Risk for ETH Than BTC (CoinDesk): Deribit data shows it now costs more to hedge ether than bitcoin, marking a sentiment shift after weeks of institutional preference for the second-largest cryptocurrency.

- El Salvador Scraps Presidential Term Limits, Opening Door for Another Bukele Term (Reuters): The bill passed in Congress Thursday allows indefinite re-election, extends presidential terms to six years, eliminates run-offs and shortens Bukele’s current term to align all elections in 2027.

- Goldman Urges Caution as Global Credit Spreads Hit 2007 Lows (Bloomberg): Although markets show confidence, strategists warned that investors may be overlooking risks like softening growth, delayed Fed rate cuts, and uneven effects from trade policy — and advised keeping hedges in place.

- Bitcoin Holders Can Now Earn Automated Yield Via $2B Solv Protocol (CoinDesk): Solv’s BTC+ vault offers 4.5%–5.5% returns on bitcoin through DeFi lending and protocol staking, automating yield generation and relieving holders from manually selecting and managing strategies.

In the Ether