Wrapped Bitcoin (wBTC) corresponds to approximately 10% of the overcollateralized stablecoin DAI reserves, which investors now consider removing as collateral. This decision could start a Bitcoin (BTC) sell-off if investors decide to close their wBTC exposure following Bitgo’s controversial announcement.

On August 10, a BA Labs spokesperson raised a risk-mitigation issue related to wBTC changes on MakerDAO’s (MKR) governance forum. As explained in the proposal, Bitgo announced a plan to transfer control of wBTC to a joint venture with BiT Global.

Moreover, the leading custody solutions provider, Bitgo, disclosed this would result in a partnership with Justin Sun and Tron (TRX). The MakerDAO community received Sun’s participation with skepticism and concerns, showing a bias toward removing wBTC as a DAI collateral.

As Finbold reported today, wealth investors have already started reevaluating their wBTC positions, with James Fickel capitulating from related trades. If this trend continues, a wBTC sell-off could create relevant Bitcoin selling pressure, potentially affecting BTC’s short-term price.

MakerDAO investors consider removing wBTC as DAI collateral

In the post, monet-supply traced similarities with a “previous situation concerning control of the TUSD stablecoin” since Justin Sun’s involvement. The investor highlighted a “market deterioration in operational processes and transparency,” fearing it could happen to wBTC under new management.

Additionally, the issue mentioned “significant depegs caused by interruptions in redemption service” and “suspension of real-time proof of reserves.”

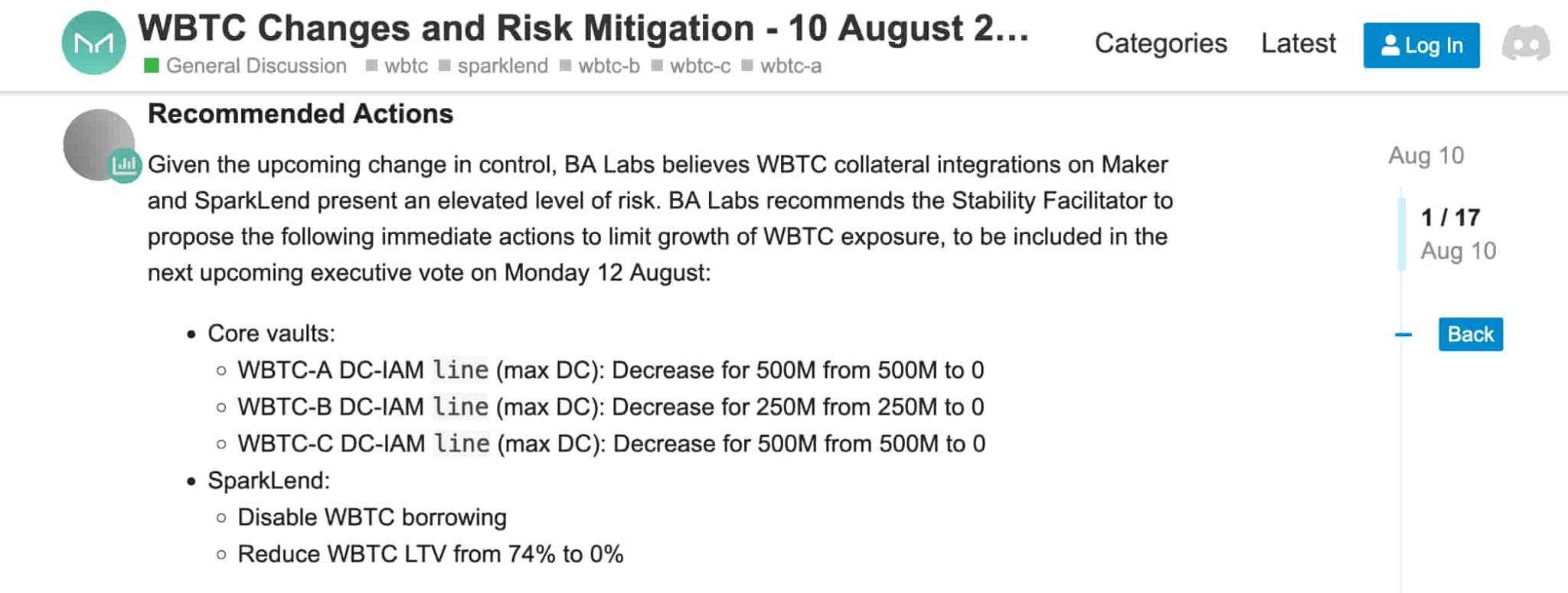

As a proposed solution, the BA Labs Team’s representative recommended decreasing all three wBTC collateral applications on MakerDAO vaults from 1.25 billion to zero, disabling wBTC borrowing, and decreasing wBTC’s Loan-to-Value (LTV) from 74% to zero. These actions would effectively remove the synthetic Bitcoin token as a DAI collateral if approved.

Interestingly, using wBTC to redeem DAI is one of the most popular use cases for the wrapped token. Its removal would not only create a potential sell-off but could also serve as an example to other protocols that could consider following MakerDAO’s leadership.

Bitcoin (BTC) price analysis and wBTC potential impact

To measure its potential impacts, it is important to understand that investors need to deposit approximately three times wBTC’s nominal value to redeem DAI, evidenced by the top 20 vaults using one of the three wBTC contracts. For example, the vault 19102 has 1,600.88 wBTC collateral for a 34.5 million DAI debt.

At the current Bitcoin price, this means a $96.05 million collateral for a $34.5 million loan. Furthermore, DAI’s $5.35 billion capitalization with 10% of its reserves in wBTC suggests a $1.605 billion collateral position.

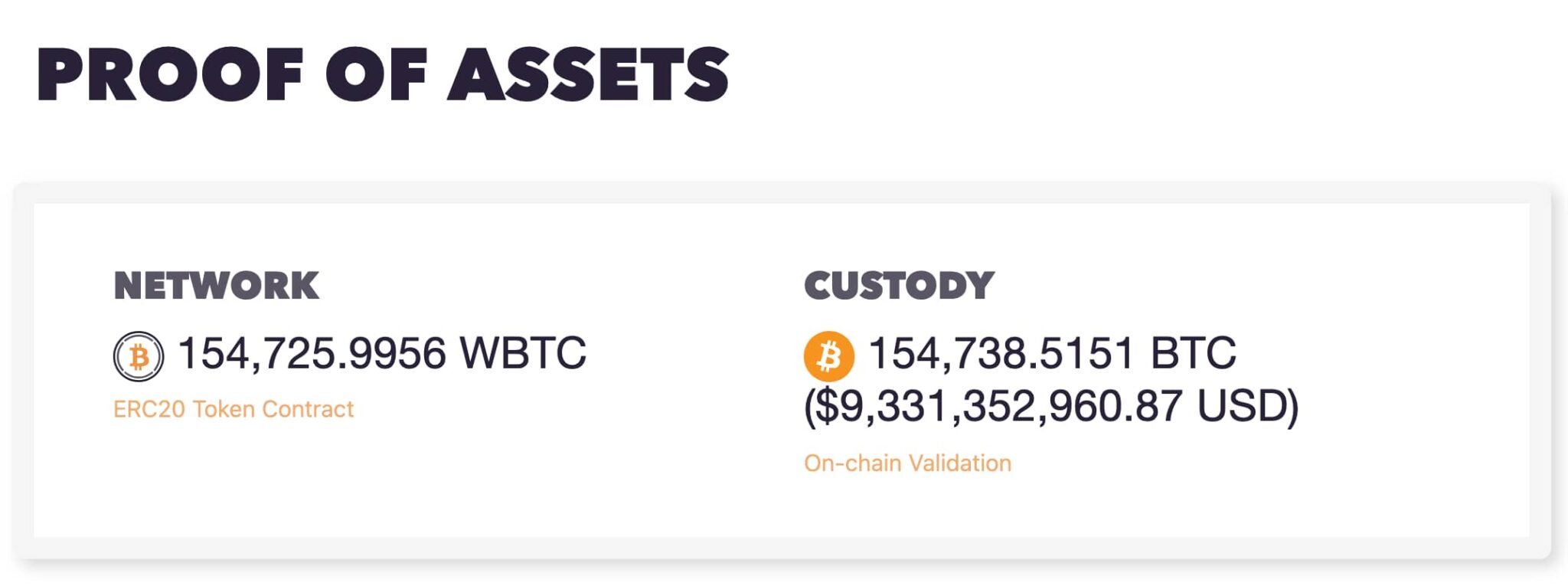

As of this writing, BTC trades at around $60,000, resulting in approximately 26,750 wBTC deposited on MakerDAO contracts. According to Bitgo’s proof of assets, an equivalent of 17% of all 154,738 BTC in custody, backing the 154,725 wBTC in circulation.

WBTC investors are likely to exchange their wrapped tokens for Ethereum (ETH) or U.S. dollar stablecoins instead of BTC. They would have bought Bitcoin directly if they wanted exposure to the leading cryptocurrency. Instead, wBTC acts as a financial tool in the Ethereum ecosystem, which these investors favor having their activities.

Nevertheless, the true impacts of the recent developments are yet to be seen. There is no guarantee that a Bitcoin sell-off will occur or that MakerDAO will approve the removal proposal. Investors must remain cautious and follow the decentralized finance (DeFi) ecosystem closely in the next few days.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.