[ad_1]

The Bitcoin market dynamics have recently taken an interesting turn, suggests Alex Thorn, Head of Firmwide Research at Galaxy. According to his recent thread on X, the options market makers in BTC are currently operating in a position that could significantly amplify any upward movement in its price.

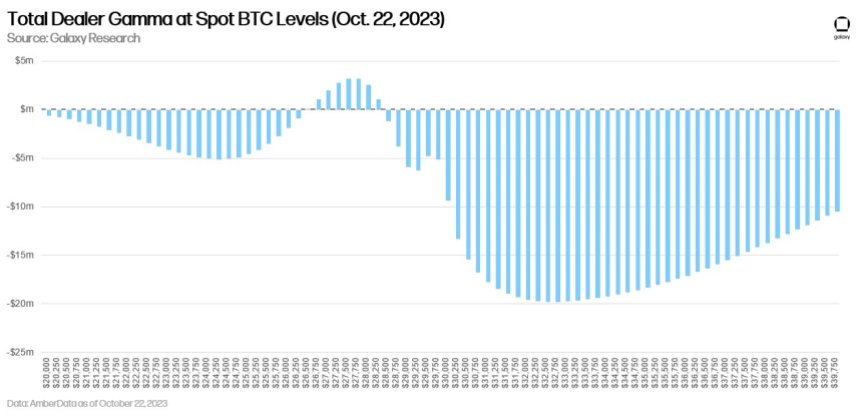

“Options market makers in Bitcoin are increasingly short gamma as BTC spot price moves up. […] This should amplify the explosiveness of any short-term upward move in the near term,” Thorn notes.

This implies that as the spot price of Bitcoin rises, these market makers have to buy back more of the cryptocurrency to maintain their positions, a phenomenon that could potentially amplify price surges.

The Greatest Show On Earth: Bitcoin

Moreover, he highlighted that data from Amber indicates that dealers are increasingly moving into a short gamma position, especially when the BTC price is above $28.5k. In more explicit terms, Thorn explains, “At $32.5k, market makers need to buy $20 million of delta for every subsequent 1% move higher.” Such positioning suggests that market makers might have to make substantial purchases of Bitcoin as the spot price continues to ascend.

However, it’s not just upward movements that are impacted. Thorn sheds light on the flip side of the coin as well. “Dealers are long gamma in the $26,750-28,250 range. When you’re long gamma & spot declines, you also have to buy back spot to stay delta neutral,” he comments. This means that any minor downward adjustment in price might find resistance as options dealers make necessary purchases to realign their positions.

For bullish investors, these dynamics present an attractive landscape. Thorn elucidates, “This is a great setup for bulls because if spot moves moderately higher, short gamma covering could make it rip much higher pretty quickly, but if it moves lower, long gamma covering could provide some support and limit near-term downside.”

Highlighting potential catalysts that might set the Bitcoin spot price in motion, Thorn pointed to the growing anticipation surrounding Bitcoin ETF approvals. Most recently, renowned personalities and institutions such as Cathie Wood, Paul Grewal, JP Morgan, and several analysts from Bloomberg Intelligence have expressed positive sentiments on the odds for approval.

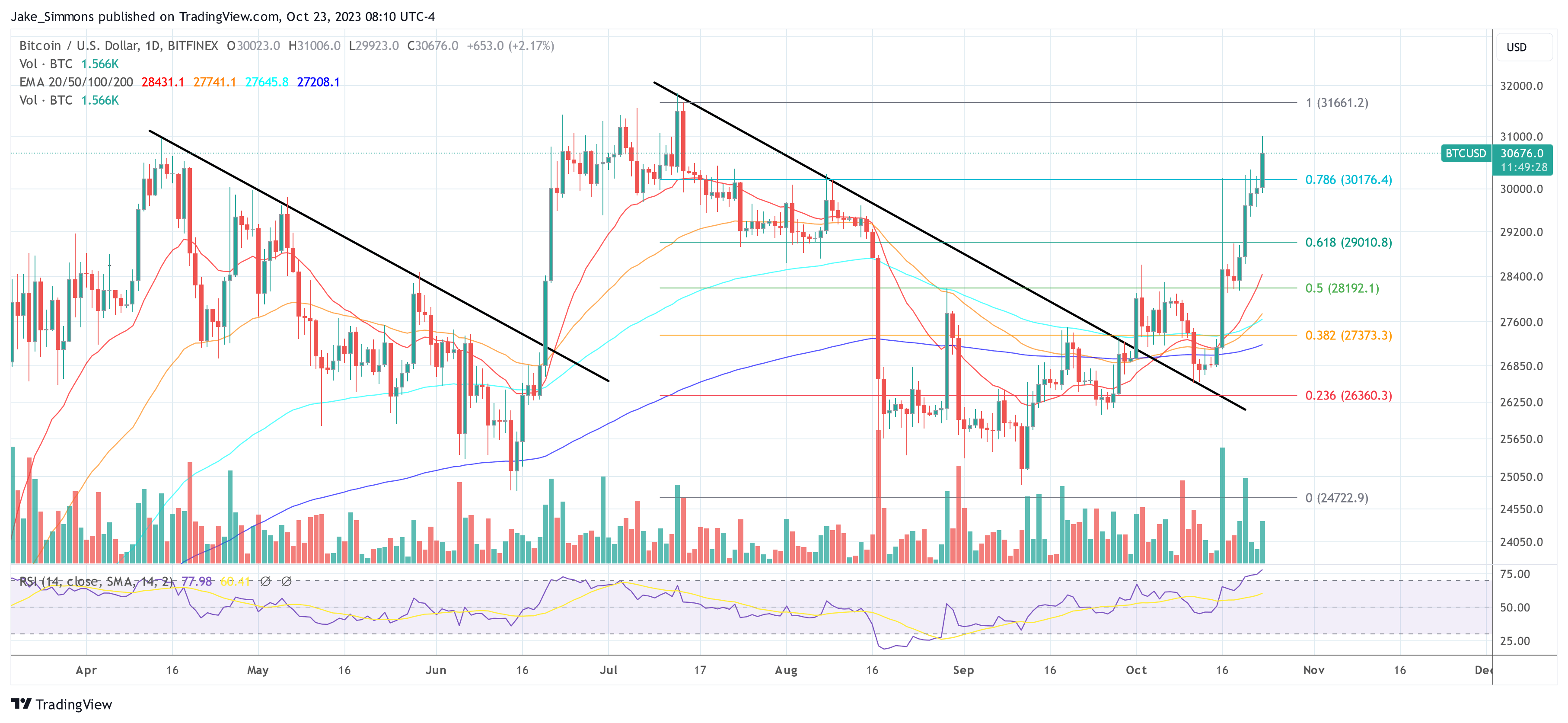

Eric Balchunas and James Seyffart of Bloomberg predict that the odds of a spot Bitcoin ETF are 75% by the end of this year and 95% by the end of 2024. Additionally, Thorn mentions the recent surge in Bitcoin’s price above $31,000, suggesting it surpassed last month’s highs following the fake news of an ETF approval.

Beyond market sentiments and speculations, fundamental supply, and liquidity dynamics also play a role. Thorn mentions, “Bitcoin’s currently constrained supply and liquidity could also serve to amplify upward moves.” Notably, exchange balances of Bitcoin have plummeted to levels not seen since 2018.

Simultaneously, smaller entities are accumulating Bitcoin, while larger holders, often termed “whales,” appear to be reducing their positions. He underscores the strength of the Bitcoin community with a note on hodlers: “70% of supply has not transacted in 1+ years, 30% in 5+ years… ATHs both.”

With all these dynamics at play, Thorn aptly sums up the current state of the Bitcoin market: “The next several months will be very interesting — Bitcoin is the greatest show on earth.”

At press time, BTC traded at $30,676.

Featured image from LinkedIn, chart from TradingView.com

[ad_2]