Bitcoin has witnessed a notable price surge recently, with growing optimism in the market. This bullish sentiment is largely driven by substantial institutional investments and new developments in the crypto infrastructure. As of mid-February 2025, Bitcoin is trading at approximately $97,601, having reached an intraday high of $98,895. The pressing question remains: Can Bitcoin break past the $100K mark?

International Adoption: A Strong Market Catalyst

Institutional investors from across the globe have significantly influenced the recent Bitcoin price surge. Two major disclosures have made headlines:

- Wisconsin Investment Board: The state investment board revealed $321 million in holdings of BlackRock’s iShares Bitcoin Trust ETF. This substantial allocation indicates growing institutional confidence in Bitcoin’s long-term value.

- Abu Dhabi Sovereign Wealth Fund: The fund disclosed $463 million in Bitcoin ETF holdings. Such investments from globally influential institutions bolster market trust and may encourage other sovereign wealth funds to follow suit.

These significant moves are solidifying Bitcoin’s status as a mainstream asset class and potentially fueling its next leg upward.

Impact on Bitcoin and Altcoins: Traditional Finance Embraces Crypto Custody

The entry of major financial institutions into the crypto space adds another layer of bullish sentiment. State Street and Citi Bank have announced plans to launch cryptocurrency custody services. This initiative aims to provide secure storage solutions for digital assets, mitigating security concerns that have traditionally deterred institutional investors.

The inflow of institutional capital doesn’t only impact Bitcoin. Historically, Bitcoin’s bullish momentum tends to lift the entire crypto market. Altcoins often experience significant gains following Bitcoin’s lead, especially Ethereum and Solana, which have seen increased adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

The broader market is also benefiting from improved investor sentiment, with Bitcoin’s dominance fluctuating as altcoins capture more attention. If Bitcoin’s uptrend continues, other assets like XRP, Cardano, and newer entrants like MEW could follow suit.

Bitcoin Price Surge: Temporary or Permanent?

Bitcoin Price Prediction: Can BTC Price Break $100K?

The $100K milestone has long been a psychological barrier for Bitcoin. Analysts have mixed opinions about Bitcoin’s potential to surpass this level in 2024:

Optimistic Forecasts: Some market analysts estimate an 85% probability of Bitcoin exceeding $100K this year, driven by ETF inflows and institutional participation.

Cautious Outlook: Historical patterns show that Bitcoin often experiences corrections after substantial gains. While new inflows from ETFs and traditional financial institutions are bullish signals, the market may face profit-taking phases that could slow its ascent.

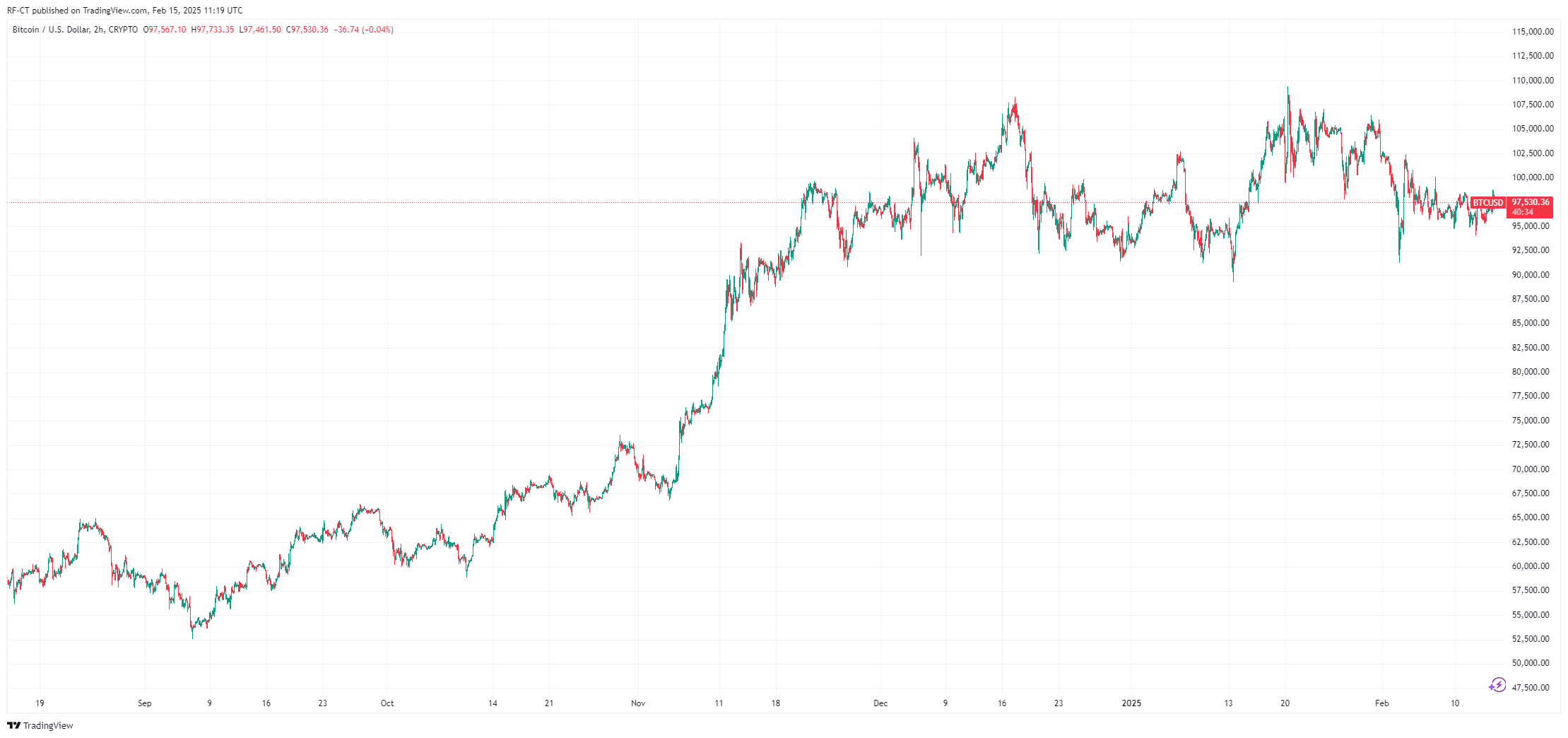

By TradingView – BTCUSD_2025-02-15 (5D)

The recent Bitcoin price surge is undeniably linked to growing institutional interest and enhanced crypto infrastructure. With heavyweight investors like the Wisconsin Investment Board and Abu Dhabi’s sovereign wealth fund entering the market, alongside the launch of crypto custody services from State Street and Citi Bank, Bitcoin seems poised for further growth.

While surpassing $100K appears increasingly plausible, the market remains susceptible to volatility. Investors should stay informed, monitor ETF inflows, and consider the broader macroeconomic landscape when assessing Bitcoin’s future trajectory.

By TradingView – BTCUSD_2025-02-15 (6M)